Obamacare Is Hurting the Middle Class

- Obamacare has cost the middle class money and freedom.

- Not even one in five people eligible for Obamacare plans who earn more than 250 percent of the federal poverty line have signed up for exchange coverage. Many chose to pay the individual mandate tax penalty instead.

- 98 percent of people who don’t get premium tax credits find Obamacare plans are not worth the cost.

Hard-working American taxpayers face a double whammy of higher health insurance premiums and higher taxes to finance Obamacare’s complicated subsidy scheme and its irresponsible Medicaid expansion. Because of unattractive plan options, only a small number of people in the middle class have enrolled in exchange coverage. Obamacare has caused a massive transfer of wealth away from people who earn a middle-class income.

Hard-working Americans shunning Obamacare plans

CBO projects that exchange enrollment will average 11 million people this year. This is two million lower than CBO’s estimate of exchange enrollment last year. It turns out that most Americans faced with the actual cost of exchange plan premiums and deductibles are shunning exchange coverage. As a result, only a small percentage of the people enrolled in the exchanges are in the middle class. According to the data released by the administration, only 17 percent of exchange enrollees this year have income above 250 percent of the federal poverty level – a rough lower-end proxy for the middle class.

The health care firm Avalere analyzed the proportion of people eligible for exchange coverage who decided to purchase a plan, by income grouping. These people include the uninsured and those with individual market coverage.

Only two percent of all eligible people earning more than four times the poverty level found Obamacare exchange plans to be worth the cost. In other words, at least 98 percent of people who do not receive premium tax credits find Obamacare plans not worth buying.

Obamacare was largely Medicaid expansion in 2014

Because it required people to get coverage and increased federal health care commitments, Obamacare was always expected to decrease the number of people without health insurance. Last year, there was a large decline in the number of people with employer-sponsored coverage. Many people also lost their non-exchange individual market coverage, as it no longer satisfied the law’s mandates. After accounting for people losing or replacing private coverage, nearly 90 percent of the net reduction in the uninsured in 2014 came from Medicaid growth.

Obamacare was not designed to help the middle class

The health care law’s expensive coverage mandates and distortionary price controls made health insurance premiums skyrocket. To keep exchange premiums from rising even higher, insurers chose to institute narrow provider networks and extremely high deductibles. In 2015, the average deductible for an Obamacare silver plan – with an actuarial value of 70 percent – is $2,927 for single coverage and $6,010 for family coverage. A plan’s actuarial value equals the average percentage of costs that the insurer is expected to pay. The average deductible for an Obamacare bronze plan – with an actuarial value of 60 percent – is $5,181 for single coverage and $10,545 for family coverage.

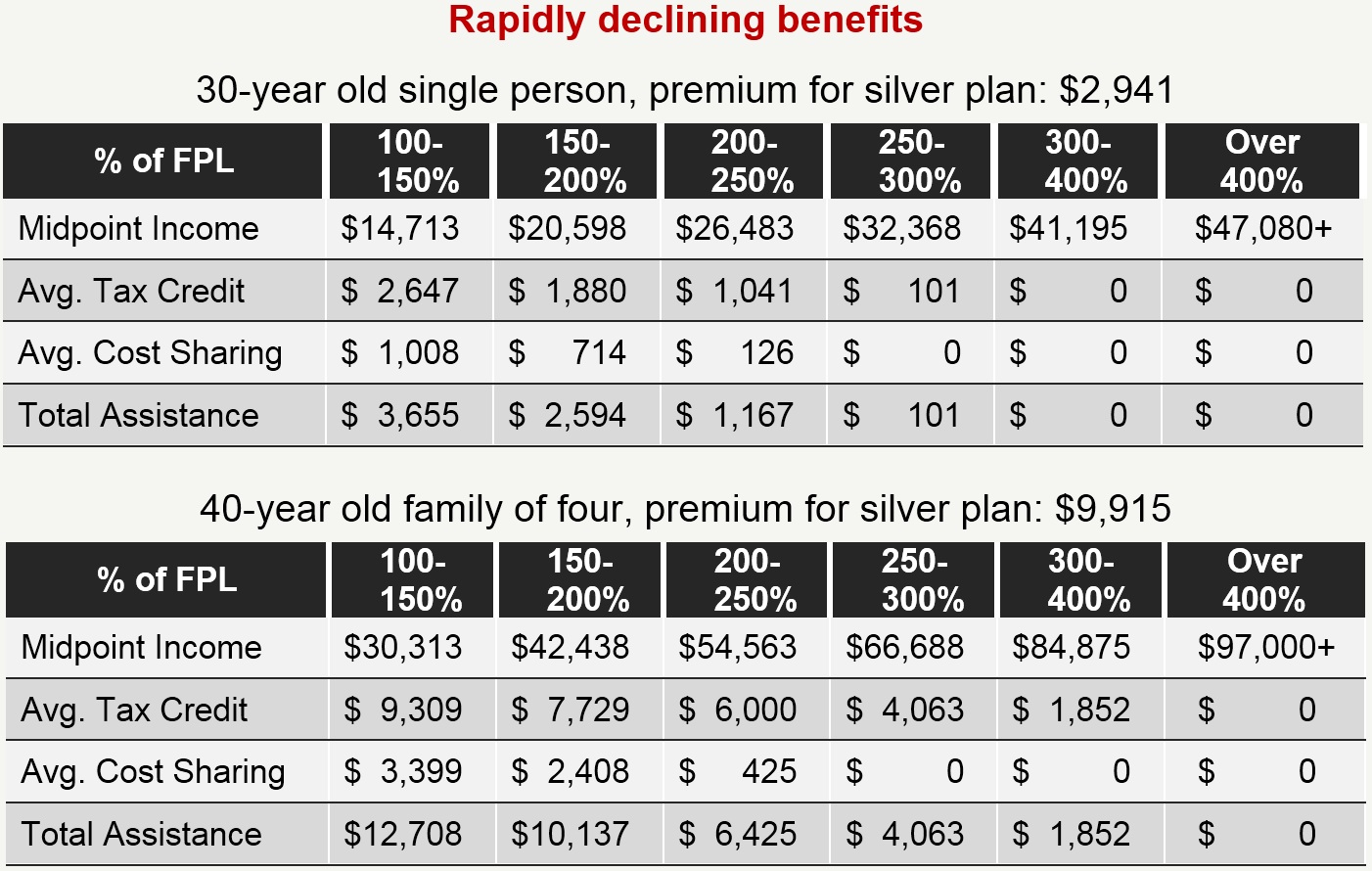

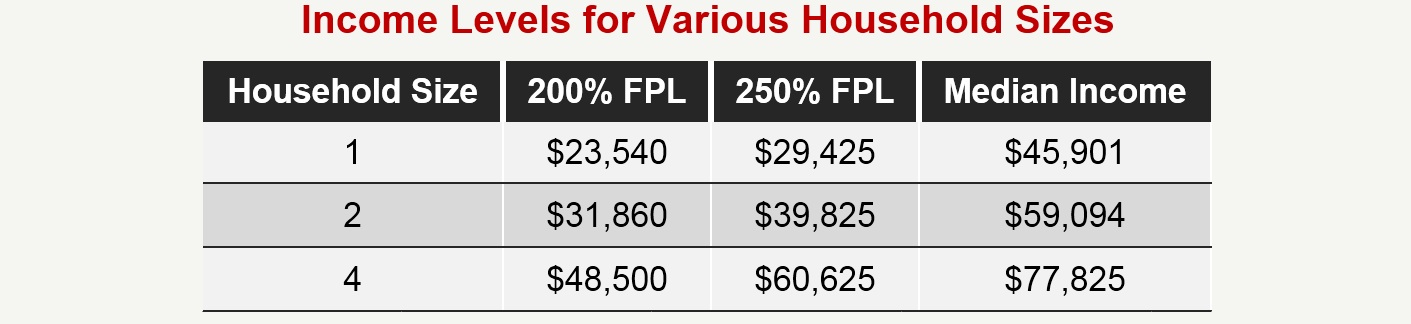

Obamacare offered two main types of financial assistance to buy health insurance: premium tax credits and cost-sharing subsidies. The premium tax credits are available to people with incomes between 100 and 400 percent of the FPL.

The cost-sharing subsidies are available to people with incomes between 100 percent and 250 percent of the FPL who purchase a silver plan. These subsidies reduce people’s costs for things like deductibles, copayments, and out-of-pocket maximums. For people between 100 and 150 percent of FPL, the cost-sharing subsidies increase the plan’s actuarial value to 94 percent. For people between 150 and 200 percent of FPL, the cost sharing subsidies increase the plan’s actuarial value to 87 percent; and for people between 200 and 250 percent of FPL, the cost sharing subsidies increase the plan’s actuarial value to 73 percent. As a result of their design, the subsidies produce cliff effects at 150 percent and 200 percent of the FPL, meaning income earned above these thresholds results in a large loss of subsidy.

Benefits don’t go to the middle class

The amount of the tax credit falls as income increases, so its structure discourages work. In general, an additional $1,000 in household income reduces the amount of the subsidy by about $150. People eligible for the credit face about a 15 percent additional effective marginal tax rate on income above the poverty level.

The cost-sharing subsidies also discourage work for people under 250 percent of the FPL. Both subsidies are structured in a way that adds enormous new marriage penalties to the tax code.

The cash-equivalent value of the cost-sharing assistance is substantial for households earning less than 200 percent of the FPL. The assistance for people between 200 and 250 percent of the FPL is about 80 percent less than people between 150 and 200 percent of the FPL get. Even though people between 150 and 200 percent of the FPL receive enormous overall subsidies, only 41 percent of eligible people earning this amount of income have signed up for coverage.

In 2014, the Congressional Research Service used income and survey data to approximate the bounds of the middle class. According to CRS, the survey responses suggest that the lower end of a middle class income would be somewhere between $39,736 and $64,553 per year, and the upper end would be somewhere just above $200,000.

Since people who earn income above 250 percent of the FPL receive no financial assistance to reduce the deductibles or copayments of exchange plans, the vast majority of people in the middle class confront all of the out-of-pocket costs if they purchase this coverage. A single person earning $30,000, a couple earning $40,000, and a family-of-four earning just over $60,000 receive no cost-sharing subsidies.

Obamacare made middle class worse off

As a result of unattractive exchange plans and the lack of financial assistance to reduce high deductibles and other forms of cost sharing, only about one-in-five eligible people who qualify for a premium tax credit but not a cost-sharing subsidy has purchased an exchange plan. People with higher incomes are also more likely to face the individual mandate tax penalty because they are less likely to qualify for an exemption. Not only are people in the middle class overwhelmingly saying “No” to exchange coverage, many of them also face hundreds or thousands of dollars in tax penalties this year for their choice not to purchase the coverage.

Most of the middle class had many more health insurance options at much lower cost before Obamacare took effect. Studies have found that Obamacare increased the price of individual market coverage by nearly 50 percent just in 2014, the first year its central mandates took hold. As a result of dramatically higher premiums for individual market coverage and cost-sharing subsidies reserved for lower-income people, Obamacare’s coverage gains have been limited mostly to the poor and the near-poor. While Obamacare was sold as a major benefit for all Americans, the vast majority of hard-working taxpayers now realize that they have fewer choices and are paying higher taxes and premiums because of the law.

Next Article Previous Article