Labor Department Rules Update

KEY TAKEAWAYS

- The Department of Labor’s regulatory reform efforts have sought to provide clarity and to overhaul burdensome rules imposed by the Obama administration.

- The department recently finalized one rule that makes an additional 1.3 million workers eligible for overtime pay and another rule to expand access to retirement plans.

- Other rules are in progress, including one to clarify situations in which two employers may be jointly liable for overtime pay and other wage requirements for the same worker.

While the Department of Labor pursues policies to protect and train America’s workforce, it also is trying to reform regulations that affect workers and employers. New regulations offer certainty and replace burdensome rules issued under the Obama administration.

Association Retirement Plans

Under the final rule on association retirement plans, which took effect September 30, more self-employed people and workers at small and midsize businesses may have workplace-based retirement savings plans. The rule allows associations of employers to set up retirement plans covering the workers at multiple businesses in the same industry or in the same geographical area.

A survey of small and midsize businesses by Pew Charitable Trusts found that about half of them did not offer a retirement plan, most often because of the cost and organizational resources needed to set one up. The ARP rule is expected to reduce paperwork and lower costs for participating businesses, compared to setting up plans on their own. For example, each plan would file a single annual report on its financial conditions and related information, rather than each business in the plan having to do so. The ARP rule may help smaller businesses offer an attractive benefit and compete better with larger businesses for workers. Employees will have access to an on-the-job retirement savings option.

overtime pay

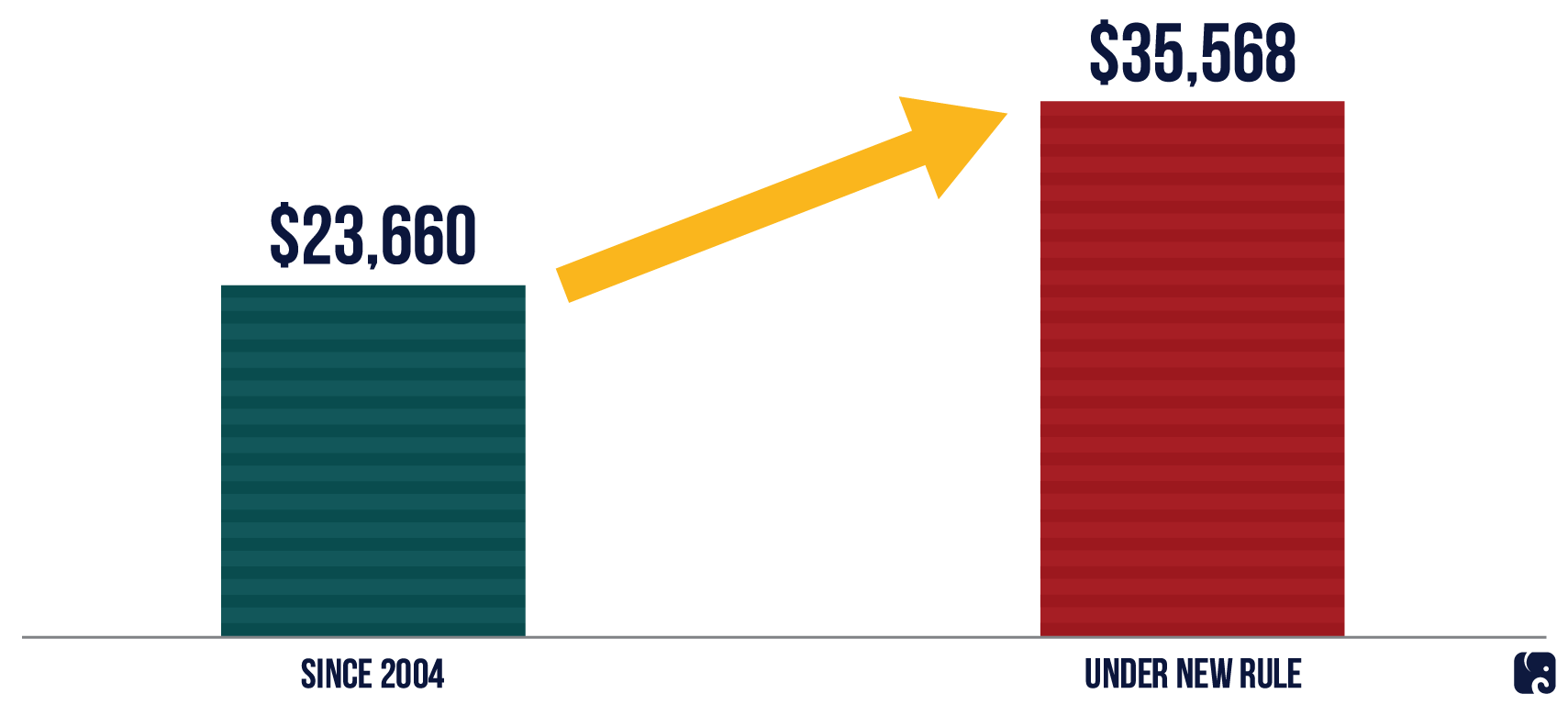

Under the Fair Labor Standards Act, employers must pay workers at least 1½ times their normal rate for working more than 40 hours a week. Some workers are exempt, such as those in “bona fide executive, administrative or professional” jobs who earn at least a certain salary. In September, the Labor Department issued a final rule that increases the salary thresholds at which these workers become exempt. The new “standard salary level” threshold for people who work primarily in an executive, administrative, or professional capacity is $684 per week or $35,568 annually, up from $455 per week or $23,660 annually.

An estimated 1.3 million people will be newly eligible for overtime pay under this rule. The department is updating these regulations partly to reflect wage and salary increases since the last update in 2004. It intends to update the thresholds more regularly using notice-and-comment rulemaking. The rule is effective January 1, 2020.

People Earning More Money Can Get Overtime

Joint Employer Status

In 2017, the Trump administration withdrew Obama administration guidance on joint employer status, which had been criticized for being expansive, increasing companies’ exposure to lawsuits, and bypassing formal notice and public comment. The Labor Department proposed a new rule in April to clarify when two employers are jointly liable for a single employee. It applies to wage requirements of the Fair Labor Standards Act, such as overtime pay. This affects franchise workers, independent contractors, and employees supplied by staffing firms, among others.

The Trump administration’s proposed rule offers a four-part test that considers whether the employer: hires or fires the worker; controls and supervises the work schedule or employment conditions; decides how and how much the employee is paid; and keeps employment records on the employee. Other factors could be considered if they point to whether the employer exercises “significant control over the terms and conditions of the employee’s work.”

So if a cook works shifts at two different restaurants owned by the same person, with managers who coordinate on the cook’s wages and schedule, the restaurants likely would be joint employers. In contrast, a cook who works at two restaurants that are part of the same national chain but have different owners who don’t coordinate on the cook’s employment conditions, the restaurants likely would not be joint employers.

Industry Recognized Apprenticeships

Apprenticeships – which combine paid work and classroom education – are one way Americans can gain skills and knowledge needed for in-demand jobs. The Labor Department proposed a rule in June that would encourage the creation of apprenticeships in more occupations. The department would recognize entities, such as companies and trade groups, that would certify and administer “industry-recognized apprenticeship programs.” The IRAPs would have to include paid, on-the-job experience, education, an industry-recognized credential, and certain worker protections.

The new IRAPs would operate alongside registered apprenticeships programs, which require approval by DOL or a state apprenticeship agency. Initially, it would preclude IRAPs from being established in the construction industry and the U.S. military, because both sectors have widely adopted apprenticeships. It is unknown if the final rule will keep this exclusion. In-demand industries, such as health care, advanced manufacturing, and information technology, would be encouraged to adopt IRAPs to attract and train workers.

fiduciary Rule

The Labor Department expects to release a proposed rule by the end of the year setting standards for retirement advice fiduciaries under the Employee Retirement Income Security Act of 1974. DOL is working on the rule with the Securities and Exchange Commission, which adopted related rules in June.

The Obama administration had put out a fiduciary rule in 2016 that sought to curb conflicts of interest in retirement investing advice. The rule’s restrictions and complex disclosure requirements caused concern that it would adversely affect some of the retirement savers it was designed to help. Last year, the 5th Circuit Court of Appeals vacated the Obama administration’s rule, saying it expected “many financial service providers will exit the market for retirement investors” instead of dealing with the new requirements.

Next Article Previous Article