Obama Budgeting from Behind

Today, 65 days after the legal deadline of February 4, President Obama finally submitted his fiscal year 2014 budget. Unfortunately, the President did not use that extra time to come up with a plan that will stabilize the nation’s finances. He just cut and pasted his rejected December fiscal cliff offer to his budget. The President’s fiscal cliff offer does contain some ideas worth pursuing on their own. But, sadly, he refuses to consider them unless they are paired with other parts of his plan for higher taxes and increased spending. As Speaker Boehner has said, “If the President believes these modest entitlement savings are needed to help shore up these programs, there's no reason they should be held hostage for more tax hikes.”

Chained CPI – Nearly as much tax revenue as spending cuts

The President has included a Chained CPI proposal in his budget, which would save $230 billion over 10 years. This is a good step, but it is not nearly enough. Only $130 billion of this savings is from decreased spending, while the remainder, $100 billion, comes through higher tax revenue.

Another $110 billion appears to have been left out of this chained CPI proposal because of the Administration’s efforts to “protect vulnerable populations” from the adjustment. CBO had estimated in March that chained CPI would lower deficits by $340 billion over 10 years.

The Administration is insisting that the President will only agree to chained CPI if it is included in a “balanced” package that includes separate tax increases. But because the President has lowered the spending savings in his proposal, his chained CPI proposal is already “balanced” between spending cuts and increased revenue.

Chained CPI is not a reform proposal in and of itself – it is a technical adjustment that better estimates how consumer purchasing behavior changes when prices rise. This proposal should be a small portion of a larger reform that strengthens entitlements for generations to come. It speaks to how unserious the President’s budget is that this technical inflation adjustment is the “highlight” of his budget.

Debt and Deficits

There is only $119 billion of deficit reduction in this budget, after removing budget gimmicks such as assuming away the cost of eliminating the sequester. Gross national debt in 2023 will total $25.4 trillion, or nearly 100 percent of the estimated 2023 GDP. This assumes the President’s tax increases.

Deficits in each year:

|

2014: |

$744 billion |

|

2015: |

$576 billion |

|

2016: |

$528 billion |

|

2017: |

$487 billion |

|

2018: |

$475 billion |

|

2019: |

$498 billion |

|

2020: |

$503 billion |

|

2021: |

$501 billion |

|

2022: |

$519 billion |

|

2023: |

$439 billion |

Spending

The budget includes discretionary spending of $1.058 trillion (this is the original Budget Control Act cap of $1.066 trillion minus the $8 billion rescission required under the American Taxpayer Relief Act). The budget request ignores the sequester by assuming it is canceled, but proposes no specific offsets. This is a reason that the deficit reduction the White House will quote is inflated – they count the sequester cancelation in their baseline budget numbers, and then count tax increases and spending cuts as “savings” from that unrealistic baseline.

The budget also requests new spending -- $50 billion for transportation stimulus spending, and universal pre-K paid for by nearly doubling the federal tax on cigarettes from $1.01 to $1.95 per pack.

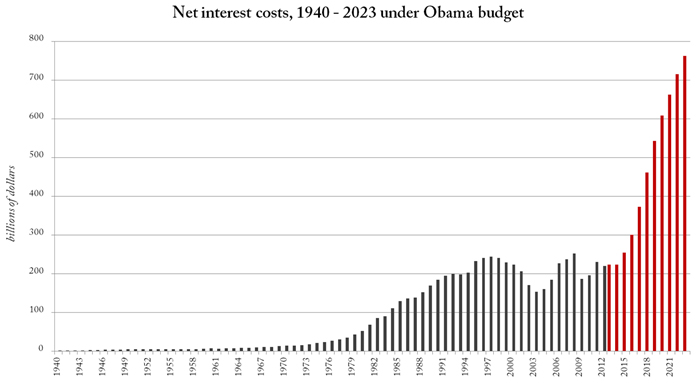

Net interest spending will skyrocket under the President’s budget, reaching $763 billion in 2023. This assumes below-average historical interest rates.

Taxes

Showing that old habits die hard, the President’s budget raises taxes by $1.1 trillion when he has already signed into law $1.7 trillion in tax hikes including his health care law.

Notable tax increases in the President’s budget include:

- $529 billion from imposing a 28 percent cap on the value of certain tax deductions. This provision has been included in all five of the President’s budget submissions.

- $157.5 billion from tax increases on international business operations.

- $53.4 billion from the Buffett rule that has failed multiple times in the Senate. This was included in last year’s budget submission.

- $78.6 billion from changes to the estate and gift tax.

- $62.6 billion from the financial sector, including $59.3 billion from a “financial crisis responsibility fee.”

- $44 billion in tax increases on fossil fuels.

- $15.9 billion from carried interest.

The budget calls for a revenue-neutral corporate tax reform, paid for with tax increases on international businesses, fossil fuels, and other sectors. The President also proposes to extend tax provisions for low-income individuals from his stimulus law. Originally passed in 2009, these provisions were extended for five years in the fiscal cliff deal.

Next Article Previous Article