Obamacare Expansion Through "COVID Relief"

KEY TAKEAWAYS

- Democrats’ partisan $2 trillion “COVID emergency” law included significant expansions of the Affordable Care Act.

- It raises subsidies for people who are currently eligible and adds payoffs for higher-income people Obamacare originally deemed too wealthy.

- Democrats are likely to try to make these temporary policy changes permanent, moving them a step closer to their goal of a single, government-run health care system for all Americans.

The so-called American Rescue Plan Act, signed into law on March 11, included a sweeping expansion of the Affordable Care Act. President Biden campaigned on his plan to expand the ACA, and Democrats used the pandemic as an opportunity to include several provisions to get more people into the government-run system. The changes are temporary – lasting two years – and Democrats are likely to try to make them permanent.

Cost of Premium Tax Credit Increase

Democrats’ partisan, $2 trillion plan extends ACA subsidies, in the form of premium tax credits, to higher-income people who did not previously qualify for them; it increases subsidies for people who already qualified; and it waives the requirement that people who miscalculated their income in 2020 repay premium subsidies they got improperly.

lavish new Subsidies

The law substantially increases government aid for people who are already eligible for subsidies, reducing the amount of their income people must pay toward their premiums. Previously, people with an income between 100% and 150% of the federal poverty level were required to spend as much as 4.14% of their income on their Obamacare premiums for a silver level plan, with the federal government paying anything above that number. Under Democrats’ new law, these people pay nothing for a silver level plan – their entire premium is paid by taxpayers.

Through the end of 2022, the law also subsidizes health insurance for people at any income level, not just those with lower incomes. Under the previous rules, people earning more than 400% of the poverty level were not eligible for a subsidy at all. Under the new structure, those people would never have to pay more than 8.5% of their income for premiums for a silver plan, no matter how much they earn. Contrary to Democrats’ marketing of their law as COVID relief, the more generous subsidies also have no requirement that a recipient’s income was affected at all by the pandemic shutdowns.

Expanded Subsidies to Higher Income Earners

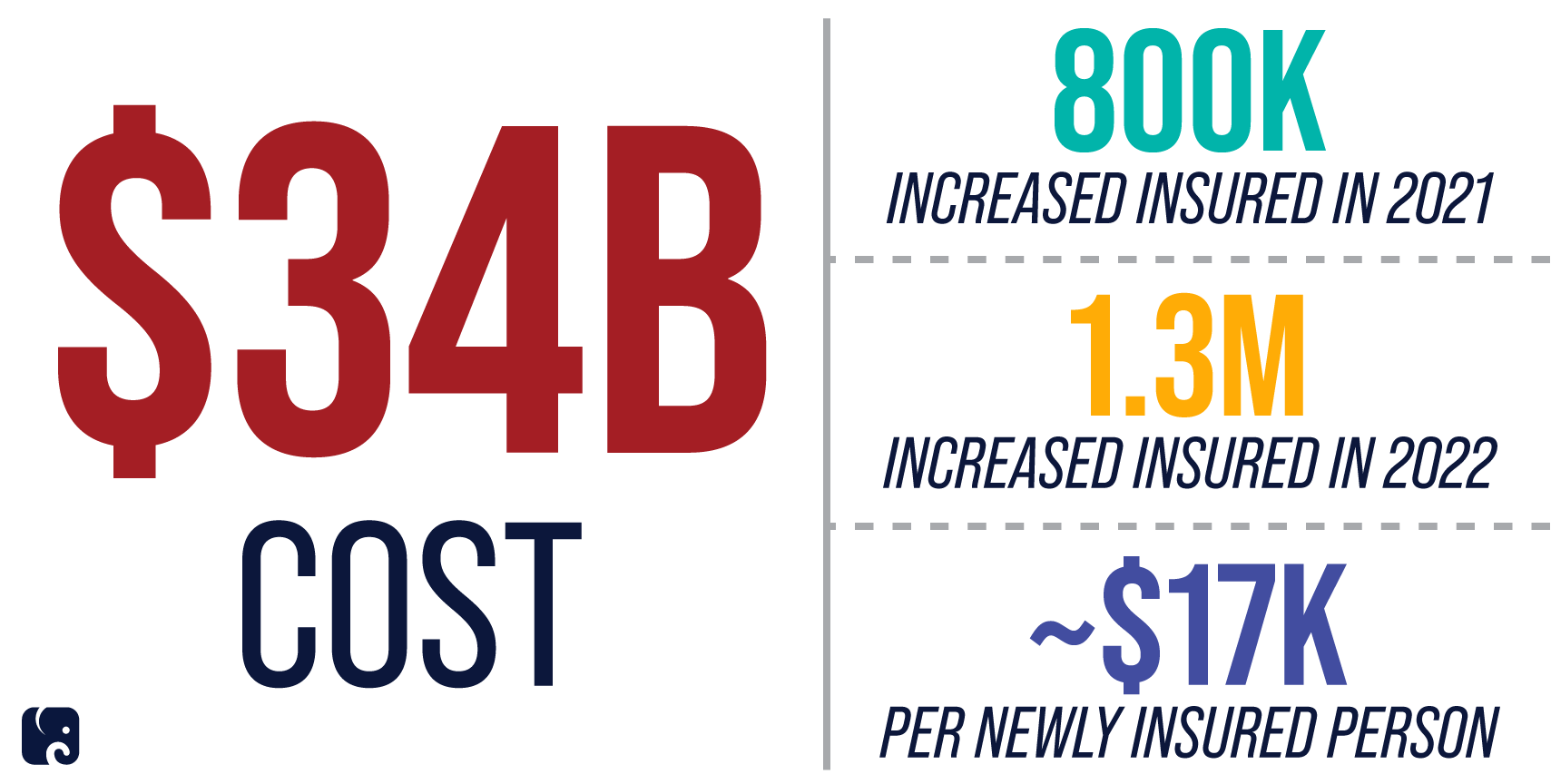

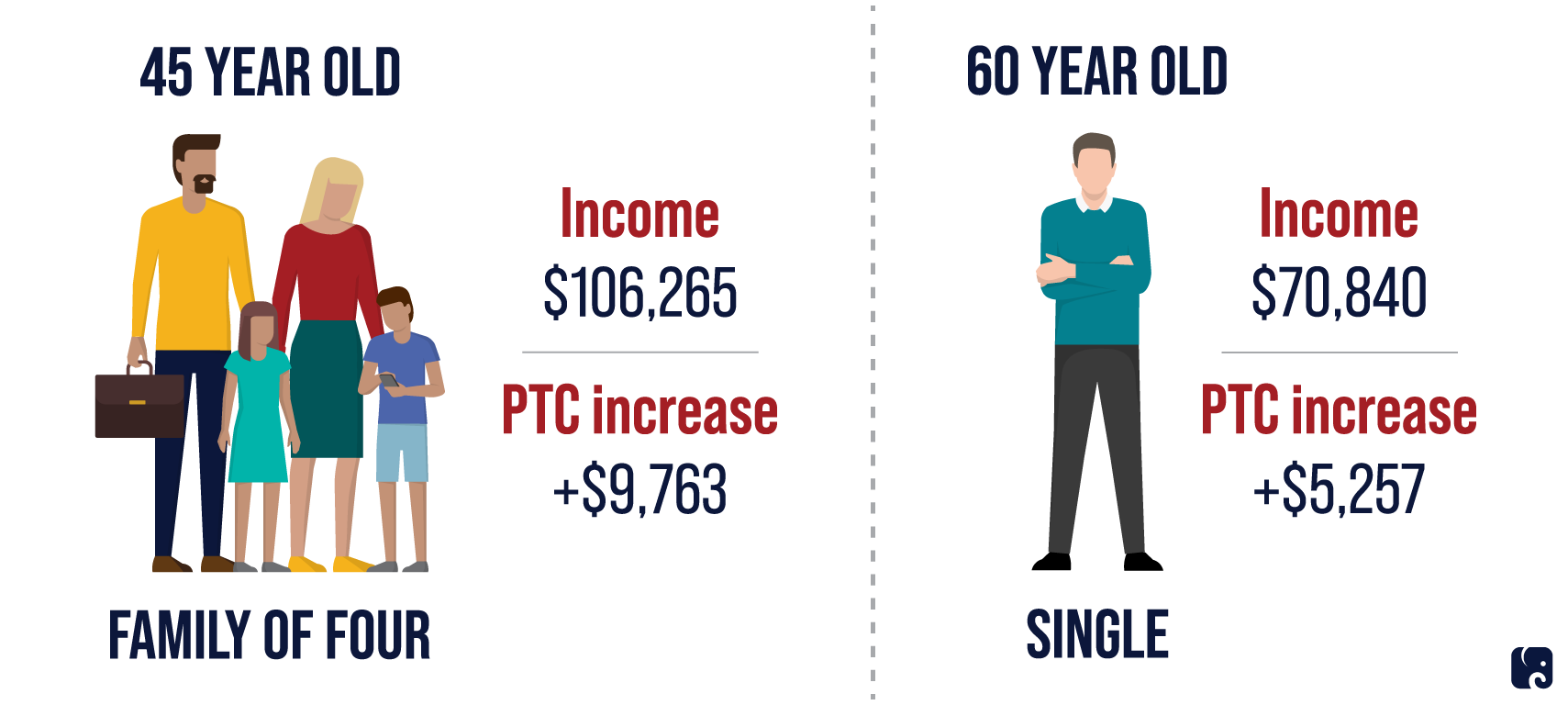

The Congressional Budget Office and Joint Committee on Taxation estimate expanding premium assistance for just these two years will increase federal deficits by $34.2 billion between now and 2030. Today there are 9 million people eligible for the premium tax credits. CBO predicts it will increase the insured by only 800,000 people in 2021, and 1.3 million people in 2022, when the provision will be in effect for the full calendar year. According to one analysis, on an annualized basis this equals about $17,000 per newly insured person. About 40% of them will have incomes above 400% of the poverty level. These higher earners will receive the greatest benefit from the law’s changes. For example, a typical family of four making $106,265 – 401% of the poverty level – could now get $9,763 in premium tax credits, where before they got $0. A single 60-year-old man earning $70,840 would not have gotten a subsidy before, but now he can collect a premium tax credit of more than $5,000. Because Obamacare plans can be so expensive, the study found “a 64-year-old couple in Kay County, Oklahoma, earning $500,000 per year, which faces a benchmark premium of $49,897 a year, would qualify for a PTC of $5,946.”

no requirement to pay back subsidies

Under the ACA, people get premium tax credit subsidies based on what they estimate their income will be for the year. These credits are paid monthly, in advance. The idea was that recipients will later reconcile their predicted income with what they actually earned and report on their taxes the next year. If people estimated wrong and got a subsidy to which they were not entitled, they were required to pay some or all of the excess back to the IRS. Democrats have now removed this requirement for the 2020 tax year. CBO’s analysis of the ACA components of the Democrats’ bill estimates this provision will cost $6.3 billion. More oversight and accountability of funds is needed, not less; and Democrats have given no indication these policies are intended to remain temporary.

Next Article Previous Article