Obamacare Picks Insurers Over Taxpayers Again

-

On February 12, the Obama administration announced it would distribute $8.2 billion through the Obamacare reinsurance program, with the majority going to insurance companies.

-

Of the $8.2 billion, HHS will distribute only $500 million to the Treasury, an amount that is $3.5 billion short of what Obamacare requires.

-

The inability of the administration to follow its own law is just another example of Obamacare not working.

ADMINISTRATION ANNOUNCES 2015 REINSURANCE FUNDING

Earlier this month, the Obama administration announced it will have $8.2 billion in reinsurance contributions to be used for the 2015 benefit year. Reinsurance is one of Obamacare’s three risk mitigation programs. The other two are risk corridors and risk adjustment.

Section 1341 of Obamacare established the reinsurance program to get money from non-Obamacare exchange plans (mostly employer-provided plans and union-provided plans). The administration would use the money to prop up Obamacare insurance companies. Reinsurance provides payments to Obamacare plans that enroll higher-cost people.

FUNDS ARE REQUIRED TO GO TO TREASURY

“This is … a scheme in which the Obama administration collected less in taxes from health insurers (mostly off the Exchanges) than they were required to do under the Affordable Care Act, created a plan to pay insurers selling policies on the Exchange considerably more than originally projected, and stiffed the United States Treasury on money it was supposed to receive from the taxes.” – Seth Chandler, University of Houston, 01-18-2016

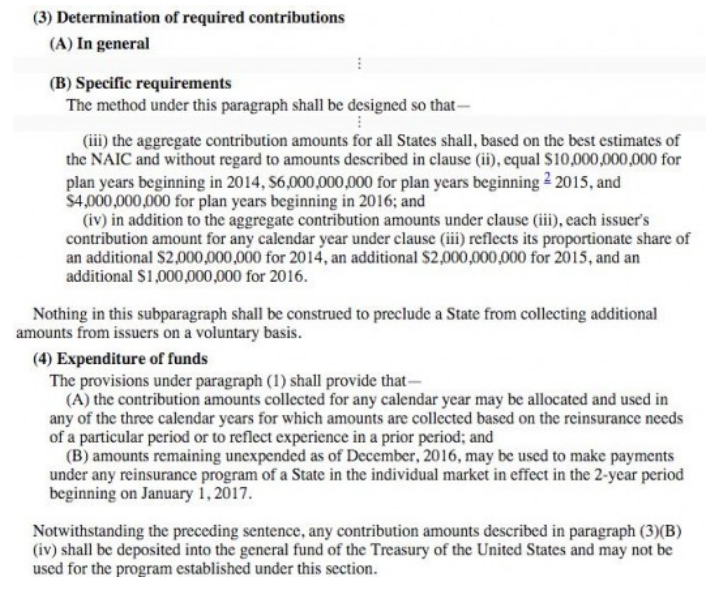

Section 1341 of the Affordable Care Act outlines the funding breakdown of the reinsurance money collected. According to the statute, the aggregate contribution amount shall equal $10 billion for plan years beginning in 2014, $6 billion for plan years beginning in 2015, and $4 billion for plan years beginning in 2016. In addition to these aggregate contribution amounts, each issuer’s contribution amount “reflects its proportionate share of an additional $2 billion for 2014, an additional $2 billion for 2015, and an additional $1 billion for 2016” which “are to be deposited into the general fund of the Treasury of the United States.”

Despite the requirement, the administration did not make a payment to the Treasury last year. Obamacare section 1341(b)(4) does not permit this: “Any contribution amounts described in paragraph (3)(B)(iv) shall be deposited into the general fund of the Treasury of the United States and may not be used for the program established under this section.” By now $4 billion in reinsurance funds should be designated to the Treasury; only $500 million has been. The other $3.5 billion in taxpayer dollars is being directed to insurance companies.

ADMINISTRATION IGNORES THE LAW

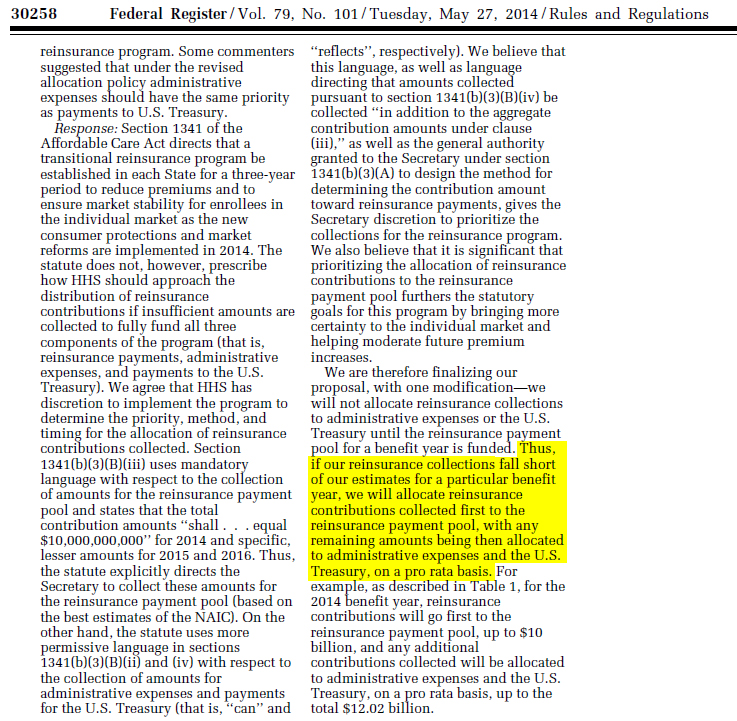

Buried at page 30258 of a Federal Register entry from 2014, the Obama administration argued that is has the discretion to divert the money owed to Treasury to insurers. “If our reinsurance collections fall short of our estimates for a particular benefit year, we will allocate reinsurance contributions collected first to the reinsurance payment pool, with any remaining amounts being then allocated to administrative expenses and the U.S. Treasury, on a pro rata basis.”

Obama administration says ACA language is not binding

The administration’s reading of the statute, however, defies the statute’s clear language. Under the precedent established by the Supreme Court in the case Chevron v. Natural Resources Defense Council, administrative agencies have discretion to interpret the law where statutory language is ambiguous. Where statutory language is clear, agencies do not have this discretion. The language of Section 1341 is clear, and the administration’s decision to divert to insurers funds owed to the Treasury is an administrative overreach in violation of the statute.

The health care law requires the administration to remit $3.5 billion to the Treasury, in addition to the $500 million that it intends to remit for the 2015 benefit year. Congress should hold the administration accountable for diverting billions of dollars from the Treasury to insurers. If Americans are required to comply with every provision of this complicated, expensive law, the administration that advocated for it should have to comply with it too.

Next Article Previous Article