Obamacare’s Co-op Debacle

-

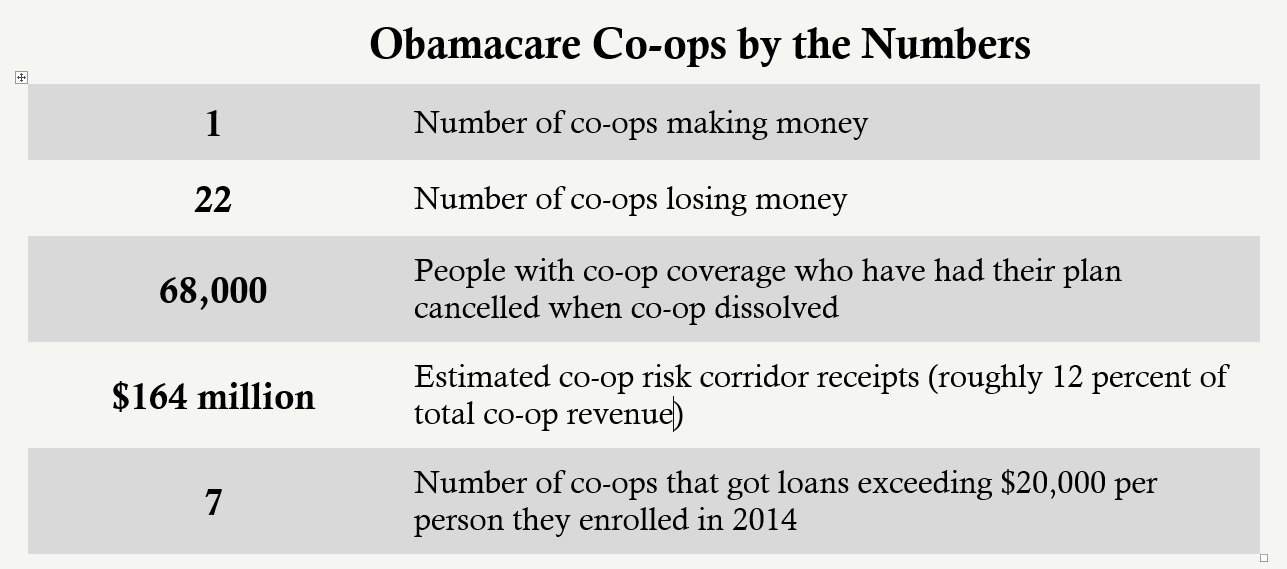

Only one Obamacare co-op made money during the first three quarters of 2014.

-

Taxpayers are set to lose more than $1 billion of the $2.4 billion loaned to the co-ops – nearly double the loss of Solyndra.

-

Many of the co-ops underpriced coverage and were counting on a bailout through Obamacare’s risk corridor program.

Section 1322 of Obamacare established a $6 billion low-interest loan program for the creation of nonprofit health insurance start-up companies, dubbed co-ops. Through several pieces of bipartisan legislation, Congress subsequently rescinded 60 percent of the initial funding. So far, the Centers for Medicare and Medicaid Services has loaned $2.4 billion to 24 co-ops, one of which failed before it enrolled anyone. Another, CoOportunity Health, has already been liquidated, affecting coverage for 68,000 people in Iowa and Nebraska. It had been the second largest co-op in the country.

From the start, the Obama administration projected that the co-op program would hemorrhage taxpayer money. In its supplement to the president’s 2013 budget, the Office of Management and Budget estimated that taxpayers would lose more than 40 percent of the value of the co-op loans – an extraordinary amount even for risky government loan programs. OMB predicted about half of the taxpayer loss would come from default and about half from artificially low interest rates.

Early evidence suggests that taxpayers might lose even more than initially projected, and many people who signed up with co-ops may lose their coverage. Other people could be forced to pay higher premiums to provide some financial protection for people with co-op coverage. Two new financial analyses – one from Standard & Poor’s and another from the University of Pennsylvania – underscore the depth and breadth of co-op financial problems.

Many co-ops were relying on transfers through Obamacare’s risk corridor program to subsidize their losses in 2014. Late last year, bipartisan majorities in Congress blocked the administration from using taxpayer funds to bail out insurers through the risk corridor program for 2014 losses. As a result of their poor management and their unwise reliance on an uncertain taxpayer bailout, the financial difficulties of co-ops will likely continue over the next few years. Several more Obamacare co-ops will likely collapse.

The “Numbers Don’t Look Very Good”

The Vermont Health Co-op, which received nearly $15 million in federal loans, was denied an insurance license by the state in late 2013 and was dissolved before enrolling anyone. It only took one year for CoOportunity Health, which received loans totaling more than $145 million, to fail. Taxpayers will likely lose most, if not all, of that money.

According to a January 23 article in the Wall Street Journal, “the amount owed on medical claims exceeds CoOportunity’s cash on hand.” The 68,000 people enrolled in coverage through the co-op will need to switch to other plans. In addition to the massive loss that federal taxpayers face from CoOportunity’s collapse, policyholders in Iowa and Nebraska will likely face higher future premiums so the states can honor their guarantees of financial protection of up to $500,000 per person enrolled in a liquidated insurance company.

Many other co-ops appear to be failing. According to S&P, almost a third of the co-ops received more than $20,000 in federal loans for each person covered in 2014:

- The Minuteman Health Inc. Co-op in Massachusetts got more than $156 million and covered only 1,822 people – nearly $86,000 per enrollee.

- The Land of Lincoln Mutual Health Insurance Co-op in Illinois got more than $160 million and covered only 3,428 people – nearly $47,000 per enrollee.

- Oregon’s Health Co-op got nearly $57 million and covered only 1,279 people – more than $44,000 per enrollee.

- Meritus Mutual Health Partners Co-op in Arizona got more than $93 million and covered only 2,679 people – nearly $35,000 per enrollee.

- Community Health Alliance Mutual Insurance Co-op in Tennessee got more than $73 million and covered only 2,094 people – nearly $35,000 per enrollee.

- Coordinated Health Mutual Inc. Co-op in Ohio got more than $129 million and covered only 4,996 people – nearly $26,000 per enrollee.

- HealthyCT Inc. Co-op in Connecticut got more than $128 million and covered only 6,094 people – more than $21,000 per enrollee.

Only one co-op, Maine Community Health Options Co-op, had positive net income through the first three quarters of 2014. Comparing actual enrollment data to earlier enrollment projections from Deloitte shows that 12 of the co-ops enrolled fewer than half of the people they expected to enroll in 2014. Of these, 10 had net losses through the first three quarters of 2014 that were at least 50 percent greater than their remaining funds, or reserves. Three of the co-ops – Community Health in Tennessee, Evergreen Health Co-op Inc. in Maryland, and Meritus in Arizona – had net losses greater than their reserves.

Despite enrolling only around 2,000 people in 2014, Community Health in Tennessee froze coverage for new people for the 2015 plan year because of concerns about its solvency. Through the first three quarters of 2014, the co-op’s losses were more than three times its reserves.

Many of the co-ops that exceeded their initial enrollment projections are also in a precarious financial situation. These include Arches Mutual Insurance Co-op in Utah (74 percent net loss as a percentage of reserves), Kentucky Health Co-op (53 percent net loss as a percentage of reserves), and Consumers Choice Health Insurance Co-op of South Carolina (50 percent net loss as a percentage of reserves).

CoOportunity Health, the failed co-op, had a net loss of about 53 percent of their remaining funds. Half of the remaining co-ops actually had higher losses as a percentage of their reserves than CoOportunity. S&P called the medical loss ratios, a measure of expenses relative to premiums, “hopelessly high” for many of the co-ops. One S&P analyst told Modern Healthcare that “some of these numbers don’t look very good for these companies.”

In order to temporarily prop up the co-ops, the Obama administration seems to be throwing good money after bad. Late last year, HHS made more than $350 million in additional loans to six co-ops: $91 million to Freelancers Health Services Co-op in New York, $66 million to Minuteman Health, $65 million to Kentucky Health Co-op, $51 million to Common Ground Healthcare Co-op in Wisconsin, $48 million to HealthyCT, and $33 million to CoOportunity. All of these additional loans are risky because of the massive losses these co-ops have endured so far.

Failing Co-ops Demonstrate Risk Corridor Problems

Obamacare included two programs to bail out health insurers that lose money in the exchanges: a reinsurance program and a risk corridor program. The reinsurance program is financed by higher premiums on almost all health insurance plans. It provides payments to insurers offering Obamacare plans to cover most of the cost of their enrollees who have high annual claims. The risk corridor program transfers money from insurers that earned “excess” profits on Obamacare plans to insurers that incurred excess losses on these plans. Both programs have distorted the insurance market and have led many insurers to underprice exchange plans in order to capture an increased market share. They were willing to take this risk because they expected that a large share of their initial losses would be subsidized.

The Obama administration worked with health insurers to make the risk corridor program more generous, putting taxpayers at risk if insurers systematically lost money on exchange plans. In December, Congress blocked the administration from tapping taxpayer funds to bail out insurers through the risk corridor program. Section 227 of the Consolidated and Further Continuing Appropriations Act of 2015 (the cromnibus) prohibits the administration from transferring funds from other accounts to pay for the risk corridor program. For 2014, outgoing payments to insurers with excess losses cannot exceed incoming payments from insurers with excess gains, effectively making the program budget neutral for one year.

According to a 2014 House of Representatives oversight report, the “10 co-ops that enrolled more than 125% of their projected initial enrollment expect aggregate Risk Corridor receipts of about $81.6 million in 2014.” The more recent University of Pennsylvania report shows that as the co-ops acquired additional claims data throughout the year, their need for a bailout through the risk corridor program grew. The average co-op loss, even including the estimated risk adjustment and risk corridor payments that may never materialize, was 17 percent of premiums through the first three quarters of 2014. In their third quarter financial statements, the co-ops reported $164 million in estimated risk corridor payments – 12 percent of total of projected revenue. CoOportunity was expecting a bailout of approximately $126 million in 2014.

Asked about the co-op program, a CMS spokesman said “[a]ny start-up business enters the market with inherent risks. Not all succeed.” Because the Obama administration is using taxpayer money to pick winners and losers, it is culpable for each failure. The co-op debacle is another example of how Obamacare is wasting taxpayer money and hurting Americans’ health care.

Next Article Previous Article