Obamacare’s Ongoing Plague of Problems

The past two weeks, Americans saw Obamacare’s ongoing problems quantified:

-

Obamacare networks have 1/3 fewer providers than commercial plans do.

-

GAO found it’s easy for people to falsify information and qualify for subsidized Obamacare coverage.

-

7.5 million taxpayers paid the individual mandate penalty in 2014.

-

An economic model predicts soaring Obamacare premiums.

Far fewer providers in Obamacare plan networks

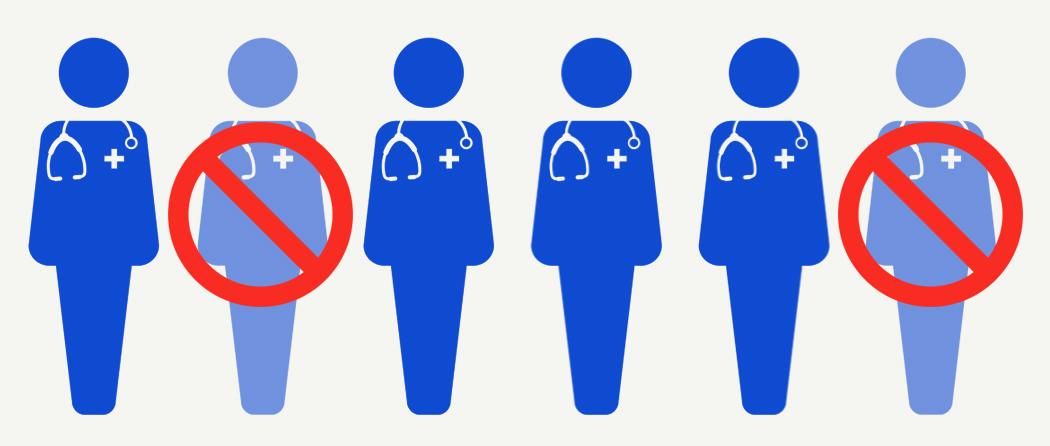

Narrow provider networks are one way insurers are attempting to keep premiums for Obamacare plans from rising even higher. The health data firm Avalere released a new analysis showing that the average provider network for Obamacare plans has 34 percent fewer providers than the average commercial plan network offered outside the exchanges. On average, Obamacare plans have 42 percent fewer oncologists and cardiologists, and 32 percent fewer primary care doctors.

34 percent fewer providers in Obamacare plans

It’s easy to get subsidized Obamacare coverage for a fake person

In its pursuit of enrolling as many people for Obamacare as possible, the administration has failed to adequately safeguard taxpayer dollars. Last year, the Government Accountability Office was able to enroll into subsidized exchange coverage 11 of 12 people with false identities. On July 16, GAO announced that all 11 maintained subsidized coverage through 2014 and were re-enrolled in 2015. Some fake applicants were approved for subsidized coverage based solely on their attestation without any supporting documents.

Six of the applicants received notices that their coverage was being terminated for failure to submit information or documentation. GAO was able to have five of them reinstated just by calling the exchange – and even got higher subsidies. The fake applicants received confusing and erroneous information from the federal exchange. GAO also found that federal contractors continued to accept documents as true without attempting to verify their authenticity.

More people paid individual mandate penalty in 2014 than expected

On July 17, the Treasury Department released Obamacare tax information. Roughly 7.5 million taxpayers – six percent of all filers – paid the individual mandate penalty in 2014. This is about 25 percent more filers than the administration’s highest estimate. The average penalty was about $200, and total penalties equaled $1.5 billion. The amount paid will increase over the next few years as the penalty rises from the greater of $95 or one percent of household income in 2014, to the greater of $695 or 2.5 percent of household income in 2016. About 300,000 taxpayers, mainly low-income people who likely qualified for an exemption, mistakenly paid the penalty. About 12 million people – about nine percent of tax filers – claimed an exemption from the individual mandate, far fewer than had been projected.

Treasury estimates that insurance companies received advanced subsidies on behalf of about four percent of filers. This means that roughly two to three million fewer taxpayers received advanced subsidies than paid the individual mandate penalty. Given Obamacare’s overly complicated subsidy structure, millions of people incorrectly filed their tax returns, and only about 10 percent of subsidized exchange enrollees received the correct subsidy amount. Half of all subsidized enrollees owed extra money at tax time; an average of $800. According to Treasury, less than two-thirds of the $15.5 billion sent to insurers in advanced subsidies has been reconciled thus far.

Large Obamacare plan premium increases in store in future

Economist Stephen Parente wrote in the Wall Street Journal on July 17 that premium increases will get worse after 2016 “when two de facto bailouts for insurance companies expire.” He noted that “[t]hanks to these two programs, insurance companies are able to artificially lower their premiums for consumers – by between 10%-15% in 2014, according to CMS – while charging the taxpayer for their losses. Reinsurance alone cost taxpayers $7.9 billion in 2014.” Parente found that the average 2016 family plan will increase 11 percent and the average 2016 individual plan will increase eight percent. He estimated that by 2023, the average plans will be about 60 percent more expensive than in 2015.

Next Article Previous Article