Obamacare in 2018: Planned Insurer Exits and Premium Hikes

- This year, 70 percent of U.S. counties have had little or no choice of insurer on the exchanges – next year, at least 44 counties are projected to have no exchange insurer at all.

- Premiums more than doubled since 2013, and rate requests by insurers show this trend will continue next year – with many insurers requesting another double-digit rate hike.

- Insurers such as Anthem warned as early as November 2, 2016 – prior to the election – that if the exchanges didn’t improve they could pull out of the them for 2018.

Obamacare’s flawed policies have left the individual insurance market very unstable, both on and off the law’s exchanges. Insurers continue to run for the exits and raise their premiums. If Congress doesn’t take action to stabilize the individual market, there will not be a market left in many parts of the country next year. As the Senate works to repeal and replace Obamacare, the new law will have to include policies that stabilize the market and lower premiums.

INsurer exits mounting for 2018

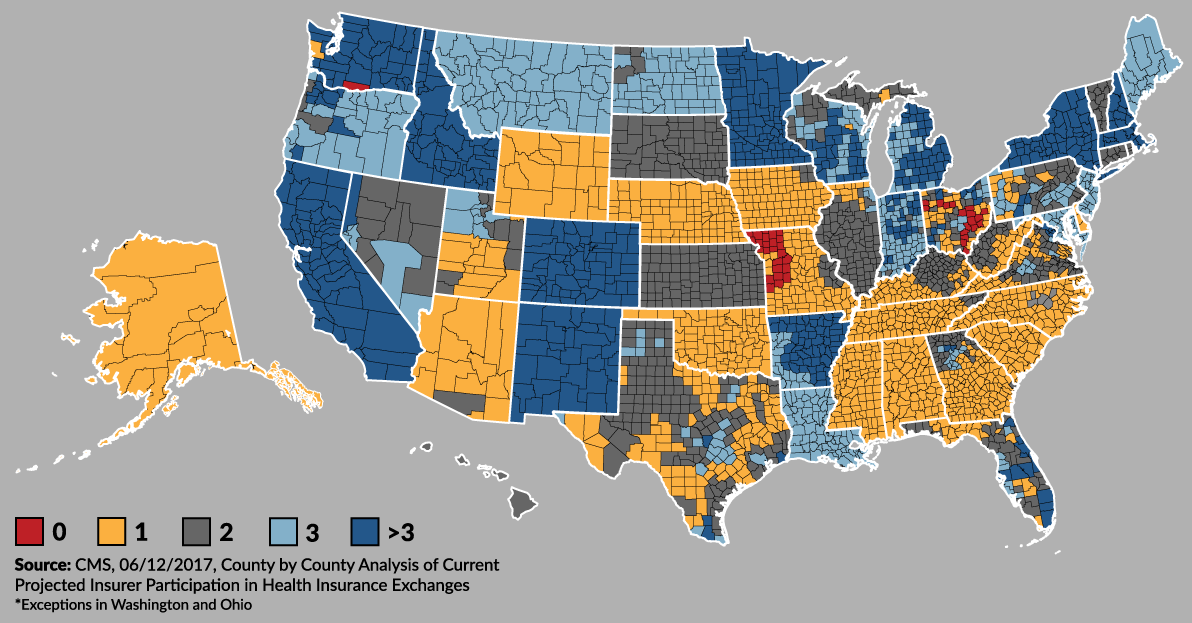

This year, insurer competition on Obamacare’s exchanges is already extremely limited. People in one-third of the nation’s counties face an insurer monopoly on their exchange, and another 37 percent of counties have had just two insurers in 2017.

Projected Insurer Participation in 2018 Exchanges by County

Insurer participation in the Obamacare exchanges is projected to be even worse next year. Some insurers are also discontinuing their Obamacare-compliant plans sold in the individual market off of the exchange.

Although decisions regarding insurer participation are ongoing, and therefore could change, at least 44 counties are projected to have no exchange insurer next year. That number will likely climb higher, according to the Centers for Medicare and Medicaid Services. CMS also projects that as many as 40 percent of counties will have a monopoly on the exchanges in 2018, meaning just a single insurer.

“If we do not see clear evidence of an improving environment and a path toward sustainability in the marketplace, we will likely modify our strategy in 2018.” – Anthem CEO Joseph Swedish, November 2, 2016

Exchange customers in counties with a monopoly really have no choice of insurer at all. Worse yet, people in counties with no insurer on the exchange will not be able use their premium subsidies to purchase coverage and could lose their health insurance as a result of Obamacare’s failures. CMS estimates that for 2018, “at least 35,000 active Exchange participants live in the counties projected to be without coverage in 2018, and roughly 2.4 million Exchange participants are projected to have one issuer.”

The following is a list of insurer exits already announced for 2018:

-

Humana will exit the Obamacare exchanges entirely. In 2017, Humana sold on-exchange coverage in 11 states: Florida; Georgia; Illinois; Kentucky; Louisiana; Michigan; Mississippi; Missouri; Ohio; Tennessee; and Texas.

-

Aetna announced it will offer no Obamacare-compliant individual plans – either on- or off-exchange – in Delaware, Iowa, Nebraska, and Virginia. This would leave all counties in Nebraska and Delaware with only one insurer on the exchange in 2018.

-

Wellmark Blue Cross and Blue Shield will leave Iowa, both on and off the exchange. This may leave the bulk of the state’s counties with only one exchange insurer next year.

-

Anthem is withdrawing from Obamacare in Ohio, leaving at least 18 counties without an insurer.

-

Community Health Plan of Washington and Kaiser Foundation Health Plan of Washington Options are dropping out of the individual market in that state. Currently, no insurer will offer plans on the exchange in one county, where 1,119 people are enrolled in the individual market.

-

Blue Cross and Blue Shield of Kansas City is no longer going to offer Obamacare-compliant plans on or off the exchanges in Missouri and Kansas. The insurer will only offer plans in these two states’ individual markets that existed before Obamacare and were “grandmothered” in. This may leave more than two dozen Missouri counties without an insurer on the Obamacare exchange next year.

-

BridgeSpan will exit the Obamacare exchange in Idaho.

-

United Healthcare is leaving the Virginia exchange. The company already exited the exchanges in most states this year.

It is possible that additional insurers will decide to drop out of more state exchanges over the next few months. For example, in 2017, Anthem has sold exchange plans in 14 states but said publicly that its future exchange participation is still uncertain. In an earnings call on November 2, 2016, Anthem CEO Joseph Swedish warned: “2017 is a critical year as we continue to assess the long-term viability of our exchange footprint. If we do not see clear evidence of an improving environment and a path toward sustainability in the marketplace, we will likely modify our strategy in 2018.”

Premiums projected to keep rising

From 2013 to 2017, Obamacare caused average premiums to double, according to reports by CMS and e-Health. The trend shows no sign of slowing down as insurers begin to file their rate requests for participation in the unstable Obamacare exchanges next year. State insurance departments evaluate the requests and approve a rate they determine to be appropriate, which can be higher or lower than the requested rate.

States where premium requests have been made public and are under evaluation include:

-

Connecticut – Anthem is requesting average increases of 34 percent, and ConnectiCare is requesting 17.5 percent.

-

Delaware – Highmark Blue Cross Blue Shield of Delaware, the only insurer selling on the exchange in 2018, is requesting an increase of 33.6 percent. This assumes that the individual mandate will not be in place and Obamacare’s cost-sharing reduction subsidies will not be paid.

-

District of Columbia – Kaiser is proposing an average increase of 13 percent, and Carefirst is requesting 39.6 percent.

-

Iowa – Medica is the only insurer offering exchange coverage in the bulk of Iowa counties next year, and it is requesting an average premium increase of 43.5 percent.

-

Maine – The three insurers selling on Maine’s exchange are requesting premium increases ranging from 20 to 40 percent.

-

Maryland – Individual market insurers want to raise premiums from 18 to 59 percent next year.

-

Michigan – Not all rates are available yet, but Blue Cross Blue Shield of Michigan is requesting a statewide average increase of 26.9 percent.

-

New Hampshire – One insurer is requesting a rate increase of 30 percent for next year.

-

New Mexico – New Mexico Health Connections, one of four insurers expected to sell on the exchange next year, is proposing an increase of nearly 80 percent.

-

New York – Insurers are requesting increases ranging from 4.4 percent to 47.3 percent and averaging 16.6 percent.

-

North Carolina – Blue Cross and Blue Shield NC is requesting an average rate hike of 22.9 percent. It says it would request an 8.8 percent increase if the Obamacare cost-sharing reduction payments are made.

-

Oregon – Insurers are seeking increases for individual market policies that range from 6.9 percent to 21.8 percent.

-

Pennsylvania – Insurers are requesting a statewide increase of 8.8 percent on the exchanges.

-

Vermont – Blue Cross Blue Shield of Vermont is proposing an average increase of 12.7 percent. MVP proposes an average increase of 6.7 percent.

-

Virginia – Insurers are submitting rate requests for 2018 that average a 28 percent increase.

-

Washington – Insurers are requesting a statewide average rate increase of 22.3 percent.

Next Article Previous Article