Medicare for All: Higher Taxes, Fewer Choices, Longer Lines

KEY TAKEAWAYS

- A single-payer health care system would eliminate all private insurance and place all medical care in the hands of the federal government.

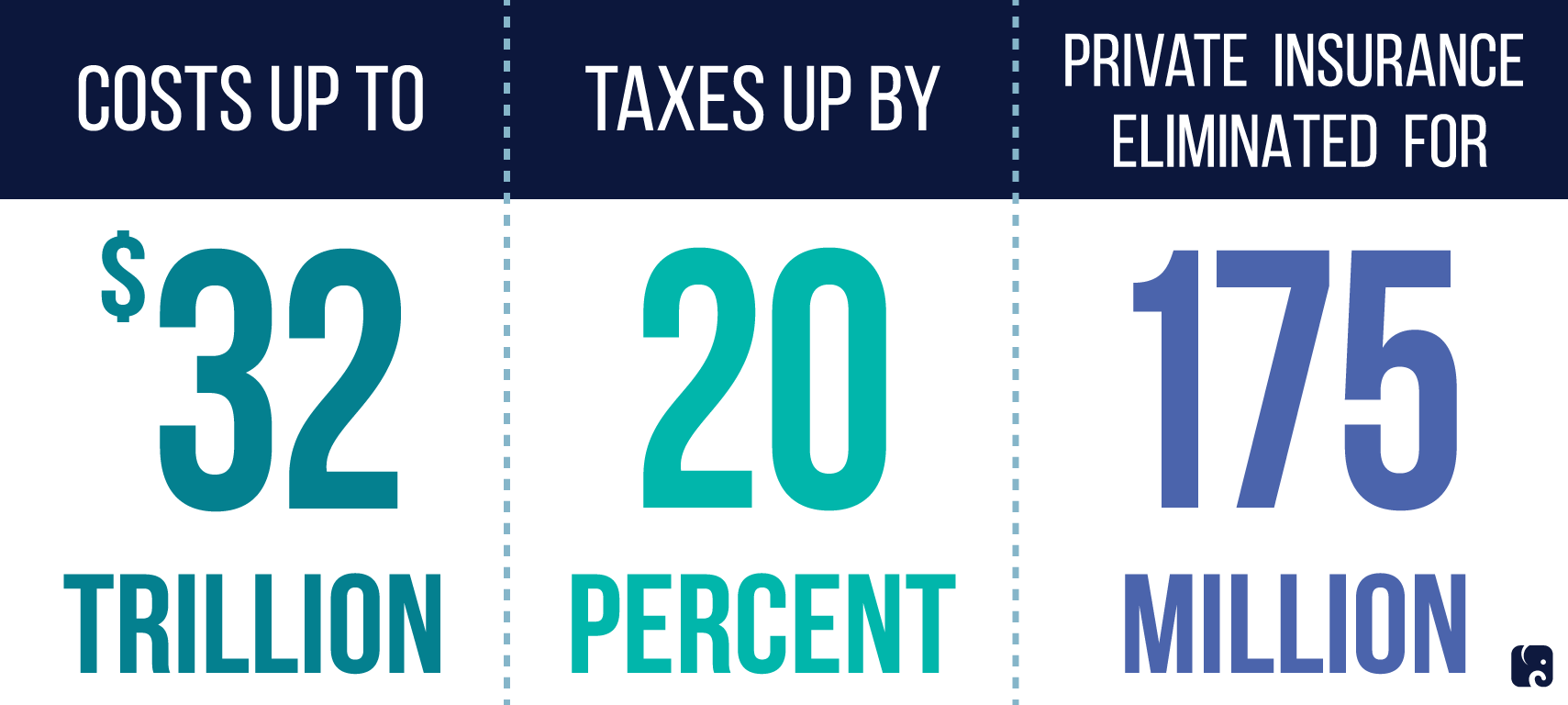

- The proposed Medicare for All system could cost an additional $32 trillion and require a 20 percent tax increase to implement.

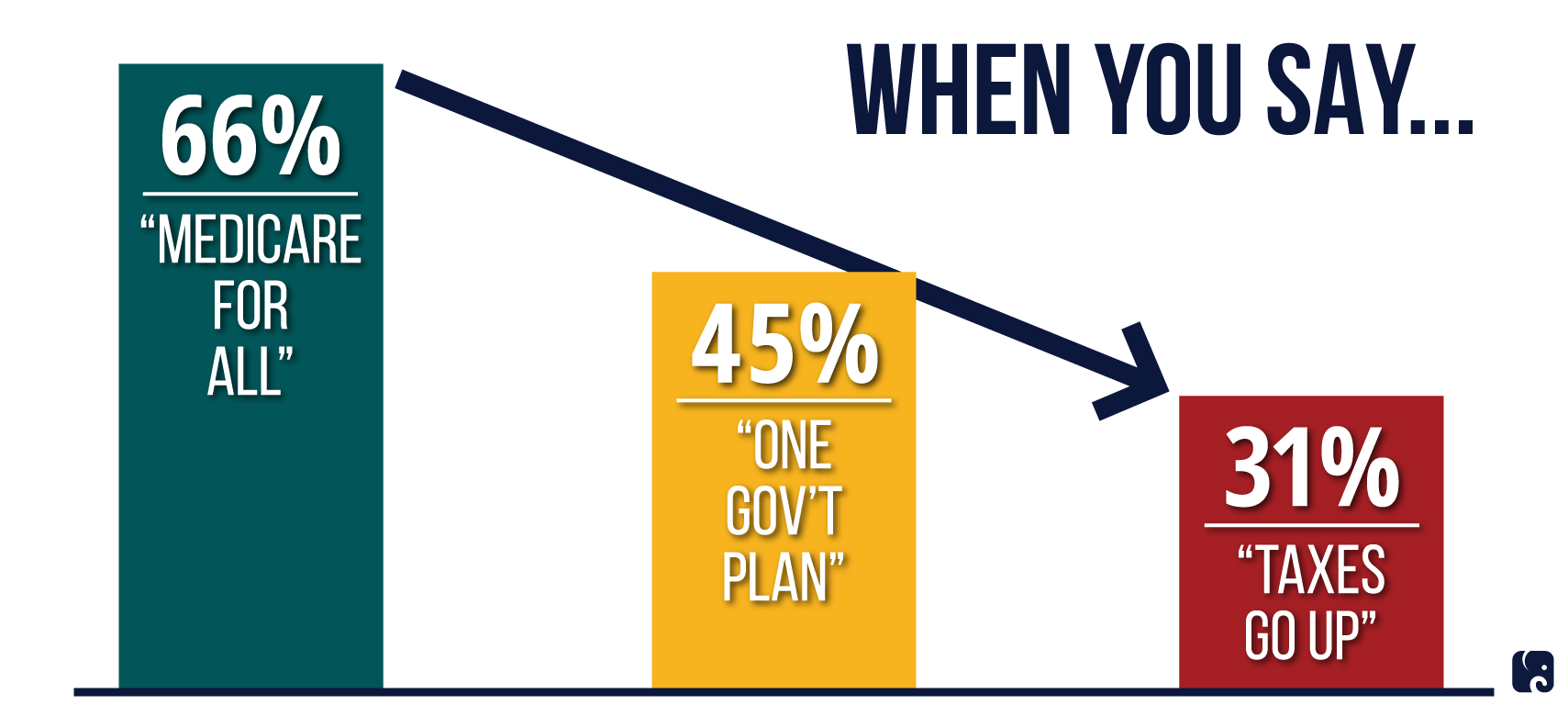

- More than two-thirds of Americans do not support the plan once they are told a government-run, single-payer system would require an increase in their personal taxes.

Democratic efforts to push “Medicare for All” are little more than an attempt to reboot their decades-old plan for a single-payer health care system. No matter they spin their radical health care proposal, it will produce more harm than good. When Americans realize the cost of implementation – to their pocketbooks and to the quality of care they receive – support drops quickly.

“Medicare for All” By The Numbers

No choice, no escape

Democrats are pursuing a national, single-payer system that would eliminate all choice and make the federal government the only source of health care. When Americans learn that “free” health care comes with countless hidden costs, support for a single-payer system evaporates quickly.

The plan would eliminate all private insurance, including plans people get through their jobs. Proponents say “free” health care for all would eliminate premiums, copays, and deductibles for everything from major surgery to dental, vision, hearing, and mental health services. In reality, enormous tax increases for all would simply pre-pay whatever health care services the government chooses to provide.

Support Plummets

The left-leaning Kaiser Foundation conducted a poll in July 2017 asking if people were comfortable getting their health insurance from a single government plan. Forty percent opposed the idea and 55 percent favored it. When asked how they would feel if they were told such a plan would give the government too much control over health care, opposition rose to 62 percent.

A September 2017 Harvard survey similarly found the Democratic plan loses support when Americans are told the true cost, especially when it means a personal tax increase. Pollsters asked if respondents supported “a taxpayer-funded national plan like Medicare,” and 66 percent said they did. Support dropped to 44 percent, however, when people were told their own taxes would rise. When asked about a system with only “one government plan,” support dropped from 45 percent to 31 percent when people were told their taxes would increase.

expect cancelLations and delays

Health care systems in other countries show the damage single-payer systems can inflict on patients. Last winter in Britain, a busier-than-expected flu season strained the system so badly that tens of thousands of patients were given substandard care or nothing at all. One in five emergency room patients waited longer than four hours to see a doctor, and 50,000 procedures deemed non-urgent by the government’s National Health Service were simply cancelled.

Americans can expect the same, if not worse. Health care decisions should remain in the hands of every American, not the federal government. Socialized health care necessarily means the American people would give up their right to choose, leaving the government to decide who gets care, when, and how much of it. As we’ve seen in other countries, universal coverage does not mean universal access to quality care.

sticker shock

Americans are likewise unprepared for the colossal price tag of a new government-run Medicare for All system. Senator Bernie Sanders claims his version of the plan would cost $1.4 trillion per year, or $14 trillion over 10 years, partly paid for by individual tax increases. His plan includes a 2.2 percent income tax and a 6.2 percent tax on employers, which likely would be passed on to workers.

Non-partisan researchers, however, have totaled up the real cost of his plan in its first 10 years of implementation and found the number could be much higher.

According to researcher Kenneth Thorpe of Emory University, “to fund the program, payroll and income taxes would have to increase from a combined 8.4 percent in the Sanders plan to 20 percent while also retaining all remaining tax increases on capital gains, increased marginal tax rates, the estate tax and eliminating tax expenditures.”

Nothing new to see here

While Democrats tout Medicare for All as a new idea, their strategy remains the same: increase Washington’s control. Government-run health care will undoubtedly do great harm to Americans, both from the lack of access and the heavy tax burden.

Nearly nine years after Democrats passed their previous attempt to reinvent health care, costs and access are still concerns for many Americans. Instead of giving Washington even more authority, Congress should focus on ways to give Americans more options and more control over their own health care.

Next Article Previous Article