Obamacare Tax Day Pain

-

Obamacare empowered Washington and the IRS to become more involved with the health care choices of Americans. The president’s fiscal year 2016 budget requested nearly $500 million for the IRS to enforce Obamacare.

-

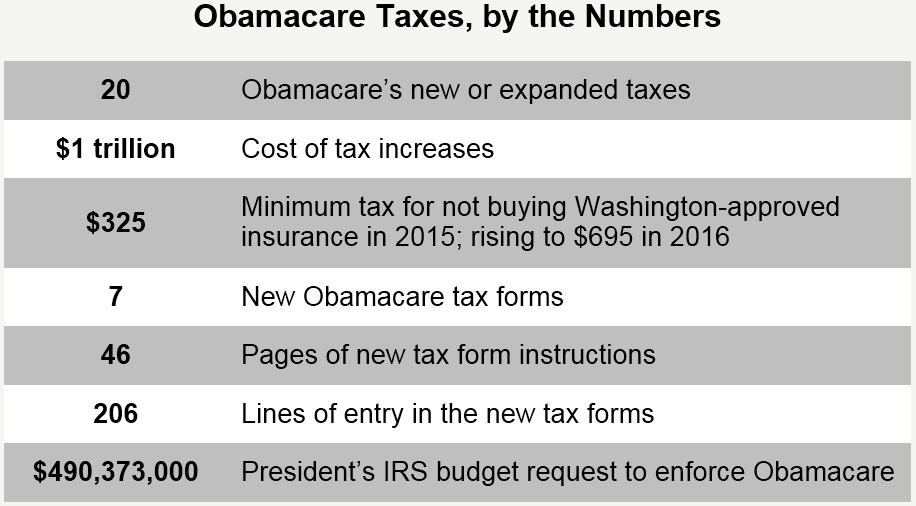

Tax day will be much more complicated for Americans – seven new Obamacare tax forms to deal with new mandate penalties and complicated subsidies.

-

Only four percent of people received a correct Obamacare subsidy in 2014; everyone else getting a subsidy will have their tax return affected. Those owing more taxes due to an incorrect subsidy will pay an average of $794.

A central promise of President Obama’s 2008 campaign was that he would not raise taxes on families making less than $250,000 per year. Obamacare broke that promise by creating or raising 20 taxes, amounting to more than $1 trillion in the first decade. Several taxes directly punish families making less than $250,000.

Some of Obamacare’s taxes – such as the excise taxes on medical devices, health insurance, and drugs – are paid by people in the form of higher prices and less innovation. Others – such as the tax on investment income and the employer mandate – are paid by people in the form of lower economic growth, lower wages, and fewer jobs. The Congressional Budget Office projects that Obamacare will reduce employment by two million full-time jobs in 2017 and by 2.5 million full-time jobs by 2024.

Obamacare’s new tax burden

Individual Mandate Tax Penalty

Obamacare gave people the choice of buying Washington-approved, expensive health insurance or paying a tax penalty. This penalty will hit as many as six million people this year – and potentially far more people in the future. In 2015, the tax penalty is the greater of $325 per person or two percent of household income. By 2016, the tax penalty equals the greater of $695 per person or 2.5 percent of household income.

Employer Mandate Tax Penalty

After a one-year delay, the employer mandate took effect on January 1, 2015, for businesses employing the vast majority of Americans. Because of Obamacare, employers that have more than 50 full-time workers are now subject to tax penalties equal to thousands of dollars per employee.

Reinsurance Tax

Obamacare’s reinsurance program represents a tax – totaling $25 billion between 2014 and 2016 – on people with insurance that does not comply with Obamacare’s mandates. This is to pay for Washington’s subsidies of insurance companies that offer Obamacare-compliant coverage in the individual market.

Obamacare empowered the IRS

The president requested that the IRS receive a 16 percent budget increase in fiscal year 2016. Nearly half a billion dollars of the total request, including 2,500 IRS employees, would be used to enforce Obamacare. The IRS may be implementing illegal taxes as well. In June, the Supreme Court will decide in the case King v. Burwell whether the IRS has issued a regulation that illegally subsidized millions of people and unlawfully subjects millions of other people to the individual and employer mandates.

The IRS has created seven new forms for implementing Obamacare’s subsidy scheme and mandates. The instructions for these forms total 46 pages, and the forms have 206 lines for entry.

For example, people who claim a subsidy receive Form 1095-A from the exchange, and they must file Form 8962 with the IRS. Form 1095-A provides information about the purchased plan, as well and the amount of the advanced subsidy received. Form 1095-A has 56 boxes for entries for single filers and 74 boxes for entries for married filers with two dependents. Supporters of the law wrote in Health Affairs on August 4, 2014, that “the new 1095s with over a dozen data fields will be mystifying.”

Form 8962 is used for reconciling the advanced subsidies. It has 95 boxes for entries for single filers and 133 boxes for entries for married filers with two dependents. Instructions for Form 8962 consist of 15 pages of complicated terminology and worksheets.

People who claim one of the 19 exemptions from the individual mandate must file Form 8965 with the IRS. As many as 23 million Americans may have to file this form for the 2014 tax year. It has 21 boxes for entries for single filers and 78 boxes for entries for married filers with two dependents. Instructions for Form 8965 take 12 pages and contain five worksheets. One tax expert told Politico, for an August 11, 2014, article that the application requirements for some of the exemptions are “hopelessly complex.”

Obamacare’s sliding-scale subsidy scheme is proving to be even more difficult to implement than imagined. According to a recent report by Kaiser Family Foundation, only four percent of households received the correct subsidy amount advanced to their insurance company on their behalf. Half of all people receiving subsidies found out they owed more taxes when they file because they underestimated their income. The estimated average amount owed is $794.

The process is so complicated that the administration sent tax forms with incorrect Obamacare information to 820,000 people. In addition, California sent incorrect tax forms to about 120,000 people. Many of these people had significantly delayed tax returns.

Next Article Previous Article