President Obama’s Failure on Social Security Disability

-

The Social Security Disability Insurance trust fund will be depleted in late 2016, forcing a 19 percent cut in payments to beneficiaries.

-

The DI trust fund has significantly worsened during the Obama administration, and its depletion is coming 10 years sooner than experts predicted in 2007.

-

President Obama has failed to lead on this issue, just recently putting forward a kick-the-can proposal that harms retirees and does not address DI’s problems.

Social Security Disability Insurance faces a funding shortfall of nearly $270 billion over the next decade. The program’s unfunded liability amounts to $1.2 trillion over the next 75 years. Social Security’s trustees project the DI trust fund will be bankrupt by late 2016. The condition of the trust fund has significantly worsened during the Obama administration, and the depletion of the trust fund is coming 10 years sooner than experts predicted in 2007.

Without changes in the law, depletion of the trust fund will mean that DI beneficiaries can only be paid from incoming payroll tax receipts specifically devoted to the fund. Since projected receipts would only finance about 81 percent of scheduled benefits, beneficiaries would face across-the-board benefit cuts of approximately 19 percent without legislative action.

The DI program’s impending insolvency is the result of demographic changes like the aging of the population, as well as structural deficiencies in the program and Social Security Administration mismanagement. These problems include:

- The SSA has allowed, and even encouraged, administrative law judges to rubber-stamp disability claims. According to a 2014 congressional report, “there were 191 ALJs who had a total allowance rate in excess of 85 percent [between 2005 and 2013]. These 191 ALJs awarded more than $150 billion in lifetime benefits between 2005 and 2013.” A 2014 study by the inspector general for Social Security found that only 11 percent of “high allowance” ALJ decisions contained a well-supported rationale. An official with an association for ALJs told 60 Minutes in 2013 that “if the American public knew what was going on in our [disability] system, half would be outraged and the other half would apply for benefits.”

- A 2010 paper by the Center for American Progress and the Brookings Institution concluded: “SSDI is ineffective in assisting workers with disabilities to reach their employment potential or maintain economic self-sufficiency. Instead, the program provides strong incentives to applicants and beneficiaries to remain permanently out of the labor force.”

- Economists with the Federal Reserve Bank of Atlanta concluded in May 2014 that the growth in disability is a significant factor in the rapid decline in the labor force participation rate during the Obama administration. Fewer than one percent of program beneficiaries return to the workforce in any given year.

- According to a 2013 paper by Mark Duggan, President Obama’s former adviser for health care policy, an increasing number of people are qualifying for DI with subjective conditions like back pain or depression.

Without reform, the failures of DI will continue to erode economic productivity and harm both the truly disabled as well as taxpayers. A bipartisan solution is urgently needed to fix the program’s problems and to preserve it for those who cannot work.

The president’s irresponsible kick-the-can proposal

Despite holding office for six and a half years, the president has not engaged with Congress to develop a longer term solution to DI’s impending bankruptcy. Now, rather than proposing reforms, the president has offered to kick the can down the road by demanding a stand-alone payroll tax reallocation. Currently, the total payroll tax equals 12.4 percent of wage income – with 1.8 percent dedicated to DI and 10.6 percent dedicated to Social Security’s old age and survivor component. The president’s proposal would increase the tax earmarked for the DI trust fund to 2.7 percent, while reducing the payroll tax earmarked for the OASI trust fund to 9.7 percent for the next five years.

President Obama’s proposed reallocation is projected to generate sufficient reserves in the DI trust fund to forestall bankruptcy until 2033. In his proposal, the OASI trust fund is projected to become insolvent at the same time. The president’s 2016 budget request argued that his plan would remedy the reserve depletion of the DI trust fund “while a longer-term solution to overall Social Security solvency is developed with the Congress.” The president is offering an irresponsible proposal that is not accompanied by any reforms in the DI program – something inconsistent with previous re-allocations.

Many Democrats are pushing the myth that there have been 11 previous bipartisan reallocations between trust funds in the past and that such reallocations are ordinary housekeeping. In fact, there has never been a reallocation from OASI to DI like the president is proposing. The previous reallocations stemmed from six pieces of legislation, four of which involved major Social Security reform. None of the previous reallocations occurred at a time when both parts of Social Security were in such poor fiscal shape.

The most recent reallocation occurred in 1994 when Congress increased the DI portion of the payroll tax by 50 percent. While Social Security’s public trustees supported the reallocation, they urged SSA and Congress to study DI and develop “substantive changes needed in the program” in their 1994 report. In the trustees 1995 report, they reiterated that the reallocation “should be viewed as only providing time and opportunity to design and implement substantive reforms that can lead to long-term financial stability.” The SSA, previous Congresses, and the executive branch failed to head the trustees’ advice. Despite the promise of reforms, these never happened – and DI’s finances have deteriorated to the point where bankruptcy is again imminent.

The president’s standalone reallocation proposal will undoubtedly delay reforms and structural changes once again. His plan defies repeated calls from the Social Security trustees – who include his secretaries at Treasury, Labor, and Health and Human Services, and the acting Social Security commissioner – for prompt action to address Social Security’s unsustainable path.

Moreover, there are long-standing reasons why the trust funds should be separate. Social Security public trustee Chuck Blahous wrote in April that “[w]hen Social Security was first established, lawmakers assured the public that its retirement pensions would be self-financing. … When disability insurance was added later, similar promises were made that it would also be self-sustaining, and not siphon funds from Social Security’s retirement program or from the general budget.” Blahous noted that President Eisenhower’s signing statement cited the separate trust fund as one of the features that enabled him to sign the bill: “A separate trust fund was established for the disability program in an effort to minimize the effects of the special problems in this field on the other parts of the program – retirement and survivors’ protection.”

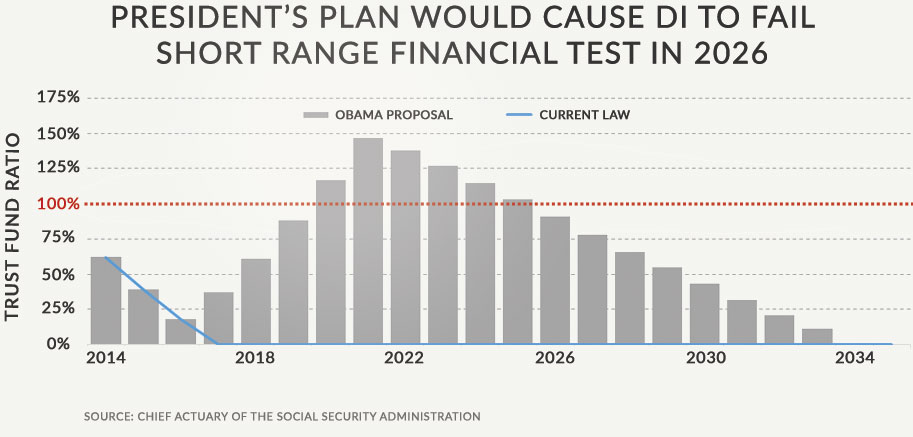

While the president’s reallocation proposal appears to avert the DI trust fund’s shortfall until 2033, uncertainty will actually return in 2026. Under the president’s plan, the DI “trust fund ratio,” which measures trust fund reserves at the beginning of a year as a percentage of projected program expenditures, will fall below 100 in 2026. A ratio below 100 fails the short-range test for financial adequacy. As a result, in 2026 and each year thereafter, the Social Security trustees will issue financial warnings from the failed adequacy test, causing anxiety over the possibility of benefit cuts.

Stand-alone reallocation harms Social Security retirement program

The president’s proposed reallocation would transfer about $350 billion from the OASI trust fund to the DI trust fund in the next five years. Since the president’s proposal worsens the solvency of Social Security’s OASI trust fund, it threatens benefits for retirees. Moreover, the president’s proposal is a particularly bad idea given that OASI’s financial condition is in even worse long-run shape than is DI’s. This was not the case in 1994 when the last reallocation passed Congress.

According to Blahous, “[r]earranging the deck chairs, rather than slowing cost growth, would be an inadequate response with potentially ruinous implications for the program.” In a January 15 editorial, the Wall Street Journal used the analogy of “an underwater borrower transferring debt from one maxed-out credit card to another with a higher balance but also a higher spending limit.”

Republicans have proposed DI reforms

Rather than demand an irresponsible solution to a problem that the president has ignored for too long, he should work with Congress on real solutions. These include modernizing DI and improving its fiscal outlook; making it easier for beneficiaries to work if they are able; and reducing waste, fraud, abuse, and mismanagement in the program. Senate Finance Committee Chairman Orrin Hatch and House Ways and Means Committee Chairman Paul Ryan have proposed bills that would begin the process of reforming the DI program. They are also soliciting ideas on reforms from disability program experts, researchers, advocates, and the general public. The responsible path forward – and one consistent with most prior reallocations – is to combine a limited reallocation with genuine policy reforms that protect both the disabled who cannot work, Social Security’s retirement program, and the workers who finance Social Security.

Next Article Previous Article