Paying for Surface Transportation Infrastructure

KEY TAKEAWAYS

- With the Fixing America’s Surface Transportation Act expiring on September 30, 2020, discussions are starting on its reauthorization and ways to pay for these investments.

- The current leading source of funding, the Highway Trust Fund, has been spending more than it takes in for years and has required infusions from the U.S. Treasury.

- Some policy options to pay for transportation projects include mileage-based charges, asset recycling, infrastructure banks, and more public-private partnerships.

Congress is expected to renew federal support for state and local transportation projects before the current authorization expires at the end of fiscal year 2020. Some lawmakers also want to consider a comprehensive bill to improve the country’s aging infrastructure and build new capacity. In both cases, a key question will be how to pay for it all.

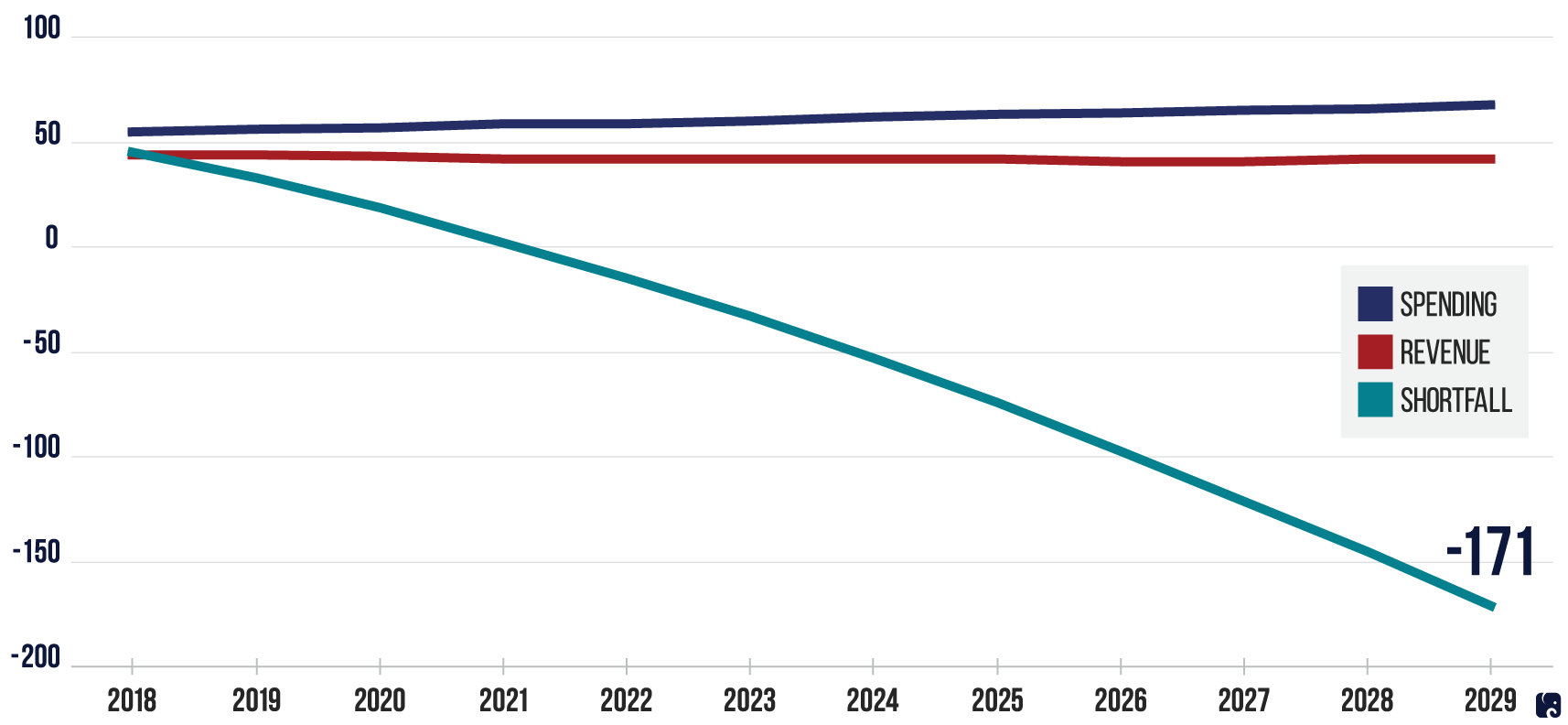

Highway Trust Fund’s Shortfall Grows ($Billions)

Source: CBO

transportation FUnding

Most federal aid to states and localities for surface transportation is paid out of the Highway Trust Fund, which comes largely from fuel taxes. Spending from the trust fund has outpaced revenue in recent years, and the Congressional Budget Office expects this gap to widen. Since 2008, Congress has been keeping the trust fund solvent by supplementing it with funds from the Treasury – $144 billion over the past decade. The fund is expected to develop a total shortfall of another $171 billion by fiscal year 2029.

In 2017, the Federal Highway Administration reported that highway construction costs had increased by 68 percent over the previous 13 years. The federal gas tax, which is 18.3 cents per gallon, was last raised in 1993 and is not tied to inflation. As motor vehicles become more fuel efficient, their drivers buy less gas and contribute less to the trust fund. This situation will get worse as hybrid and electric vehicle sales increase.

States and localities, which provide most public spending on transportation projects and maintenance, have their own budget constraints. In the past six years, 30 states and the District of Columbia have raised their own fuel taxes or changed their laws in ways that may increase taxes. States also have increased or added taxes on motor carriers, electric and hybrid vehicles, vehicle registrations, and bicycle sales.

transportation financing tools

Beyond the Highway Trust Fund, capital-intensive transportation projects can be paid for with public borrowing or private investment. The Department of Transportation’s Build America Bureau offers project sponsors several forms of support. One is a loan program for freight, commuter, and transit rail projects. Another is the Transportation Infrastructure Finance and Innovation Act program, which offers low-interest loans for highway, transit, and other projects. New York’s Tappan Zee Bridge replacement and the Grand Parkway tollway expansion in Houston are among the projects with TIFIA as part of their financing. Proposals for future transportation financing include those to broaden TIFIA eligibility and expedite the program’s application process.

The federal government also subsidizes state and local infrastructure projects through tax-exempt bonds for government projects. It also does this for certain major state and local projects considered private activities. In particular, the transportation secretary may allocate a total of $15 billion in bonds for privately developed and operated highway and freight transfer facilities. As of May 7, 2019, about $12.5 billion of this authority had been allocated or issued. Some proposals call for creating new categories of these qualified private-activity bonds or raising the cap to $21 billion.

a Mileage-based model

In the current surface transportation law, Congress authorized a $95 million program to help states test alternative models for funding transportation projects. One alternative would use GPS devices or odometer readings and impose charges based on the number of miles driven, not the number of gallons of gas bought. Major concerns with this vehicle-miles-traveled model include privacy issues, individual data protection, fairness for rural drivers, and the administrative costs.

Several western states are studying reporting and payment options, as well as public acceptance; they are planning a regional pilot project. Oregon has a program in which participants report miles traveled and get rebates for the fuel taxes they pay. Delaware and the I-95 Corridor Coalition have a multi-state pilot to test the model with commercial trucks and other drivers.

asset recycling

Another option to pay for transportation infrastructure projects is “asset recycling.” Under this idea, the federal, state, or local government leases or sells a public asset to the private sector and uses the proceeds for other projects. The lease terms may require the private partner to repair or improve the asset, such as adding new lanes to a road. Facilities with tolls or other revenue options are often the best candidates for asset recycling.

When Australia set up an asset recycling initiative in 2014, the program generated an estimated AU$15.3 billion in proceeds, plus AU$2.3 billion in federal incentive payments, to be spent on new infrastructure projects. New South Wales helped fund a Sydney metro rail expansion and other projects with proceeds from asset sales and leasing part of its electricity network.

A 2018 Reason Foundation study suggested asset recycling could be a way to fix aging transportation assets in the U.S. and find money for new projects, especially those unable to secure private financing. Challenges include potential objections over lengthy leases and what authority and risk the different partners would assume. Australia also found it was unclear if the proceeds went toward new, high-priority projects or to projects that were already underway and easier to approve by the program’s deadline.

National Infrastructure Bank

Some lawmakers have proposed creating a “bank” that issues loans and other credit assistance to infrastructure projects. The bank could be housed in a federal agency or set up as a new government corporation. Most proposals include appointing board members with expertise in finance or infrastructure. Initial funding would come from federal appropriations, and some plans would allow the bank to issue bonds or charge fees to raise more funds. Proponents see such a bank as another way to increase private investment in large infrastructure projects. Detractors say it would duplicate existing federal credit programs and would not be suitable for projects that cannot charge user fees or raise other dedicated revenue.

Next Article Previous Article