Obamacare Bad for People, Good for Insurers

It’s been clear for some time that Obamacare has failed to deliver on the president’s key promises – including that family premiums would drop by $2,500 per year, and people would not lose their insurance. The law is failing America’s families on many other promises as well. New evidence shows that insurance market concentration has increased and that more Americans than ever are foregoing medical treatment because of the high out-of-pocket cost.

While American families suffer from higher prices, Obamacare has produced record profits for the insurance industry that supported the law. These profits largely result from Obamacare’s enormous new government spending, which was used as an incentive for their support. Much of the new spending – including the administration’s payment of cost-sharing subsidies to insurers and its payment of premium tax credits to insurers operating in states with federal exchanges – may be ruled illegal by the Supreme Court in the case King v. Burwell.

More People Foregoing Health Care

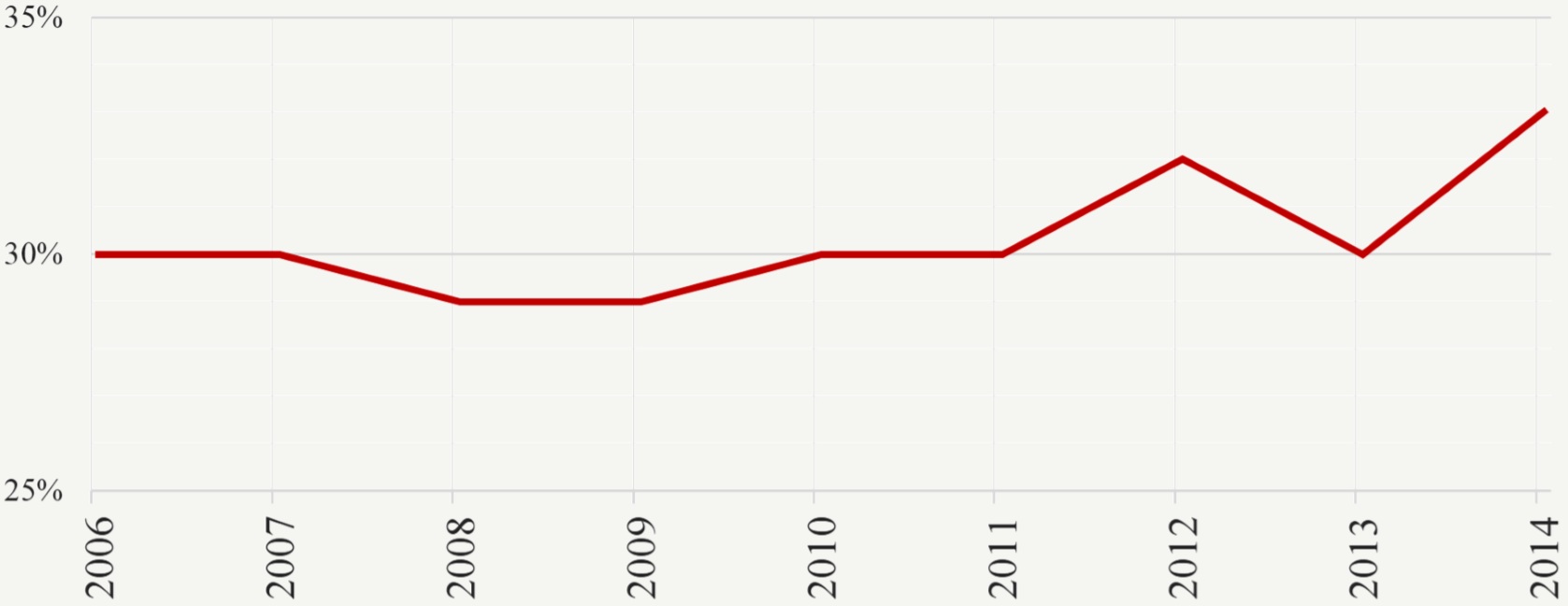

According to a Gallup poll last month, more Americans than ever reported putting off medical treatment because of cost.

Percentage of Americans putting off treatment because of cost

Source: Gallup

That’s despite the president’s promise that his law would improve health care access.

Among Americans who put off treatment, 66 percent said it was for a serious condition. Privately insured people represented the greatest increase in the number of Americans putting off medical treatment because of cost – jumping from 25 percent last year to 34 percent this year.

President Obama sold his law as the proverbial free lunch – people would have more generous insurance benefits while being able to keep their doctor and pay lower premiums. While it never made any sense, shrewd tacticians like Jonathan Gruber helped the president and congressional Democrats create their false narrative.

Many Americans are now confronted with the unpleasant reality of higher premiums, higher taxes and debt to finance Obamacare’s new spending, and higher out of pocket costs. In addition to Obamacare’s staggering cost, recent reports indicate that many people with exchange plans are struggling to find doctors who will accept their coverage. A December 7 AP story quoted an insurance agent who recommends that his clients choose unsubsidized plans outside the exchange because of the extremely limited provider networks for plans inside the exchange.

Individual Insurance Market Concentration

When selling its reform to the American people, the White House argued that “the insurers’ monopoly is so strong that they can continue to jack up rates as much as they like … and their profits will continue to soar under the status quo.” In an address to Congress in September 2009, the president said that “in 34 states, 75 percent of the insurance market is controlled by five or fewer companies.”

Last week, the Government Accountability Office released an analysis of the aggregate market concentration of the insurers with the greatest enrollment in every state plus the District of Columbia. The analysis showed that market concentration has increased since the law passed. For 2013, GAO found, in 42 states, 75 percent of the individual market is now controlled by three or fewer companies. Moreover, the average market share of the three largest insurers in each state’s individual market has increased from 83 percent in 2010 to 86 percent in 2013.

Insurer Profits Up

Although many of the broken promises of the president’s health care law have inflicted pain and confusion on Americans, the most cynical tactic employed at the time may have been the public demonization of health insurance companies. During the congressional debate, the president repeatedly decried excessive insurance company profits. Then-Speaker of the House of Representatives Nancy Pelosi called insurer profits “immoral.”

Profits are now even higher, thanks to Obamacare. The increased profits are driven by the law’s massive new spending on subsidies and Medicaid expansion, as well as the unprecedented federal overreach that mandated all people purchase insurance.

According to a November 17 article in the New York Times, “the relationship between the Obama administration and insurers has evolved into a powerful, mutually beneficial partnership that has been a boon to the nation’s largest private health plans and led to a profitable surge in their Medicaid enrollment.” The White House has already begun serving its new, big health insurance company allies.

In April 2014, the White House – including senior presidential advisor Valerie Jarrett – intervened to increase both the likelihood and the size of the risk corridor taxpayer bailout. That’s in addition to the law’s reinsurance program, which transfers $20 billion to insurance companies offering Obamacare-compliant coverage.

The administration also appears to be making unlawful payments to insurance companies through Obamacare’s cost-sharing reduction program. Despite the lack of a congressional appropriation for these payments, the administration began making them in January 2014. The Congressional Budget Office estimated in April that these payments will total $175 billion over the next decade.

Even more egregious, the administration, through the IRS, appears to have broken its own law by sending advance premium tax credits to health insurance companies on behalf of enrollees in federal exchanges. This is the subject of the King v. Burwell case currently before the Supreme Court. Despite the clear statutory language that these tax credits were only permissible in exchanges established by states, the administration has been making billions of dollars in payments to insurers for enrollees in federal exchanges as well.

A private health insurance market, without excessive government mandates, regulation, subsidies, and bailouts is essential to a well-functioning health care market. By insulating insurers from competition, standardizing and overregulating their benefit packages, and protecting insurance company profits, Obamacare harms consumers by increasing prices and reducing competition and innovation.

Next Article Previous Article