Obama on the Deficit: Gimmicks Not Solutions

Today the Congressional Budget Office released its updated Budget and Economic Outlook. CBO reports that going over the “fiscal cliff” will cause a recession:

- Negative economic growth of 0.5 percent from the fourth quarter of 2012 to the fourth quarter of 2013.

- Unemployment will reach 9.1 percent in the fourth quarter of 2013.

President Obama has offered no plan to deal with the sequester, the spending side of the fiscal cliff. In fact, the President pledged to veto efforts to cancel it. Because of his veto threat and no plan from the White House for serious deficit reduction, the President bears responsibility for the resulting job losses and shrinking economy.

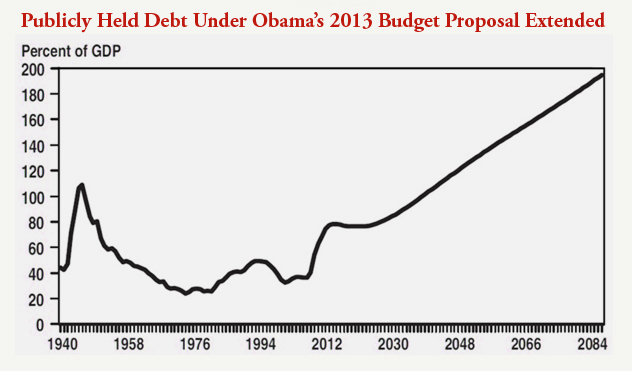

Obama’s Budgets Lead to Skyrocketing Debt

While the fiscal cliff would cause severe economic hardship, CBO’s numbers also reinforce the need for a serious deficit reduction plan that will stabilize our country’s finances in the long-term. Without such a plan, CBO’s more realistic alternative fiscal scenario shows that 10-year deficits will total $9.975 trillion. Americans realize that there is a need for deficit reduction. Unfortunately, President Obama has shown he is not interested in reducing the deficit or balancing the budget. He proposes gimmicks, not solutions, so he can spend more. Importantly, after four years of trillion dollar deficits, the President has failed to put forward a common sense plan that will address our country’s fiscal problems.

In the President’s fiscal year 2013 budget, the Office of Management and Budget showed that the Obama plan is simply to let debt explode:

Gimmicks Do Not Fix Fiscal Situation

Instead of presenting a plan that makes tough choices, the President has been content to propose gimmicks that do not fix our fiscal situation. The country's future unfunded liabilities are $70 trillion, yet Obama has not gotten serious. His proposals are not going to pay off debt or meaningfully reduce the deficit. The President is not going to use spending reductions or tax increases to shore up Medicare or Social Security. He has promised to spend it on more stimulus and government programs.

The following graphs show how several of the President’s high-profile policy proposals would affect 10-year deficits under CBO’s alternative fiscal scenario.

1Note: This is the revenue increase from the first, and largest, millionaire surtax of 5.6 percent. The Senate voted on this surtax to offset the President’s American Jobs Act stimulus proposal.

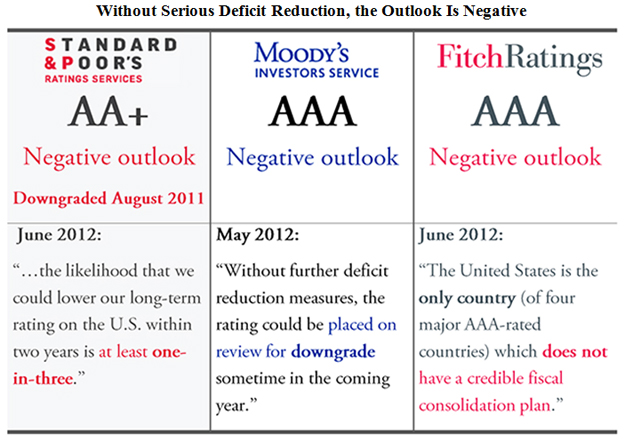

Without a Plan, U.S. Credit Rating Will Be Cut

Future economic growth will require large spending reductions that begin to stabilize debt as a share of GDP. Although President Obama has not proposed a serious plan, others have been hard at work. The House Republican budget proposed more than $5 trillion in spending cuts over 10 years compared to the President’s budget. The President’s Fiscal Commission proposed $4 trillion in deficit reduction in less than a decade compared to a realistic baseline.

The credit rating agencies have repeatedly said that the U.S. needs a large fiscal stabilization plan that will put the country on sound footing once and for all. President Obama has not heeded that warning.

After nearly four years in charge, President Obama has proven that he is uninterested in reducing the debt burden on America's families. His spending has been out of control, and his solutions have been inadequate.

Next Article Previous Article