King v. Burwell

Contents:

Question before the Supreme Court

Politics of the time

IRS’ writing of the rule

Other court rulings on the IRS regulation

Administration plan for insurers; no plan for people

Five things at stake for Americans

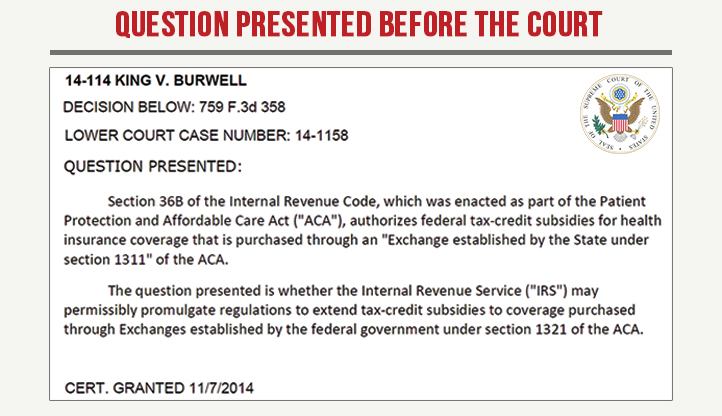

Question before the Supreme Court

This month, the Supreme Court will rule on yet another Obamacare-provoked controversy. The case – King v. Burwell – involves an IRS regulation that provides health insurance subsidies in the form of refundable tax credits, contrary to the plain text of the law. The central question before the court is whether the executive branch can interpret laws to essentially rewrite what Congress passed.

As written, Obamacare limits these subsidies to people buying insurance in exchanges established by states, not the federal government. Specifically, the law says that people may receive a premium tax credit if they enroll through “an Exchange established by the State.” Despite this, the IRS authorized the subsidies in all states, regardless of whether states established an exchange.

The plaintiffs in King are suing on behalf of millions of people subjected to Obamacare’s individual mandate penalties by the IRS’ regulation. Without the subsidies, Obamacare coverage would meet the law’s definition of “unaffordability” for many people. They would be allowed an exemption from the individual mandate tax penalty. The subsidies also trigger penalties under the employer mandate, so IRS’ actions expanded the employer mandate beyond what the law allowed.

Politics of the time

The Democrat-controlled 111th Congress limited subsidies to state-established exchanges for a reason. In order to overcome an expected filibuster, Democrat leaders had to secure the support of centrist Democrat Senators like Ben Nelson of Nebraska, who preferred to have exchanges run by the states and not by Washington. Because the Constitution prevents Congress from requiring states to implement federal policy, Washington has a long history of using a carrot-and-stick approach to encourage states to implement those policies.

By late 2009, the president and congressional Democrats had decided to pursue their health care law in a completely partisan manner. Obamacare was jammed through the Senate on Christmas Eve 2009 without a single Republican vote. While many Democrats were concerned about Obamacare’s approach, they made the calculated decision that it was the only bill they could pass after Scott Brown’s election ended the Democrats’ filibuster-proof majority in the Senate.

On March 9, 2010, several days before the House voted to pass the Senate bill, Speaker Pelosi said, “we have to pass the bill so that you can find out what is in it.” The 2010 elections brought a flock of new state officials opposed to the health care law, with the vast majority of states indicating they would not establish Obamacare state exchanges.

Justice Sotomayor: “But nobody no one’s going to visit the program if there are no subsidies because not enough people will buy the programs to stay in the exchanges.”

Mr. Carvin: “That is demonstrably untrue and not reflected anywhere in the legislative history. The legislative history quite clearly contradicts that. Many Senators got up and said there are very valuable benefits to the exchange … There’s not a scintilla of legislative history suggesting that without subsidies, there will be a death spiral. Not a word.”

There is evidence that Obamacare’s restriction of subsidies to state-established exchanges was intentional.

- First, in a 2009 law review article, one of the nation’s leading liberal health policy scholars wrote that Congress “could exercise its Constitutional authority to spend money for the public welfare (the “spending power”), either by offering tax subsidies for insurance only in states that complied with federal requirements (as it has done with respect to tax subsidies for health savings accounts) or by offering explicit payments to states that establish exchanges conforming to federal requirements.” Obamacare, which offered subsidies only in exchanges established by states and contained payments to states that met federal requirements, had both of these elements. The author of that article was later invited to Obamacare’s signing ceremony.

- Second, on multiple occasions in 2012, Obamacare architect and administration advisor Jonathan Gruber stated that the law had been designed to restrict tax credits to states that established exchanges. At one event, he said that what is “important to remember politically about this is if you’re a state and you don’t set up an exchange, that means your citizens don’t get their tax credits – but your citizens still pay the taxes that support this bill.”

- Third, in early 2010 a group of liberal House Democrats from Texas wrote a letter to President Obama and then-Speaker Nancy Pelosi detailing what they viewed as significant problems with the Senate health care bill that would eventually become law. Despite acknowledging the federal fallback exchange in the Senate bill, the group was afraid that the Senate bill “relies on states with indifferent state leadership that are unwilling or unable to administer and properly regulate a health insurance marketplace.” According to the letter, “millions of people will be left no better off than before Congress acted.” This indicates that members of Congress knew beforehand that the bill would tie the law’s supposed benefits to state cooperation.

IRS’ writing of the rule

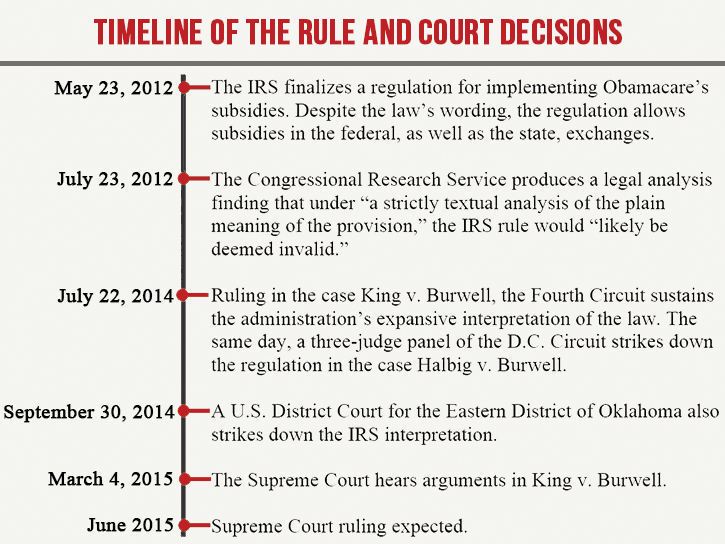

In November 2011, the IRS proposed a rule allowing subsidies for people buying health insurance through the federal exchanges. At least 25 members of Congress, including ranking member of the Senate Finance Committee Orrin Hatch, wrote to the IRS saying that its proposed rule was inconsistent with the statute. Undeterred, the IRS made the rule final in May 2012.

A later investigation by the House of Representatives found that IRS and the Treasury Department failed to properly develop the rule. In February 2014, the House Oversight and Government Reform Committee and the Ways and Means Committee released a joint report showing that early drafts of the regulation made specific reference to the statutory language restricting tax credits to exchanges “established by the State.” This language was cut from the drafts in early March 2011. Around that same time, IRS and Treasury officials expressed concern that there was no direct statutory authority to interpret federal exchanges as an “Exchange established by the State.” These officials asked political appointees at the Department of Health and Human Services to issue regulations creating equivalence between a federal exchange and a state exchange. HHS did so in their exchange regulations, and IRS followed suit shortly thereafter.

The administration was unable to produce any emails to House investigators showing that there was a substantive discussion at IRS or Treasury about whether the law authorized tax credits in federal exchanges. Six months before publishing the final rule, Treasury officials started looking into whether the statute was ambiguous enough that they could get away with the broader interpretation they preferred.

The oversight subcommittee of the Senate Judiciary Committee invited three Treasury officials to testify on June 4, 2015, about how the rule was written. All three declined to attend and answer Senators’ questions. The administration claimed that the witnesses should not comment on what they did and how the rule was developed, given the pending Supreme Court decision.

Other court rulings on the IRS regulation

Several federal courts have issued opinions on the IRS rule. On July 22, 2014, two Circuit Courts of Appeals reached different conclusions on the legality of the IRS rule. In a 2-1 decision, the D.C. Circuit Court ruled in Halbig v. Burwell that the IRS’ decision to issue subsidies in states using the federal exchange was an impermissible interpretation of the statute. It found that the law clearly restricted subsidies to state-established exchanges. That same day, in King v. Burwell, a three-judge panel of the Fourth Circuit unanimously upheld the rule, finding that the language of the law is “ambiguous and subject to multiple interpretations.”

In September 2014, a judge with the U.S. District Court for the Eastern District of Oklahoma sided with the state of Oklahoma in a challenge to the regulation. The judge noted that the IRS rule “leads us down a path toward Alice’s Wonderland, where up is down and down is up, and words mean anything.” The judge added that “the court is upholding the Act as written. Congress is free to amend the [Affordable Care Act] to provide for tax credits in both state and federal exchanges, if that is the legislative will.”

Administration plan for insurers; no plan for people

The administration negotiated late last year to give relief to insurance companies if the subsidies were struck down. According to an October 21, 2014, Forbes article, the administration included in its 2015 contracts with insurance companies a clause “assuring issuers that they may pull out of the contracts, subject to state laws, should federal subsidies cease to flow.”

Last December, Senate Republican leaders wrote to the secretaries at the Departments of Treasury and Health and Human Services. The letter discussed the need to inform people contemplating signing up for coverage through HealthCare.gov that the subsidies could be ruled illegal. The Senators wrote that without “this information, many families could turn down more-secure coverage options (e.g., through a different employer) in favor of less-secure Obamacare coverage. We urge you to reconsider [your] position and ensure that these Americans have all available information as they make decisions about health insurance coverage.”

The administration refused to listen – a failure that stands in stark contrast to the relief the administration provided for health insurance companies. People who lose a subsidy they expected will be understandably frustrated. Republicans have put forward ideas that would protect these people while also addressing broader concerns the American people have with Obamacare. Last week, the HHS secretary testified that the administration has no fallback plan if the court rules against its subsidy scheme. So far, the president appears oblivious to the damage caused by his law and unwilling to work with Republicans on common-sense reforms.

Five things at stake for Americans

Protecting Taxpayers: A ruling for King would end unauthorized federal spending

The IRS rule increased taxes and spending beyond what was authorized by Congress. In doing so, the IRS shifted costs from exchange policyholders to taxpayers. According to the Congressional Budget Office’s most recent estimates, Obamacare’s subsidies will increase Washington’s debt by $849 billion over the next decade. The Urban Institute estimates that a ruling for King would reduce federal spending on subsidies by $340 billion over the next decade.

Growing the Economy: A ruling for King would lead to more and better jobs

Because of the unworkability of the employer mandate and the compliance burdens it imposes, the administration has delayed and modified it twice. Despite these delays, the employer mandate will take full effect next year. Businesses and their employees are only assessed employer mandate penalties if at least one worker receives an Obamacare subsidy. If the court strikes down the IRS rule, it would largely repeal the employer mandate in all states relying on the federal exchange.

Last month, the American Action Forum projected that such a ruling would free 262,000 businesses from the employer mandate and would lead to 237,000 new jobs. Worker pay at small and medium-sized firms would increase by around $900 per year, and more than three million part-time workers could gain additional hours.

Freedom from the Individual Mandate: A ruling for King would end an unprecedented tax

The health care law created, for the first time, a federal tax on people who do not purchase a specific product. A court ruling striking down the IRS rule would also free millions of people in states with federal exchanges from this individual mandate tax because of the affordability exemption. The American Action Forum estimates that a ruling for King would free more than 11 million people from the individual mandate tax, with an average of $1,200 in tax relief.

Healthcare Transparency: A ruling for King would show the true cost of Obamacare coverage

The subsidies paper over the cost of Obamacare’s many mandates and rules. These requirements increased the average price of individual market coverage by an average of 49 percent in just the first year the law took effect. Rate request filings for 2016 indicate that much higher premiums are in store for enrollees next year. According to the American Action Forum’s projections, a ruling for King could affect the out-of-pocket premium share of 6.6 million federal exchange enrollees who are currently receiving subsidies. On average, these enrollees are receiving subsidies to cover about three-quarters of the cost of their coverage, and the average annual subsidy is $3,156.

Preserve Separation of Powers: A ruling for King would restrain an out-of-control executive

A court ruling striking down the IRS regulation would help ensure that future administrations do not rewrite laws to implement tax and spending schemes without congressional authorization.

Next Article Previous Article