QE3 Could Hurt in the End

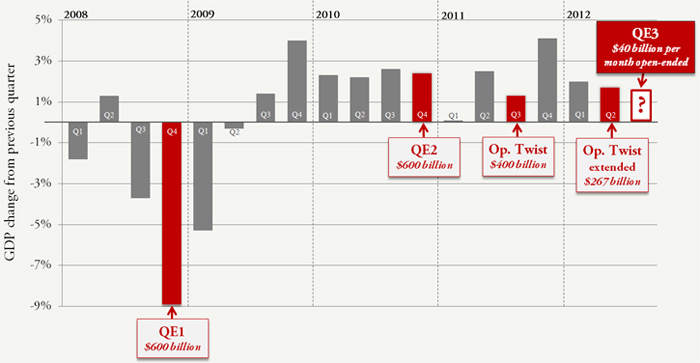

Today the Federal Reserve’s Federal Open Market Committee announced that it would initiate a third round of quantitative easing, or “QE3,” by purchasing $40 billion of mortgage-backed securities per month on an open-ended basis. Since 2008, there have been five major Fed policies that have attempted to spur the economy with little success:

- QE1 – $600 billion of quantitative easing announced in November 2008;

- QE2 – Another $600 billion of easing announced in September 2010;

- Operation Twist – Switching $400 billion of Treasury holdings from short-term bonds to long-term bonds announced in September 2011;

- Operation Twist extension – An extension of Operation Twist was announced in June 2012 at approximately $267 billion;

- QE3-The Fed will purchase $40 billion of mortgage-backed securities per month for an indefinite period. The Fed indicated that it will continue QE3 until the labor market improves “substantially,” which it may not expect to occur until mid-2015 given its separate pledge to keep interest rates low until that year. If QE3 lasts this long, it would total $1.44 trillion over three years.

Fed’s Past Moves Have Not Jumpstarted Economy

The previous four other major announcements from the Fed since the economic crisis began have not resulted in robust economic growth. At best, QE1 may have had a positive impact, but GDP did not grow again until the third quarter after the announcement. The Fed also today revised down GDP projection for 2012 from 1.9 percent to 1.7 percent.

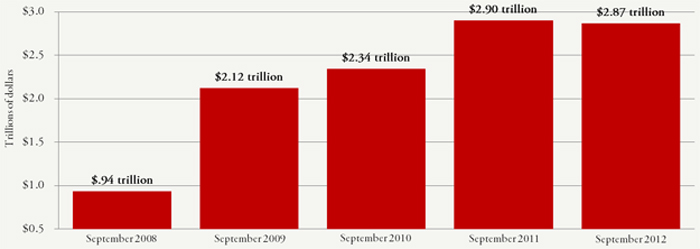

Fed’s Balance to go Over $3 Trillion

With today’s action, the Fed is now on pace to have more than $3 trillion on its balance sheet before the end of the year – much of it toxic assets. That’s up from less than $1 trillion at this time in 2008.

Fed Actions Could Result in Negative Consequences

In a Wall Street Journal op-ed on Tuesday of this week, former Senator Phil Gramm and Stanford professor John Taylor outline the negative consequences that could result from QE3.

- Inflation –

- Interest on the Debt – To combat inflation, the Fed may begin selling its assets. At that point, the Fed will not be able to buy any Treasury debt. This will cause the interest rate on the national debt to increase, ballooning our federal budget deficit.

- Private Sector Hurt – With the Fed selling old Treasury bonds and the Treasury selling new bonds, investors will have many more Treasury bonds to buy. At higher interest rates, the safety of Treasury bonds may cause investors to buy Treasuries rather than invest in the private sector.

These negative consequences show that we cannot get something for nothing. We have already had the largest monetary stimulus in American history; monetary policy has reached its limit on what it can achieve in the Obama economy. Economic growth will come through an environment conducive to growth, which does not include the tax hikes, record debt, and regulatory burdens of the Obama Administration.

Next Article Previous Article