Presidential Actions on Trade

KEY TAKEAWAYS

- President Trump has begun imposing tariffs on more than 1,300 kinds of foreign imports, the value of which could exceed $150 billion.

- Presidents have far-reaching authority to impose tariffs based on various legal powers Congress delegated to the executive branch in the 1960s and 1970s.

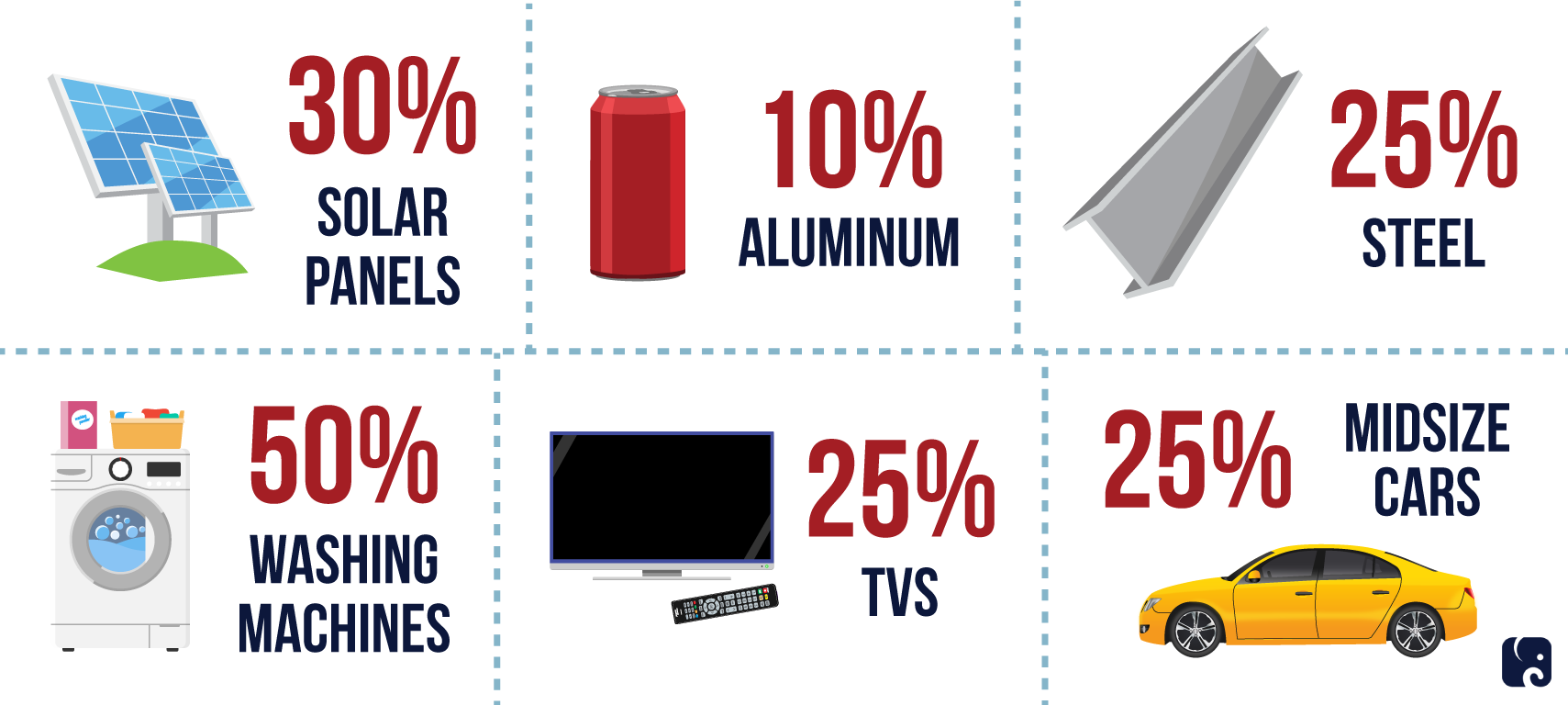

- Imported items subject to new tariffs include solar panels, steel, aluminum, televisions, and midsize cars.

Over the last three months, President Trump has used his broad legal authority to impose tariffs on a variety of products and countries. Many of these actions have been aimed at disputes with China, including those over anti-competitive behavior, intellectual property theft, and national security concerns.

New U.S. Tariffs on Imports

SOLAR PANELS AND WASHING MACHINEs

On January 22, 2018, President Trump authorized tariffs on washing machines and solar panels imported from almost all countries. The tariffs went into effect on February 7.

The solar panel and washing machine tariffs were imposed under a law that allows the president to shield U.S. industries from foreign competition without additional action from Congress. Section 201 of the Trade Act of 1974 allows “import relief” for domestic industries when the U.S. International Trade Commission determines that imports are a “substantial cause” of injury or threatened injury to domestic industry. There is no requirement that foreign practices be unfair, only that American industry is harmed by imports. The ITC recommends remedies to the president, who can take any “appropriate and feasible action” to remedy the situation.

Tariffs on washing machines start at 50 percent and decline slightly over the next three years, ending at 40 percent. Tariffs on solar panels begin at 30 percent and decline to 15 percent over four years.

STEEL AND ALUMINUM

On March 8, President Trump announced tariffs of 25 percent on steel imports and 10 percent on aluminum. These will take effect on May 1 for imports from Argentina, Australia, Brazil, Canada, the European Union, Mexico, and South Korea. For all other countries, including China, the tariffs took effect on March 23.

The administration argued steel and aluminum tariffs are needed to protect U.S. national security. According to the Commerce Department, this includes the “general security and welfare of certain industries, beyond those necessary to satisfy national defense requirements, which are critical to minimum operations of the economy and government.”

President Trump imposed these tariffs under section 232 of the Trade Expansion Act of 1962, by which Congress authorized tariffs if the administration determines they are needed to protect national security. Before the tariff can go into effect, the secretary of commerce must investigate “the effects on the national security of imports of any article.” The secretary then can recommend action or inaction, and the president can take the recommended action or one of his own preference to “adjust imports” of the item. There have been 16 of these investigations since 1980.

Secretary of Commerce Wilbur Ross’ January 2018 reports on steel and aluminum imports found that both metals are used extensively by the armed forces and in critical transportation and manufacturing industries. This use, combined with the fact that U.S. steel and aluminum production has declined in recent years, led him to recommend tariffs to bolster domestic production.

China has initiated a World Trade Organization challenge over the tariffs, but legal experts believe the challenge has little chance of success. The WTO has no authority to settle disputes over tariffs grounded in claims about national security. The national security exception to WTO authority has rarely been invoked and has been policed only by customs and norms between members of the organization.

PENALTY TARIFFS AGAINST CHINA

On March 22, President Trump directed the U.S. trade representative to increase tariffs on a list of 1,300 imports from China, valued at more than $46 billion. The items include televisions, machinery, mechanical appliances, electrical equipment, and midsize cars. These tariffs would be designed to recoup losses from Chinese theft of intellectual property belonging to U.S. companies. Before the tariffs go into effect, they must be published in the Federal Register and undergo a 30-day comment period.

Section 301 of the Trade Act of 1974 allows retaliatory tariffs against foreign government practices that are unreasonable, discriminatory, or burden U.S. commerce. If the USTR finds unfair foreign trade practices, the president has broad authority to take any “appropriate and feasible action.”

New Chinese Tariffs on U.S. Items

Chinese Tariffs Against the United States

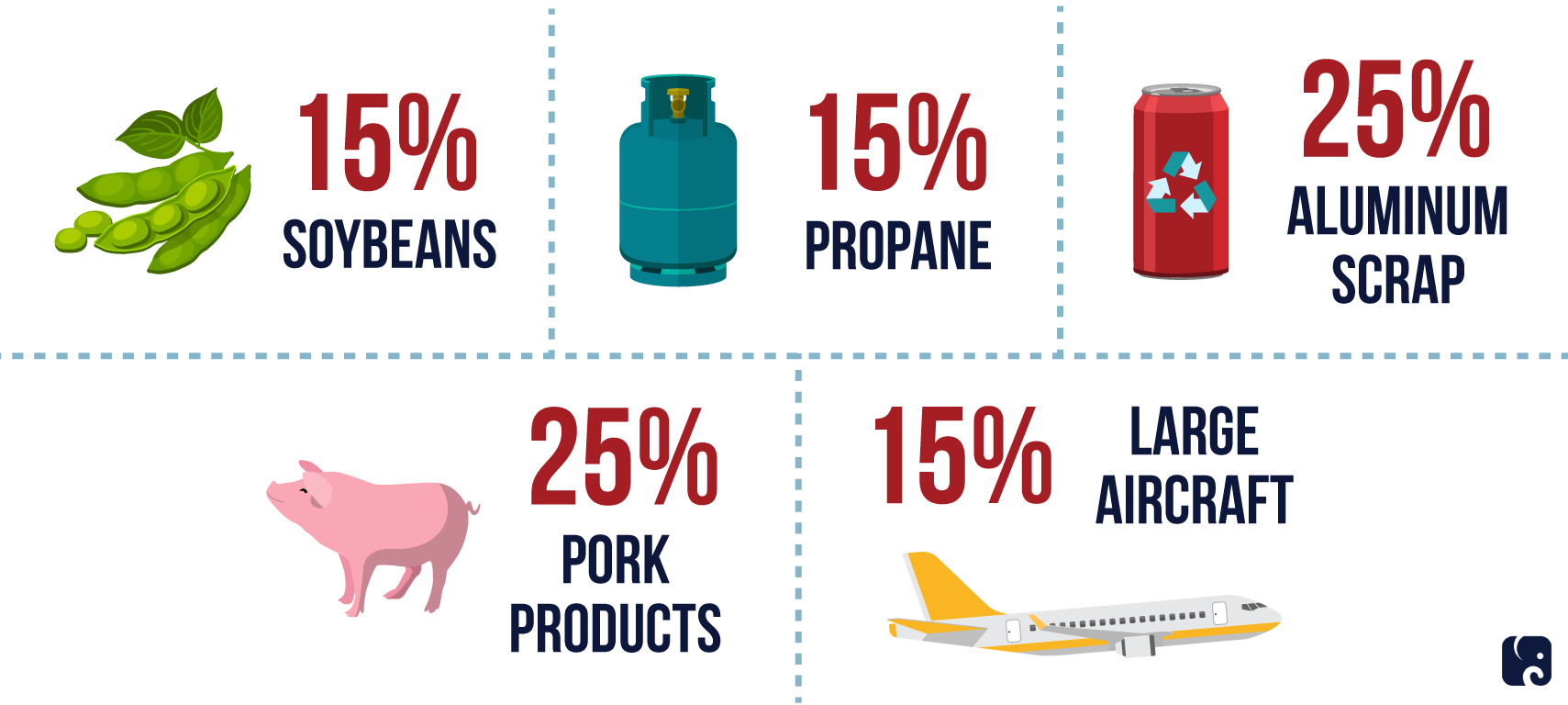

On April 2, China imposed retaliatory tariffs, effective immediately. China imposed a 15 percent tariff on U.S. exports of 120 items, including soybeans, cotton, propane, large automobiles, and large airplanes. There is also a 25 percent tariff on aluminum scrap and pork products. The cumulative value of the items targeted is roughly $50 billion, matching the total expected effect of U.S. tariffs. The Chinese government has also initiated a second WTO protest against the U.S. tariffs on Chinese goods. WTO dispute settlement procedures require at least two months of consultations before a panel can be established to adjudicate the issue.

U.S. Retaliatory Tariffs

In response to the Chinese retaliatory tariffs, President Trump said on April 5 he would seek additional tariffs on $100 billion worth of Chinese imports. It is not yet known what products will be targeted. This action also would be based on Section 301 of the Trade Act of 1974.

Next Article Previous Article