Producer Price Inflation Soars

KEY TAKEAWAYS

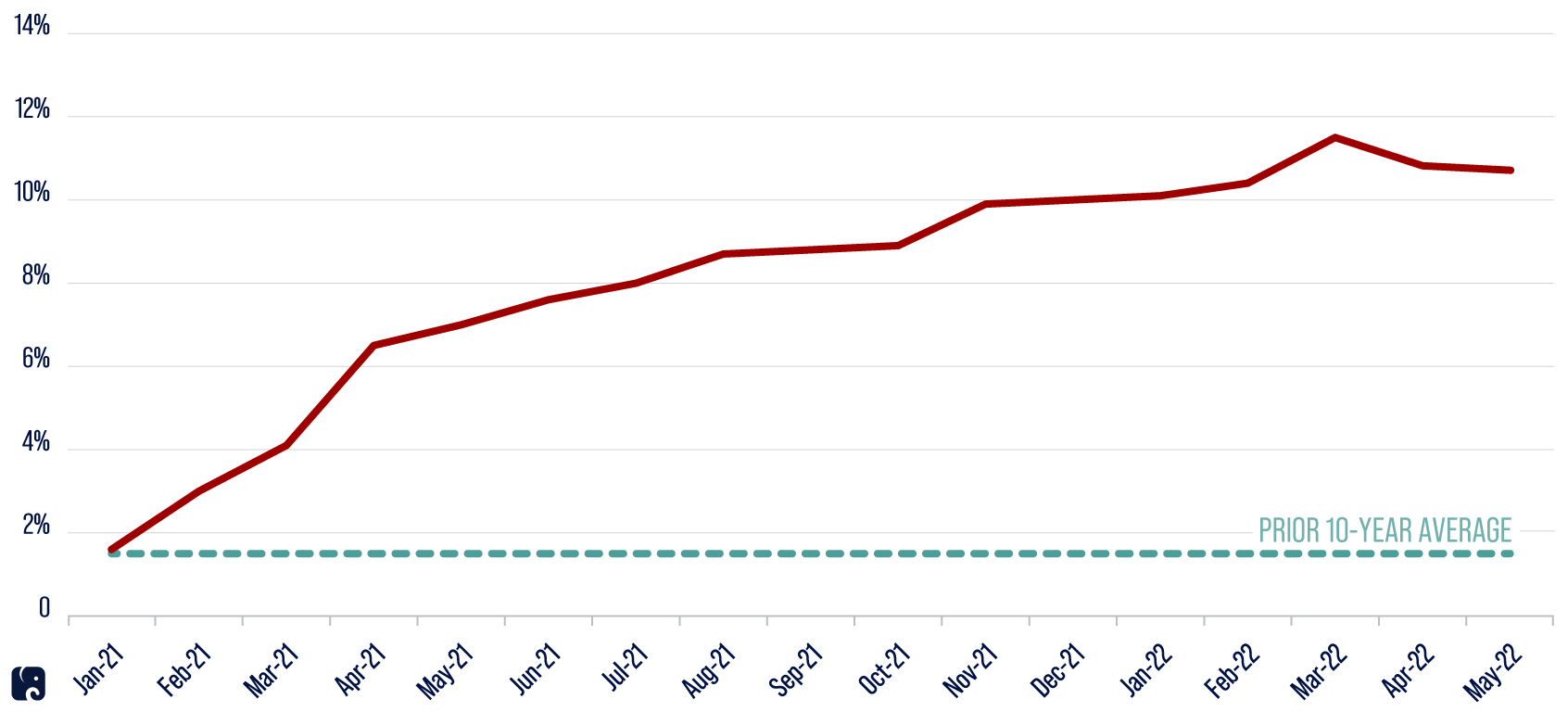

- Producer prices remained high in May, soaring by 10.8% from one year earlier.

- Producer-level inflation has surged since President Biden took office, increasing at double-digit rates for six months in a row.

- Soaring producer prices reflect inflationary pressures in U.S. production pipelines, and businesses sometimes must pass higher prices on to their customers, which include other businesses and consumers.

The Labor Department reported that overall producer prices surged 10.8% in May from one year earlier, with things like truck freight transportation services and gasoline posting large gains. May was the sixth straight month of double-digit increases. Producer price inflation during President Biden’s tenure is far above the average of 1.5% for the prior 10 years. Prices at earlier stages of production also surged in May. Businesses sometimes, but don’t always, pass on higher costs as goods and services move through production pipelines, and higher costs can also be passed on to consumers. These latest producer price increases come after the department reported that consumer price gains hit a new 40-year high in May.

Producer Price Inflation Surges Under the Biden Administration

tracking producer price inflation

The producer price index is an important economic indicator. The headline part of the report, called “final demand,” tracks prices that U.S. producers get for the things they sell to consumers and the government, things they sell to other businesses as capital investments, and things they export. These producers include businesses such as farms that produce fruit and vegetables for consumers, or manufacturers that make furniture or clothing they sell to retailers or directly to consumers. Businesses that make agricultural machines and computers that other businesses buy as capital investments would also be included, as would producers of jet and diesel fuel that they sell to the government. Producers of things like meat, tires, soap, mobile homes, and construction equipment, and businesses providing truck freight and air freight transportation services would also be included.

PPI also tracks prices of things that producers sell to other businesses to use in their own products, or “intermediate demand” goods and services. The report tracks these kinds of prices at several stages of production and across different types of commodities. It includes things like asphalt, plastic resins, lumber, grains, raw milk, raw cotton, slaughter cattle, iron and steel scrap, and industrial chemicals.

Typical Factors In the Indexes

PPI and the well-known consumer price index have some overlap and can move in the same direction, though producer price changes do not necessarily predict future consumer prices. The two indexes have different scopes. The consumer price index tracks prices that consumers pay for things like groceries, rent, electricity and natural gas utilities, new cars, airfares, and appliances. CPI includes imports and sales taxes that consumers pay, but PPI does not. One measure of shelter costs in CPI, owners’ equivalent rent, is what homeowners would pay if they were renting their home. It carries a 24% weight in the final CPI number, but it is not captured by PPI. While categories such as gasoline, some types of food, and vehicles appear in both indexes, PPI measures the prices producers get when they sell these things to businesses and other customers, while CPI reflects prices consumers pay.

High inflation in businesses’ supply chains

The producer price index report for May also underscored the overall inflationary pressures on U.S. supply chains, as prices for intermediate demand goods saw substantial increases. Overall producer prices for processed goods for intermediate demand, which includes things like processed poultry and plastic packaging products, increased by 2.3% from April to May and by 21.6% from one year ago. Overall prices for unprocessed goods like wheat and crude petroleum jumped by 6.3% from April to May and by 48.5% over the past 12 months.

As businesses face higher costs for things like energy, transportation, and materials, they sometimes pass these costs through production pipelines and to their customers, which include other businesses and consumers. Ongoing supply chain disruptions and worker shortages are adding to the pressures on small businesses and large corporations alike. It’s no wonder that 93% of small business owners say inflation is having a moderate or substantial effect on their business. Businesses have been forced to cover their higher expenses by accepting lower earnings, implementing cost-cutting measures, and raising prices.

As high inflation courses through the economy, consumers and businesses are looking for meaningful relief. It is unclear how long this high inflation will last, and small business optimism about near-term conditions has fallen to a 48-year low. Consumer sentiment has plunged to a record low as well. The latest news on producer and consumer prices doesn’t provide much optimism that families can expect relief any time soon.

Next Article Previous Article