Obama’s $4.5 Trillion Tax Hike

Unless President Obama changes course, one-quarter of all job creators will see their income taxes increase in 2013. In an economy like this, we can’t afford to raise taxes on anyone—especially not on small businesses and America’s job creators.

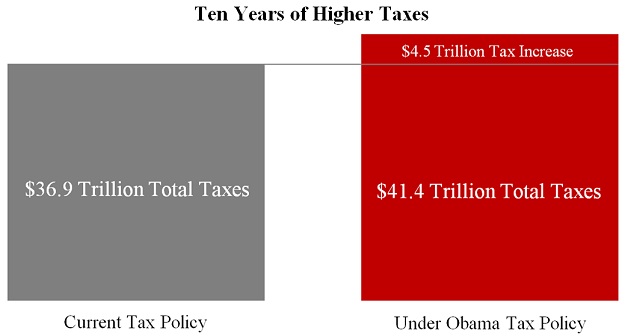

Income Taxes Go Up $4.5 Trillion Next Year

Total scheduled individual income tax increases are $4.5 trillion over 10 years. Under the Obama tax hike plan, a typical family of four earning $50,000 will send an extra $2,000 to Washington next year.

Higher Taxes Hurt Jobs

New and higher taxes will not create jobs — except at the IRS. According to the Congressional Budget Office, “higher marginal tax rates do reduce economic activity.” President Obama’s tax hike plan will hurt the ability of small businesses to innovate, invest, and create careers.

- One Out of Four Employees Work At Businesses Hit. Businesses employing 25 percent of the American workforce would be hit with higher taxes.

- Nearly All Small Businesses Affected. Government data shows that 94 percent of small businesses pay taxes through the individual tax code.

- Hundreds of Thousands of Small Businesses Caught. Approximately 750,000 small businesses would be hit by President Obama’s tax hike.

- America’s Competiveness Hurt. Raising the dividend and capital gains rates will result in a 68.6 percent integrated dividend tax rate (the highest among industrialized countries) and a 56.7 percent integrated capital gains tax rate, second highest among these nations (behind Italy). Such a high rate will drive investment and jobs overseas.

Taxes That Will Go Up

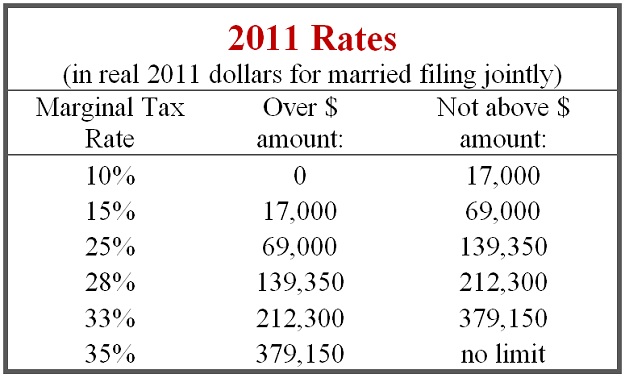

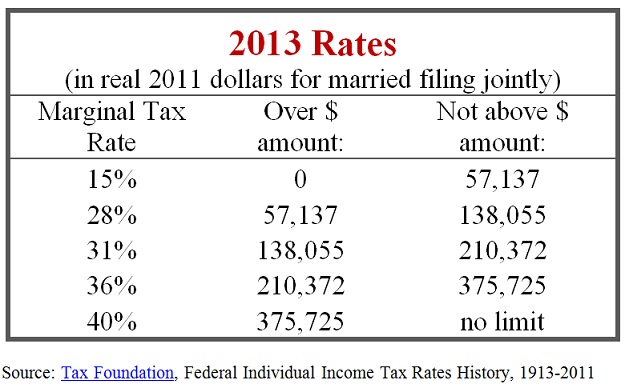

Personal income tax rates for all American taxpayers will go up in 2013.

- Current Rates: 10%, 15%, 25%, 28%, 33%, 35%

- Rates Without Action: 15%, 28%, 31%, 36%, 39.6%

- Lower-Income Americans Harmed. For lower-income Americans, the 10 percent tax bracket would increase to 15 percent. This will raise the average taxpayer’s bill by $500.

- Married Couples Harmed. The average married couple would pay $600 in higher taxes.

- Personal Savings Harmed. For taxpayers investing and saving, the dividends rate of 15 percent would increase to as high as 45 percent, and the capital gains rate of 15 percent would increase to 23.8 percent including the President’s health care law tax increases.

- Families With Children Harmed. For families with children, the child credit of $1,000 would be reduced to $500. The average family will see its taxes rise by $1,033.

- Adoption Harmed. For families adopting a child, the adoption credit of $10,000 and exclusion of $10,000 saved families an average of $4,000 in 2008.

- Dependent Care Harmed. In 2009, families claiming the credit making between $25,000 and $40,000 lowered their tax liability by $600.

- Child Care Harmed. Job creators providing child care will lose a tax credit equal to 25 percent of child care expenses.

- Education Savings Harmed. For taxpayers saving for education, Education Savings Accounts will decrease from a maximum annual contribution of $2,000 to only $500.

- Personal Exemption Harmed. The personal exemption and Pease itemized deduction phase-outs for high earners will both return. Neither provision applies to all taxpayers, but each can increase the marginal tax rate by approximately one percent.

- Death Tax Returns. Estate and gift taxes will increase from a top rate of 35 percent with a $5 million exemption to 55 percent with a $1 million exemption. An estimated 49,200 more estates will pay the tax than paid it in 2011.

Class Warfare

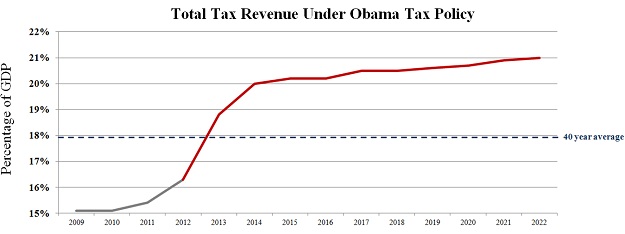

President Obama is using tax policy to divide Americans. He proposes tax increases for a minority and tells the majority that this will solve our debt and deficit problem.

These tax hikes will not solve our debt problem. If the IRS confiscated 100 percent of all income belonging to those making over $1 million per year, it would not pay for our projected deficit of $1.3 trillion for the current fiscal year. According to the IRS, in 2009 the total income of everyone making over $1 million was $726.9 billion. Their taxable income (after deductions) is already taxed at a 25 percent effective rate, leaving approximately $545 billion left to tax.

Since taxing the “rich” is not enough, President Obama, like President Clinton before him, will continue to break his pledge of not raising taxes on the middle class in order to finance his ever-growing government spending.

In order to stabilize the growth of our national debt, the President must propose real spending cuts that shrink the size of government. He has proved unwilling to do this.

New Obama Taxes

In addition to the scheduled $4.5 trillion Obama Tax Hike, the President has proposed new taxes that will further hurt economic growth and job creation. Based on his record, the President would spend the new tax money rather than use any of it to reduce Washington’s debt. As he said when he fought to raise taxes in 2009, “There are a whole bunch of better ways to spend the money.”

- Buffett Tax. The President has proposed that no one making more than $1 million per year pay less than 30 percent of their income in federal taxes. This tax raises approximately $47 billion over 10 years.

- International Minimum Tax. The President proposed that American companies doing business internationally pay an unspecified minimum tax on their overseas profits. He proposed no specific rate, so the exact amount of the tax increase is unknown. The President has adopted this new minimum international tax policy instead of a territorial tax system endorsed by his own Jobs Council and Fiscal Commission.

- Reduce Value of Deductions. The President has proposed limiting the value of existing tax deductions by capping these deductions at a 28 percent rate. This raises taxes by $321.3 billion over 10 years.

- President’s Fiscal Year 2013 Budget Tax Increases. In his budget, the President proposed new taxes on businesses, including:

- Tax increases on businesses: $189 billion. Key provisions include:

- Repeal gain limitation for dividends received in reorganization exchanges;

- Tax carried interests as ordinary income;

- Require a certified taxpayer identification number (TIN) from contractors and require withholding if a TIN is not given;

- Require tax withholding for payments to an independent contractor in excess of $600 per year.

- Tax increases on American businesses operating internationally: $147 billion. Key provisions include:

- Defer deduction of interest expense related to deferred income of foreign subsidiaries;

- Tax gain from the sale of a partnership interest on look-through basis;

- Prevent use of leveraged distributions from related foreign corporations to avoid dividend treatment.

- Tax increases on the financial sector: $80 billion. Key provisions include:

- Impose a “financial crisis responsibility fee” (despite the fact that Treasury has largely made a profit from TARP loans to financial firms);

- Modify proration rules for life insurance companies.

If President Obama fails to lead, taxes will increase dramatically in January. In addition, he has proposed billions of dollars in higher taxes on American families and small businesses. This one-two punch of Obama tax hikes would harm job creators, hurt American workers, and shut down economic growth.

Next Article Previous Article