Options to Loosen the Grip of Obamacare

-

Obamacare is raising premiums and restricting choice; the law is fundamentally flawed.

-

Republicans have offered proposals to replace the entire law.

-

Republicans have also proposed targeted changes to reduce the law’s taxes and mandates, and to make health care more personal, individual, and local.

On July 26, Republican Senators supported repealing the president’s fundamentally flawed health care law. No Democrats joined this effort. While Democrats believe in having Washington manage people’s health care choices, Republicans would return key health care decisions to the people and the states.

Obamacare gave Washington much greater control over Americans’ health care choices. The word “secretary” appears nearly 3,000 times in the law, most frequently referring to new powers given to the secretary of health and human services. The administration has written tens of thousands of pages of regulations in its attempt to micromanage the decisions of doctors and patients.

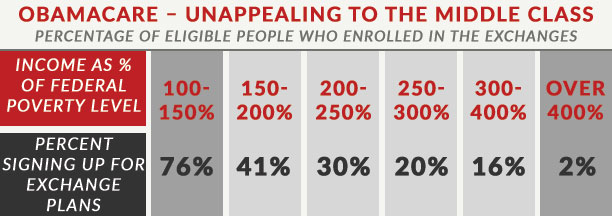

Insurer rate filings across the country show that premiums for Obamacare plans are set to increase significantly again next year. These increases are on top of large premium hikes in the past and are generally for plans with high deductibles and narrow provider networks. While people below 200 percent of the poverty level receive subsidies to offset much of the price, those in the middle class are getting little benefit. They are left with higher taxes and higher premiums to fund the law. Enrollment in the exchanges is about 30 percent lower than initial projections. Obamacare’s complicated mandate and subsidy scheme will lead to two million fewer workers by 2017 and will lower national income by one percent compared to what it would be otherwise.

Republicans continue to offer reforms that increase people’s freedom to decide what works best for their families. These proposals include full-scale replacement plans for Obamacare, such as one put forward by Senator Hatch, Senator Burr, and Representative Upton. Their plan addresses Obamacare’s excessive controls and mandates, its complicated tax and subsidy scheme, and its unwise and unaffordable Medicaid expansion. In addition to full replacement plans, there are many other Republican ideas that aim to loosen Obamacare’s grip on health care and the economy.

Returning power to the states

In preparing for a possible ruling in King v. Burwell that would have stopped Obamacare’s subsidies in two-thirds of the country, Republicans united around the idea of allowing states to opt out of Obamacare’s heavy mandates and regulations. These mandates and regulations restrict consumer choice and push up health care costs. Rather than having health insurance regulated by Washington, Republicans would return these key decisions to the states.

In 2013, Senators Barrasso, Graham, and Ayotte introduced the State Health Care Choice Act to allow states to protect their residents from some of the most harmful parts of Obamacare. States that take this option would be freed from Obamacare’s one-size-fits-all approach. People in those states would have more choices, fewer mandates, and lower costs. Younger people in these states stand to benefit the most, as Obamacare’s mandates and pricing regulations have increased their premiums the most.

Allow people to keep plans that they like

Politifact’s Lie of the Year in 2013 was the president’s statement – made 37 times when selling his law – that “if you like your health care plan, you can keep it.” The Associated Press found that at least 4.7 million Americans stood to lose their insurance plans because of Obamacare. Facing public outrage about cancelled policies in the fall of 2013, the president unilaterally decreed that state insurance commissioners could allow non-Obamacare compliant plans through 2016. In September 2014, the House overwhelmingly passed a bill that would permit insurers to continue offering non-Obamacare compliant plans through 2018. This bill was not brought up for consideration when Senator Reid was Majority Leader. Senator Cassidy, the author of the bill in the House last year, has reintroduced the bill in this Congress.

In addition to prohibiting millions of people from continuing insurance coverage that met their needs, Obamacare banned anyone over the age of 30 from purchasing a catastrophic health plan. Senator Flake has introduced legislation that would allow catastrophic coverage to satisfy Obamacare’s requirements, permitting people of any age who purchase catastrophic coverage to avoid the individual mandate penalty. Senator Portman has introduced legislation that allows people to purchase catastrophic insurance and that relieves small businesses of several of Obamacare’s burdensome requirements.

Repealing Obamacare taxes

Obamacare’s drafters “paid for” all of the law’s new spending in three principal ways: tax increases; Medicare cuts; and budget gimmicks. Obamacare has more than 20 tax increases that will cost hardworking taxpayers more than $1 trillion over the next decade.

Individual Mandate

In preparation for the Supreme Court’s decision in the King v. Burwell case, Senator Johnson proposed the Preserving Freedom and Choice in Health Care Act. Part of this legislation, which has 30 co-sponsors, would repeal the individual mandate and its associated tax penalties. Senator Hatch also has introduced legislation, with 29 co-sponsors, to repeal the individual mandate. Senator McCain has a proposal that allows people to opt out of paying the individual mandate tax.

Repealing the individual mandate would significantly decrease federal deficits because fewer people would buy subsidized coverage or sign up for Medicaid once Washington coercion is removed. In March 2014, CBO projected that repealing the individual mandate would reduce federal revenue by $4 billion, and federal spending by $469 billion, between 2014 and 2024. During the Senate debate of the “Doc Fix” in April 2015, Senator Cornyn offered an amendment to repeal the individual mandate. All Republicans supported this amendment, and all Democrats opposed it.

Medical Device Tax

On June 18, the House of Representatives passed a bill to repeal the medical device tax by a vote of 280 to 140. Forty-six Democrats joined a unanimous Republican caucus in supporting the legislation. That bill would decrease revenues by approximately $31 billion over the next decade. Senator Hatch has introduced a Senate bill that repeals the medical device tax. The bill has 38 co-sponsors, including five Democrats.

Health Insurance Tax

The federal government will raise $145 billion in revenue from 2015 to 2024 because of Obamacare’s health insurance tax. The actuarial firm Oliver Wyman projects that this tax will increase small group premiums by $210 for single coverage and $530 for family coverage this year. Senator Barrasso, along with 37 co-sponsors, has introduced a bill that repeals the health insurance tax. In the House of Representatives, a bill to repeal this tax has 232 co-sponsors.

Cadillac Tax

The federal tax exclusion for employer-sponsored insurance distorts health care decisions and contributes to excessive health care spending. Obamacare’s non-deductible Cadillac tax equals 40 percent of the cost of coverage above $10,200 for single coverage and $27,500 for family coverage starting in 2018. The Cadillac tax encourages the design of insurance that costs less than the threshold amounts, posing a threat to expensive employer-sponsored plans and union plans. CBO projects that the Cadillac tax will bring in $87 billion of revenue to Washington between 2018 and 2025.

Over-the-Counter Drugs

Obamacare restricted the ability of people to use a medical savings account to purchase over-the-counter medications. Medical savings accounts have been shown to increase consumer engagement with their health care purchases and lower unnecessary spending. Senator Roberts has introduced legislation that repeals these provisions in Obamacare. Nine Republicans, as well as Senators Heitkamp and King, have co-sponsored this legislation.

Restoring the 40-hour work week

On January 8, the House of Representatives passed the Save American Workers Act by a vote of 252 to 171. Twelve Democrats joined a unanimous Republican caucus in supporting the legislation. For purposes of the employer mandate, the bill changes Obamacare’s definition of a full-time employee from someone who averages 30 hours per week to someone who averages 40 hours. The bill would reduce the number of employers subject to Obamacare’s penalties and would lessen the amount of the penalties. CBO projects that this bill would reduce government revenues by $32 billion and increase government spending by $21 billion over the next decade.

As a result of this bill, fewer workers would have their hours cut below 30 hours per week. An analysis by the Hoover Institution found that there are 2.6 million workers at risk of having their hours cut because of the 30-hour work week rule. According to the study, 63 percent of those most at risk of lost hours are female, and almost 60 percent are between the ages of 19 and 34. Senator Collins has introduced similar legislation in the Senate. So far, 40 Senators, including Democrat Senators Donnelly and Manchin, are co-sponsoring this legislation.

Several liberal groups have proposed scrapping the employer mandate entirely. Senator Johnson’s Preserving Freedom and Choice in Health Care Act would have repealed the employer mandate.

Repealing Washington’s Medicare payment board

Obamacare created the Independent Payment Advisory Board, a board of 15 political appointees who will make Medicare cuts if spending exceeds budget targets. These are above and beyond the more than $800 billion that Obamacare cut from Medicare in the next decade to spend on its new entitlement programs.

On June 23, the House of Representatives passed a bill to repeal the IPAB, with 11 Democrats joining a unanimous Republican caucus. CBO projects that the IPAB will lower federal spending by $7.1 billion between 2022 and 2025. To pay for the bill, the House cut funding from Obamacare’s slush fund for the Department of Health and Human Services. An IPAB repeal bill in the Senate, introduced by Senator Cornyn, has 40 co-sponsors.

Repealing Obamacare’s insurance company bailout

Hidden in section 1342 of the president’s health care law is a potential taxpayer-financed bailout of insurance companies through a risk corridor program. The program was designed to transfer money from insurers that earned “excess” profits on Obamacare plans to insurers that incurred excess losses on these plans. On May 1, Standard & Poor’s released a report showing that insurance companies expect to receive at least 10 times more in payments from Obamacare’s risk corridor program than they expect to pay in.

Last year Republicans protected taxpayers from having to bail out insurance companies through the risk corridor program. In December, Congress blocked the administration from tapping taxpayer funds if insurers generally underpriced Obamacare plans and lost money. Section 227 of the Consolidated and Further Continuing Appropriations Act of 2015 (the cromnibus) prohibits the administration from transferring funds from other accounts to pay for the risk corridor program. For 2014, payments to insurers with excess losses cannot exceed incoming payments from insurers with excess gains, effectively making the program budget neutral for one year. Senator Rubio has introduced legislation with 11 co-sponsors that repeals the risk corridor program, and Senator Cassidy has introduced legislation co-sponsored by Senator Rubio that would ensure the risk corridor program remains budget neutral.

Restoring the definition of “small business”

Starting in 2016, Obamacare defines small businesses as companies with up to 100 workers. This means that starting next year businesses with 51 to 100 workers must abide by the rules governing the small group market. As a result of having to comply with the stricter Obamacare rules, the employees of businesses of this size that do not self-insure will likely face steep premium increases. Actuaries also warn that adverse selection in these markets may increase because of this change.

Senator Scott has introduced legislation that would allow states to maintain their small group insurance definition at 50 workers. Five Democrat and four Republican Senators have co-sponsored this bill. In the House, Representative Guthrie has introduced similar legislation with 178 co-sponsors.

Next Article Previous Article