President’s Health Care Law: Tax and Spend

President Obama once promised to cut the deficit in half during his first term in office. Instead, his own Office of Management and Budget says the deficit this year will be $1.2 trillion and that Washington's debt will have skyrocketed to $16.35 trillion by October. Rather than keeping his promise to tackle the nation’s out-of-control debt and clamp down on reckless federal spending, the President and congressional Democrats went on an old-fashioned liberal spending binge.

The President's signature legislative accomplishment was not a solution to Washington's deficits, it was a health care bill that increased federal taxes and spending.

Taxes Here, Taxes There, Taxes Everywhere

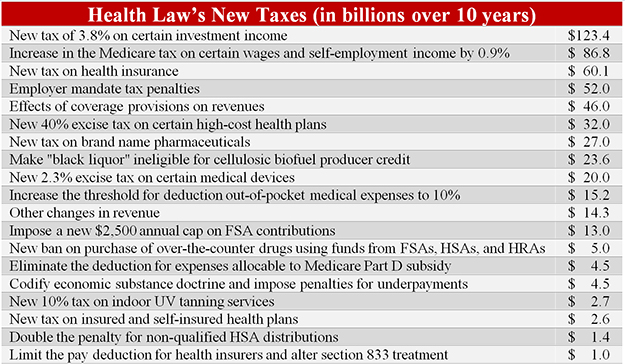

As a candidate, President Obama repeatedly pledged not to increase taxes on Americans making less than $200,000 per year or families making $250,000 per year. As President, he quickly broke that promise. According to the Congressional Budget Office (CBO), the health care law contains at least 18 separate tax increases totaling more than $500 billion over 10 years.

These tax hikes will either hit middle class families directly, or hit them indirectly through higher prices and lower wages.

Individual Mandate Tax Punishes the Uninsured

The tax penalty on people who do not have insurance will be a direct tax on the middle class. According to the CBO, 77 percent of those taxes will fall on people making less than $120,000.

Despite President Obama's attempts to redistribute income in the name of "fairness," his individual mandate tax would produce more tax revenue for the government than the "Buffett tax" on higher income people the President has pushed.

"Cadillac Tax" Penalizes Middle Class Workers

President Obama’s health care law institutes a Cadillac tax on generous employer-sponsored health insurance starting in 2018. The law levies a tax on health insurance plans that cost more than $10,200 for individuals and $27,500 for families. Many people in high-risk occupations such as law enforcement purchase high cost plans protecting themselves should they sustain a significant injury.

The law indexes the Cadillac tax threshold to grow slowly. Because insurance costs are expected to rise much faster than that index, over time more and more middle class Americans will find themselves paying this tax. In fact, the Joint Committee on Taxation (JCT) estimates that 87 percent of the Cadillac tax burden falls directly on Americans making less than $200,000 per year.

Medicare Tax Depresses Labor

One of the biggest tax hikes in the law affects the portion of payroll taxes used to fund the Medicare Hospital Insurance (HI) Trust Fund. In 2013, the health care law will increase Medicare’s HI payroll tax from 2.9 percent to 3.8 percent on wages higher than $200,000 for individuals and $250,000 for couples.

Since Medicare's creation in 1965, Congress had dedicated its payroll tax revenue to finance the program. The health care law turns this principle on its head. The law levies increased Medicare payroll taxes, but uses the tax hike to offset spending on a brand new program. The President’s tax and spend health care law turns the dedicated Medicare payroll taxes into a more general revenue stream like the income tax. Using the health care law as a precedent, there is nothing to stop future Congresses from raiding defined payroll tax revenues and using them to offset defense, highway, or any other Washington spending.

Additionally, experts agree that higher tax rates cause workers to reduce their hours. This will slow economic growth at a time when job creation is needed to jump start the economy. As the federal government imposes higher taxes on the income of small businesses, they will have fewer financial resources to invest in the business and create jobs.

Because the law’s income thresholds are not indexed to inflation, the HI tax will directly hit more and more middle class families over time. In the same way more middle class families have been caught by the poorly designed Alternative Minimum Tax, they will be ensnared by higher Medicare taxes in the President's health care law.

Employer Tax Stalls Small Business

A recent survey shows that only a net three percent of small businesses plan to hire more workers. At a time of record unemployment, the President plans to start taxing employers who fail to provide government approved health insurance to their workers. Beginning in 2014, businesses that employ more than 50 full-time workers will be fined $2,000 per employee (after the first 30 workers). Even those employers who offer insurance will pay a $3,000 penalty for every full-time worker whose coverage the Obama Administration deems unaffordable. Those workers will receive a federal subsidy to buy insurance in a government exchange.

The employer tax penalizes small businesses if they grow beyond 50 employees and encourages large businesses to drop health insurance coverage. Employers are left with three bad options:

- Offer government approved health insurance at high cost;

- Pay the tax penalty because it is less expensive than providing health insurance, and force workers to buy insurance through government exchanges;

- Keep the number of employees below the new tax threshold – by laying off workers or not hiring.

Insurer Tax Drives Up Premium Costs

President Obama and Democrats in Congress paid for their health care spending law by imposing billions of dollars in new taxes on American business and consumers. Independent experts agree these taxes only serve to increase the cost of medical coverage.

Section 9010 of the health care law creates a new $60.1 billion tax on health insurance plans starting in 2014. This new tax hits small businesses directly.

The JCT makes it clear that the insurance tax will be borne by 1) consumers in the form of higher prices; 2) owners of firms in the form of lower profits; 3) employees of firms in the form of lower wages; or 4) other suppliers to firms in the form of lower payments. JCT calculated that eliminating the tax could decrease the average family premium in 2016 by $350 to $400.

An independent study calculated that the health insurance tax will raise premiums by nearly $5,000 per family over a decade. Struggling middle class American families cannot afford this new tax.

Case for Repeal

A majority of Americans opposed the health care bill when it was being debated in Congress -- and a majority continues to oppose the law today. A recent Gallup survey found nearly half of all Americans believe the President’s health care law will hurt the economy.

In the three years since the law’s enactment, the American people remain anxious about how its mandates, tax increases, and spending provisions will impact them personally. They watched as President Obama teamed up with Washington Democrats to pass a health care law that:

- Causes insurance premiums to go up;

- Threatens job creation

- Takes away the coverage that families have today, like, and want to keep,

- And raises taxes amid an economic downturn.

The American people want health care reform that gives them access to the care they need, from the doctor they choose, at a lower cost. What they got was broken promises, more wasteful spending, and higher taxes.

Next Article Previous Article