Obamacare at Five: Higher Costs, Less Freedom

-

Obamacare was rushed through Congress five years ago on a partisan vote.

-

The law is still not fully implemented, and its damaging side effects already include: higher premiums; narrow provider networks; a more far-reaching IRS; worse economic growth; discouraging work and marriage; and encouraging states to shift resources from the social safety net.

-

Repealing and replacing Obamacare to increase choice and lower costs remains a top health care priority for Congress.

Obamacare, five years later, has reduced Americans’ freedom to control their health care decisions, significantly raised premiums for millions of people, and caused millions of others to have their coverage cancelled. Congress’ top health care priority continues to be repealing the law and replacing it with sensible reforms that increase choice and lower costs.

Obamacare’s high cost for taxpayers

The national debt now exceeds $18 trillion, an increase of 70 percent since President Obama was inaugurated. Rather than pursue policies to control health care spending – the federal budget area growing most rapidly – the president and congressional Democrats pushed through Obamacare, claiming it was fiscally responsible. Even with the latest lower enrollment projections, Obamacare will increase federal health care spending by more than $1.7 trillion over the next decade.

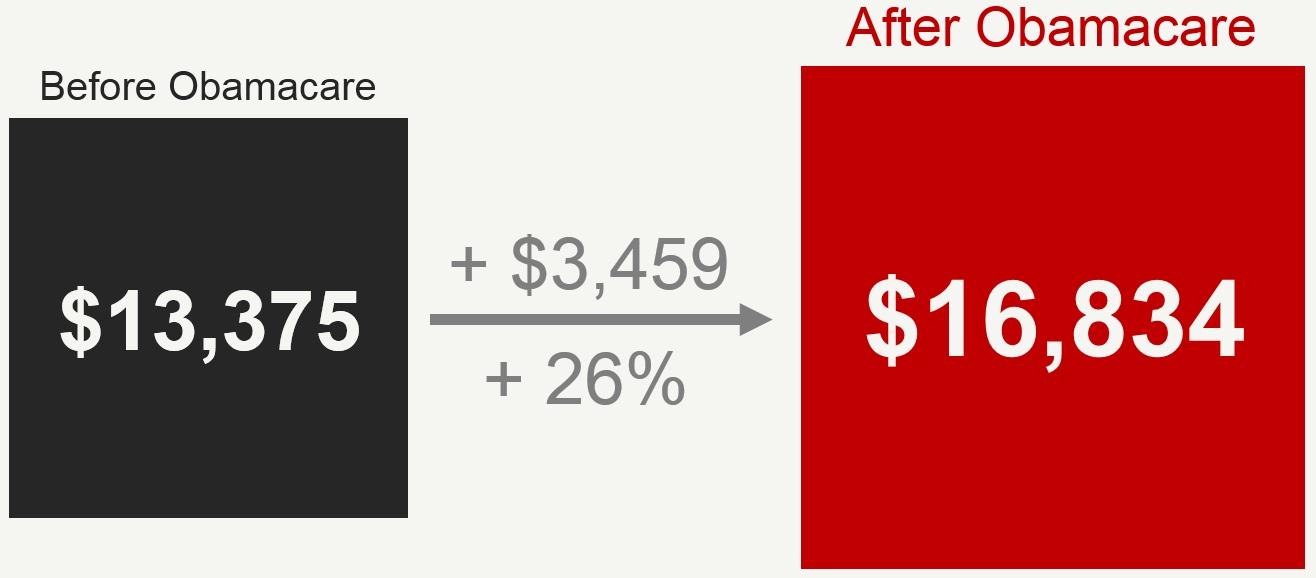

Health insurance premiums for a family of four

Obamacare leads to higher premiums

Despite the president’s promise to lower insurance premiums, the average family premium for employer-sponsored coverage has risen by nearly $3,500 – from $13,375 to $16,834 – between 2009 and 2014. Premiums in the individual market increased an average of 49 percent from 2013 to 2014, the first year that the bulk of Obamacare’s mandates and regulations took effect. Premiums increased the most for young people – up an average of 75 percent for young men and 40 percent for young women.

These higher premiums are generally for insurance with larger deductibles and cost-sharing than before, and that is accepted by far fewer doctors and hospitals. In 2015, the average deductible for an Obamacare silver plan was $2,927 for single coverage and $6,010 for family coverage. These deductibles are twice the median net financial assets of non-elderly households with income greater than 100 percent of the poverty level.

CBO expects that Obamacare plans “will not be able to sustain provider payment rates that are as low or networks that are as narrow” in the future. If this happens, premiums for exchange plans will only increase further. CBO expects annual premium increases for Obamacare’s benchmark plan will exceed eight percent in each of the next three years.

Obamacare’s harmful pay-fors

Obamacare’s drafters “paid for” all of the law’s new spending in three principal ways: tax increases; Medicare cuts; and budget gimmicks. Obamacare has more than 20 tax increases that will cost Americans more than $1 trillion over the next decade. Among some of the worst are large excise taxes on medical devices, pharmaceutical products, and health insurance. These taxes will increase prices and reduce innovation. While Medicare faces large budget problems, Democrats used the “savings” from the Medicare cuts to finance Obamacare’s Medicaid expansion and subsidy scheme, rather than to shore up Medicare’s long-term finances.

Obamacare hurting workers

Obamacare’s destructive employer mandate taxes businesses that don’t offer employees an expensive health insurance package. The burden of this provision has already caused businesses, schools, and local governments to cut worker hours and jobs. Federal Reserve surveys show that Obamacare is causing businesses to hire less, move workers to part-time status, and lower wages.

One economic study of small businesses found that Obamacare has lowered employment by 350,000 workers and reduced workers’ annual wages by an average of nearly $1,000. Another analysis found that “the health law has likely led a few hundred thousand workers to see their hours cut or capped. … Most of them are among the economy’s most vulnerable: low-wage, part-time workers who likely have few other options.”

CBO projects that Obamacare will reduce employment by two million full-time workers in 2017, and about 2.5 million full-time workers in 2024. One economist estimates that the law will reduce hours worked by three percent and wages and national output by two percent. A three percent decline in hours worked equates to about four million fewer full-time workers.

Obamacare empowering the IRS

Obamacare, for the first time in our nation’s history, permitted the federal government to penalize Americans for not purchasing a product. The law did this to coerce young, healthy adults to buy overpriced health insurance in order to subsidize premiums for others.

As many as 23 million Americans may claim one of the 19 exemptions from the unpopular individual mandate. In typical bureaucratic fashion, taxpayers will confront a form with 21 boxes for entries for single filers and 78 boxes for entries for married filers with two dependents. The instructions take up 12 pages and contain five worksheets. According to one tax expert, many people will find this process “hopelessly complex.”

Perhaps even more frustrating for taxpayers will be the government’s efforts to get back money from people who received excess subsidies during the year. Millions of Americans are learning that the government paid too much to insurance companies on their behalf last year. Many of those people will have their income tax refund reduced by hundreds or thousands of dollars as a result.

On February 20, the administration admitted that it messed up tax forms for more than 800,000 people. To cover its tracks, it allowed taxpayers who filed with bad information to keep refunds to which they were not entitled. The administration failed to promptly send other taxpayers corrected forms, resulting in significantly delayed refunds.

Obamacare was an unwise Medicaid expansion

Medicaid expansion accounted for 89 percent of Obamacare’s net coverage expansion in 2014. Through the first nine months of 2014, the increase in individual market enrollment was 5.8 million people, which was largely offset by the 4.9 million people who lost workplace coverage. Over the same period, enrollment in Medicaid and the Children’s Health Insurance Program increased by 7.5 million people.

In addition to placing more people into a failing Medicaid system, one of Obamacare’s most perverse features is that the federal government now reimburses states substantially more for providing Medicaid services to able-bodied, working-age adults than for the disabled and for low-income children, pregnant women, and seniors. These were the people traditionally covered by Medicaid. This funding mechanism could lead states to provide generous services to relatively healthy people, while skimping on care for the truly needy.

Obamacare’s subsidies discouraging marriage

Obamacare’s subsidy scheme also introduces a new marriage tax penalty. For example, the penalty for two 50-year olds each earning $35,000 is $2,567. In addition, the law contains a “family glitch.” If any worker in the household receives an offer of affordable workplace coverage for an individual plan – even if the family plan is unaffordable – then no one in a household can qualify for a subsidy. Couples will have a financial incentive to remain unmarried, or even to divorce, in order to get a subsidy.

Replacing Obamacare

On its fifth anniversary, Obamacare continues to inflict pain on American families, workers, and businesses. Additionally, the administration has unilaterally delayed, changed or ignored unpopular parts of the law. These changes have increased the deficit impact of the law. For example, the administration has violated the letter of the law to benefit large insurance companies and wasted billions in taxpayer dollars on failed websites and subsidies to people not entitled to receive them, including more than 300,000 unlawful residents.

If the Supreme Court decides in the case King v. Burwell that the Obama administration has been illegally giving subsidies to people buying coverage in federal exchanges, the law’s failure will be even more apparent. Without the subsidies to paper over the cost of Obamacare’s many mandates and rules, insurance premiums will skyrocket in up to 37 states. That ruling will also weaken the individual mandate and eliminate the employer mandate in those states. Congress will focus on a better plan that increases choice and lowers health care costs.

Next Article Previous Article