Protecting America's Supply of Rare Earth Elements

KEY TAKEAWAYS

- The United States economy and our military depend upon a ready supply of critical minerals, including a subset known as “rare earth elements” that are processed and used to make products ranging from common consumer electronics to advanced weapon systems.

- China now makes these critical materials that the United States previously produced domestically. Recent events, such as the impact of the coronavirus on production in China, have highlighted the problem of relying on imports of these materials.

- Faced with the threat of losing access to rare earth materials, the U.S. is investing again in domestic sources for unrefined elements and the refined materials they yield.

Recent shocks to the global trade system have highlighted America’s dependence on foreign-produced products and materials. Headlines have focused on tariffs placed on consumer products and how the coronavirus is affecting the availability and affordability of goods. One of the most strategically important aspects of the issue is our dependence on imports of “rare earth elements.”

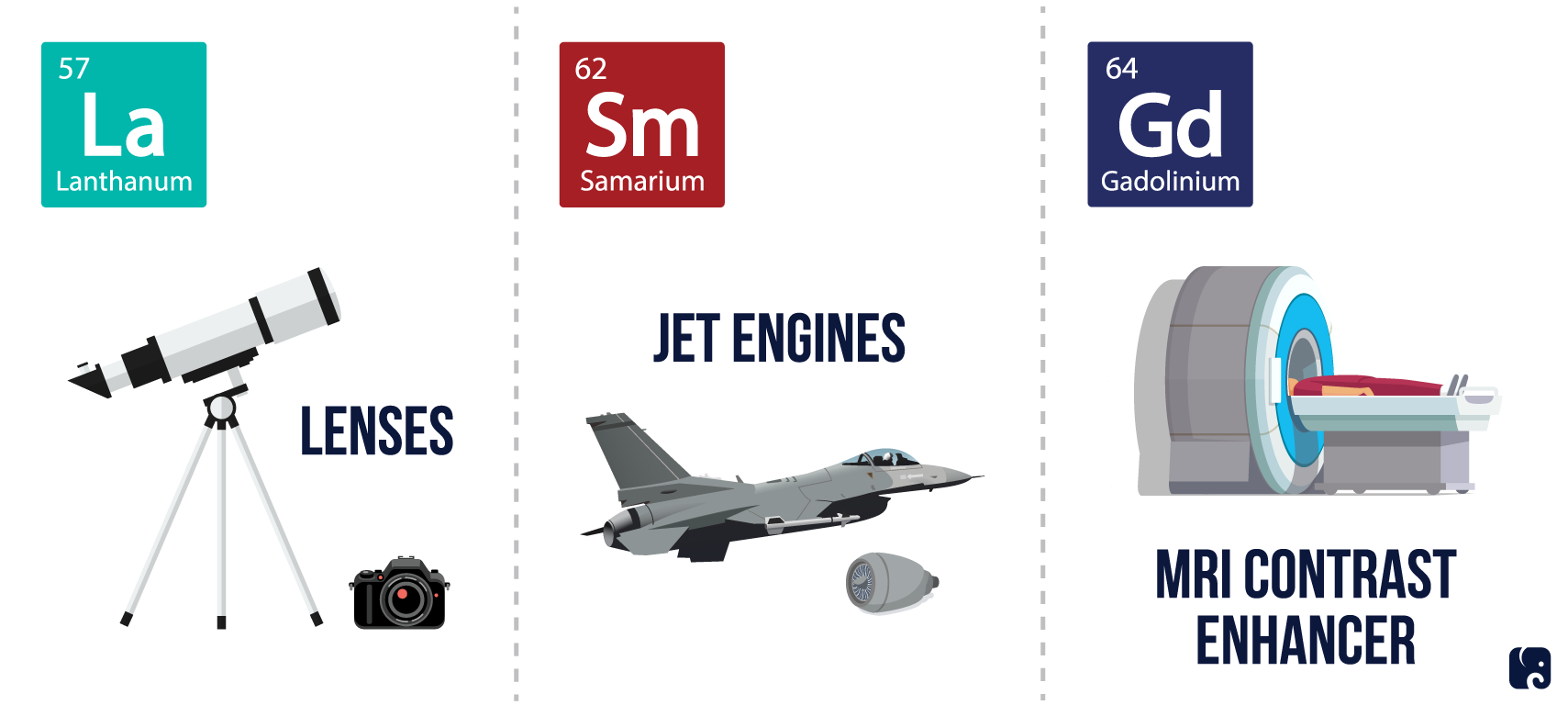

A Few Ways We Use Rare Earth Elements

American dominance vs. cheap chinese imports

Rare earth elements are a group of 17 chemical elements that, despite their name, are abundant and relatively easy to mine, but nonetheless rare because they are difficult to separate and refine into a usable form. Once refined, manufacturers use them in a wide variety of goods, including LED lights, flat-panel screens, magnets, electric motors, automobiles, and computers. Defense contractors use these elements to produce weapon guidance systems, jet engines, sonar devices, and laser weapons.

The United States was the world leader in rare earth element production from the mid-1960s to the mid-1980s. The United States produced around 15 kilotons a year, compared to around five kilotons annually for the rest of the world combined. Nearly all of this production came from the America’s largest rare earth element mine, which operated near Mountain Pass, California, until the 1990s. In 1992, China announced it would strategically exploit its large supplies of the elements. Without America’s labor laws or strict environmental regulations, China could satisfy world demand at a fraction of the cost of U.S. production. China quickly became the dominant power in both the mining and the refining of these elements. By 2016, the United States imported all of the rare earth elements we used, mostly from China. During this time uses for rare earth elements expanded, and so did demand. Total U.S. imports rose by more than 14% from 2017 to 2018.

While the coronavirus outbreak has disrupted China’s mining sector, the Chinese government recently increased its production quotas for rare earth elements in response to growing demand. The overall slowdown in trade from China has heightened concerns about whether these materials will continue to be as available as we need them to be. Added to this threat, China could withhold exports of intermediate products using rare earth materials in a trade dispute or other conflict. It has happened before. China abruptly stopped exports of rare earth elements to Japan during a diplomatic clash in 2010 over the fate of a Chinese fishing boat captain. In May 2019, at the height of last year’s trade dispute with China, President Xi visited a rare earth processing facility in Ganzhou. This move was viewed as a possible threat that China could restrict our access to these elements.

expanding production and supply

In order to address the growing risk of China’s dominance in the marketplace of rare earth elements and other critical materials, at the end of 2017 President Trump issued Executive Order 13817: “A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals.” In May 2018, the Interior Department included rare earth elements on a list of minerals deemed critical to the economic and national security of the United States.

Also in 2018, a group of investors restarted limited production of at least two rare earth elements at the mine in Mountain Pass. As a result of this restarted production, U.S. mining of rare earth raw materials increased by 44% from 2018 to 2019, to 26 kilotons. However, China still mines five times as much as we do, and American raw material must be shipped to China to be refined into intermediate products. Other U.S. companies are seeking to develop facilities domestically to refine rare earth elements in Colorado and possibly Alaska. If successful, the U.S. companies would expand those refining operations to a rare earth mine in Texas.

In July 2019, President Trump activated Section 303 of the Defense Production Act to declare domestic production capability for rare earth elements and other critical minerals “essential to the national defense.” He also noted that the existing domestic industry cannot provide the capability in a reasonable timeframe. This declaration will allow the U.S. Army to fund private sector efforts to build a domestic refinement capability.

In addition to funding production, the Energy Department’s national laboratory in Ames, Iowa, is researching ways to replace rare earth elements, such as by developing aluminum alloys that can operate at higher temperatures. Title II of the American Energy Innovation Act addresses multiple aspects of the supply chain for rare earth elements and other critical minerals. Section 2102 of the bill directs the Energy Department to develop advanced separation technologies for the extraction and recovery of rare earth elements from coal and coal byproducts.

Last year, the State Department’s Bureau of Energy Resources began the Energy Resource Governance Initiative, which will diversify the global supply chain of rare earth elements away from China. The department announced the launch of an online “toolkit” to help countries with underdeveloped mining industries meet U.S. standards for investment and trade.

Next Article Previous Article