Medicare Part D Prescription Drug Coverage

KEY TAKEAWAYS

- Medicare Part D began in 2006 as a voluntary benefit for people enrolled in Medicare, to help pay for their prescription drugs.

- Insurance companies that participate in the program submit bids to the federal government and compete with other plans to keep costs affordable and medicines accessible.

- Any policy reforms to ensure the program remains viable for future beneficiaries must maintain the free-market benefit structure, which has helped patients and encouraged pharmaceutical innovation.

Medicare Part D is a voluntary outpatient prescription drug benefit for people enrolled in Medicare. Implemented in 2006 under the Medicare Modernization Act, the program has consistently come in below CBO cost predictions. Its market-based design has been effective in controlling costs for the Part D benefit and has contributed to better-managed costs for the Medicare program as a whole. While the program has been successful and has remained popular, reforms could help ensure it effectively assists enrollees in affording and accessing their prescription drugs, as well as protecting taxpayers.

Plan bids and the enrollment process

People on Medicare have the option to enroll in either a stand-alone prescription drug plan that enhances traditional Medicare (Parts A and B) or a Medicare Advantage (Part C) plan that covers prescription drugs. With the exception of “dual-eligibles,” who are eligible for both Medicare and Medicaid, enrollment is optional for people on Medicare. They can enroll in a plan when they become eligible for Medicare or during the open-enrollment period, October 15 through December 7 each year. Dual-eligible beneficiaries are automatically enrolled in a prescription drug plan if they not select one on their own. Roughly 47 million people are enrolled in prescription drug coverage.

Part D uses private-run plans rather than government-run plans to offer prescription drug coverage. Each year, insurance companies submit their bids to the government detailing the drugs they would cover and the cost per enrollee they would want from Washington. The federal government bases an insurer’s payment on an average of the bids in each of 34 geographic regions. The premiums that customers pay are the difference between Medicare’s share of the average bid and an individual plan’s bid. The goal is for the bidding process to spur competition among insurers.

Medicare Part D Shopping

This year there are 901 stand-alone prescription drug plans across the country, with 20 to 30 options typically available to residents of each state. Enrollees can also select from a similar number of Medicare Advantage plans that provide a prescription drug plan. Premiums and benefits vary widely, so consumers can be cost conscious and choose the plan that works best for them. This year, beneficiaries pay a base premium of $33.19 per month, which is adjusted up or down by a number of factors. The actual premium an enrollee pays depends on the type of plan they choose and whether or not they are eligible for income-based subsidies.

Every Part D plan has a drug formulary – the list of drugs the plan covers – that enrollees consider when determining which plan is best for them. Part D plans must provide at least a “standard coverage” package of benefits, including at least two drugs in each category on their formulary. Plan sponsors also must cover a substantial number of the drugs in six classes: immunosuppressants, HIV/AIDs treatments, antidepressants, antipsychotics, anticonvulsive medications for seizure disorders, and anticancer drugs.

The benefit design

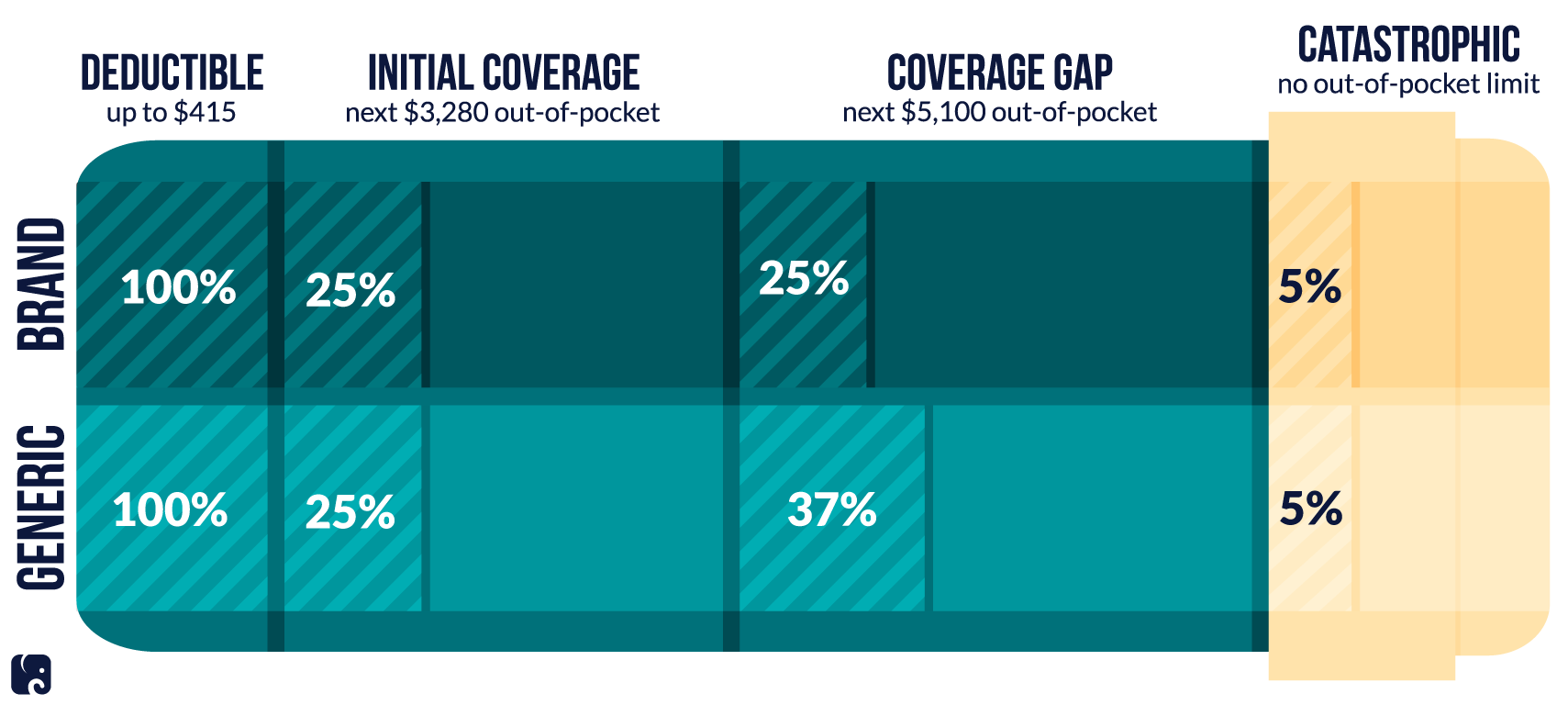

The way plans calculate and pay benefits has been modified several times since the MMA established Part D. Currently, beneficiaries are required to pay for the total cost of their prescription drugs until they reach their deductible, which can be no more than $415 this year.

At that point, patients enter the “initial coverage phase,” where they pay 25% of the cost of their drugs and insurance covers the rest. They are in this phase until they’ve paid $3,820 out of pocket, at which point patients fall into the coverage gap, commonly referred to as the “donut hole.” In this phase, patients are required to pay a slightly bigger share of their prescription drug costs: 25% for brand-name drugs, and 37% for generics.

Patients stay in the donut hole until they have spent $5,100 out of pocket, when they move into the final coverage phase: “catastrophic coverage.” In this phase, the consumer pays 5% of the retail price for drugs, the plan pays 15%, and Medicare covers the remaining 80%. There is no limit on out-of-pocket costs in the catastrophic phase, meaning some seniors could still face sizeable, though heavily subsidized, bills.

2019 Medicare Part D Consumer Share

Reforms to build on success

While Part D premiums have remained relatively level in the past few years, enrollees’ out-of-pocket costs have been increasing – especially for expensive specialty drugs. The Medicare trustees anticipate that spending in Part D will increase over the next decade for several reasons, including because of increases in the price and use of these specialty drugs.

The Finance Committee has proposed simplifying the benefit design and reducing cost-sharing requirements for enrollees. The proposal would introduce an out-of-pocket cap at $3,100 for beneficiaries to hit the catastrophic phase, eliminating the coverage gap phase entirely. In the catastrophic phase, the proposal would eliminate patients’ 5% cost-sharing requirement. The prescription drug benefit would remain market-based in design to manage spending; drug prices would continue to be determined without broader interference by the federal government.

Next Article Previous Article