Labor Rules Crushing Business

-

The Obama administration is racing to finalize regulations affecting broad sectors of the economy, threatening job creation.

-

In January, White House Chief of Staff Denis McDonough said, “we’ll do audacious executive action over the course of the rest of year, I’m confident of that.”

-

The administration’s revisions to several important rules – in addition to the piles of regulations already on the books – are costing billions of dollars in compliance costs.

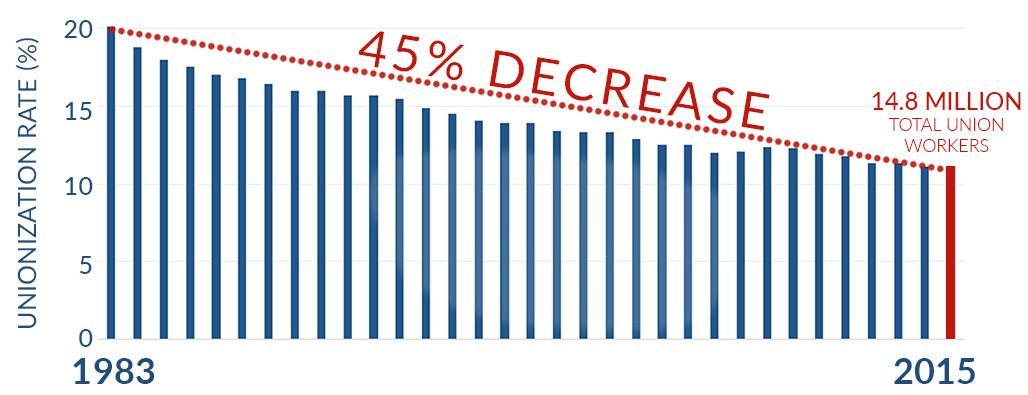

The Obama administration is rushing to finalize its anti-business, pro-union regulatory agenda before its time runs out next January. Even though union membership has been declining for years, the Labor Department continues to try to extend its bureaucratic territory and pander to this essential part of Democrats’ political base.

Percentage of workers in a union

PERSUADER RULE

On March 23, the Obama administration published its “persuader rule.” The rule was first proposed by DOL in 2011 and has long been sought by unions. It will require lawyers and consultants to disclose the kind of advice they give to employers facing union drives, and their fees, even if the consultants are not contacting employees directly. Disclosure requirements are not being placed on lawyers and consultants working for the unions. The unions’ goal is to disrupt confidentiality, divulge information to strengthen union organizing, and make it harder for firms to get advice on how to respond to unionization efforts. The American Bar Association has raised “serious concerns” that the DOL rule impinges on attorney-client privilege.

The rule took effect on April 25, and it will be applicable to arrangements, agreements, and payments made on or after July 1. Three lawsuits have been filed to try to block the rule.

FIDUCIARY RULE

On April 6, the DOL published its final fiduciary rule. The rule, originally proposed in April 2015, is considered one of the biggest regulatory priorities of the Obama administration. It will significantly limit the availability of financial advice related to pension and retirement plans. It will also put the department in charge of financial advice provided to all individual retirement accounts and private sector, employer-provided retirement plans. The rule is estimated to affect $3 trillion that Americans hold in individual retirement accounts. It will be particularly harmful to low- and moderate-income workers seeking advice for their retirement planning.

The final rule is estimated to cost $31.5 billion over 10 years, along with requiring nearly 57,000 hours in compliance time. DOL claims that the rule will save investors up to $17 billion.

A resolution of disapproval has been introduced in both the House and the Senate. The Senate measure, S.J. Res. 33, is sponsored by Senator Isakson and has 35 cosponsors. Additional legislation has been introduced in the Senate to address concerns with this rule: S. 2505 by Senator Kirk; S. 2502 by Senator Isakson; and S. 2497 by Senator Blunt.

OVERTIME RULE

Published in July 2015, the proposed rule would raise to $50,440 the salary threshold under which workers are guaranteed time-and-a-half pay – more than double the current threshold of $23,660. It automatically increases the salary threshold for inflation, ignoring regional differences in pay.

The Obama administration estimates that the change will make an additional 5 million U.S. workers eligible for overtime pay. Last year, an analysis for the National Retail Federation predicted that it is unlikely that many of these workers would see their take home pay improve. Employers would likely have to find other ways to reduce labor costs in order to remain competitive.

Coupled with the salary threshold are “duties tests” to refine who is eligible for overtime pay. While DOL is not proposing specific regulatory changes to the duties tests, its proposed rule “seeks to determine whether, in light of our salary level proposal, changes to the duties test are also warranted.” This back-door approach to changing the tests may violate the Administrative Procedure Act.

The proposed rule is currently at the Office of Management and Budget for review before it is published as final rule. Senator Scott introduced S. 2707 to address concerns with changes to the overtime regulation.

JOINT EMPLOYER RULE

In its 2015 Browning-Ferris decision, the National Labor Relations Board overturned 30 years of precedent to adopt a broader standard for determining “joint employer” status. It said that two different companies can be joint employers of the same worker if they both have “indirect” or “reserved” input over workers’ conditions of employment. Previously, an employer had to exercise “direct and immediate” control in order to qualify under the rules. The board’s interpretation is likely to create new joint-bargaining obligations and potential joint liability for unfair labor practices.

One group of employers most at risk is franchise owners. The NLRB has brought a large case against McDonald’s seeking to treat the corporation as a joint employer with all of its franchised restaurants. The trial began in March. Unprecedented in size, the NLRB action has pulled together 21 unfair labor practice complaints. Testimony will be heard in several cities.

The Department of Labor has piggybacked on the NLRB decision and issued guidance arguing that more businesses should be classified as joint employers. This step could make companies liable for labor violations tied to their temps and contract workers.

DOL’s Occupational Safety and Health Administration is also investigating franchise businesses, including McDonald's, for alleged workplace safety violations and is considering complaints that would view the companies as joint employers. Senator Alexander has introduced S. 2686 related to this rule.

BLACKLISTING RULE

On May 28, 2015, the Federal Acquisition Regulatory Council published a proposed rule regarding the “blacklisting” procedures included in President Obama’s Fair Pay and Safe Workplaces executive order. The order prohibits any company that has been charged with noncompliance with a list of federal labor and state equivalent laws in the previous three years from bidding on a federal contract. It requires contractors and subcontractors to update disclosures of any violations every six months, and it prohibits contractors from arbitrating sexual assault, sexual harassment, and Title VII claims unless the complaining employee consents.

DOL issued separate guidance to accompany the proposed rule. The rule will greatly increase the risk and costs that contractors face in performing services for the government. It’s estimated that up to 25 percent of all U.S. employers are federal contractors.

SILICA RULE

On March 24, the Department of Labor published its final rule on crystalline silica. OSHA says that the rule will cost the construction industry $511 million annually. Industry groups estimate the cost to be closer to $5 billion. Previously, the permissible workplace exposure limit was 250 micrograms per cubic meter for workers in the construction industry and shipyards, and 100 micrograms for other industries. The rule slashes the limit to 50 micrograms per cubic meter for all workers.

The Small Business Administration’s Office of Advocacy requested an extension of the rule’s comment period to allow it to update its process that gives small businesses a voice in the rulemaking process. Instead, OSHA relied on a report on small business comments from 2003. The final rule will take effect in June, and it includes multiple timetables.

Next Article Previous Article