Key Data on the American Economy

- This year’s deficit will increase by 35 percent due to a poor economy, lower tax revenue, and higher Washington spending.

- The U.S. median income rose significantly in 2015 for the first time during the Obama administration, but is still below 2007 levels.

- Economic growth is disappointing – near 1 percent for the last three quarters.

Americans say that the economy under President Obama is not working for them. In the most recent Gallup poll, the economy ranks as the most important problem for the nation, followed by unemployment and dissatisfaction with government. After 7½ years of a very poor recovery from the recession, it is easy to see why Americans are concerned about the economy and jobs. It’s also easy to see why they lack faith that their government can create an environment in which the private sector will thrive.

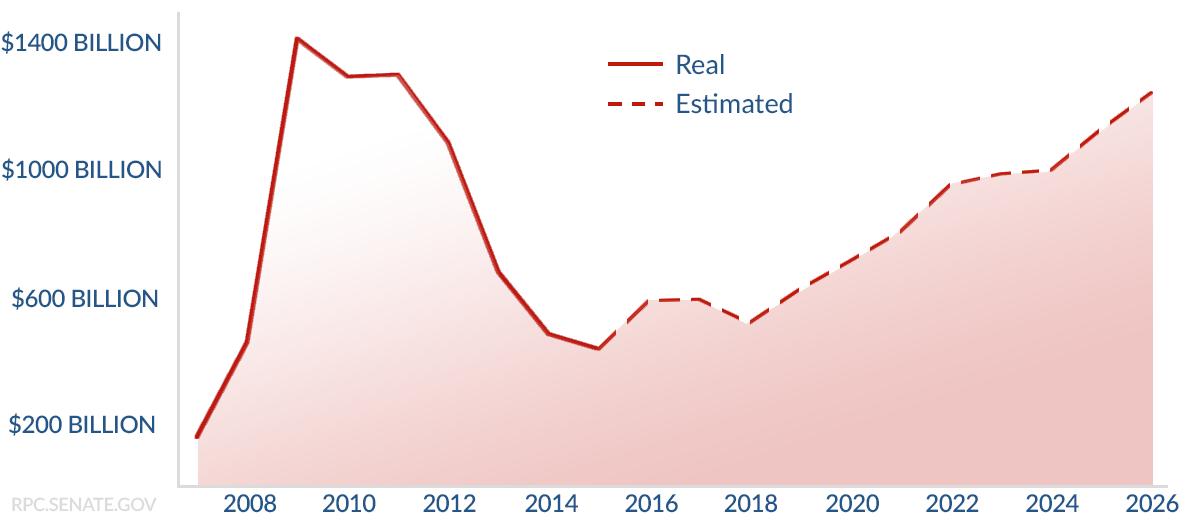

Deficits

Last month, CBO updated its federal budget estimates for the next 10 years. CBO now projects that the federal budget deficit for 2016 will be $590 billion, a 35 percent increase over last year.

Deficits Increase Due to Obama Inaction on Mandatory Spending

The deficit had reached unprecedented highs from 2009 to 2011, and had been declining since then. The budget is now on a path to return to trillion dollar deficits by 2024. Altogether, CBO expects that Washington’s debt will grow by almost $9 trillion over the next decade. While President Obama has done his best to raise tax rates, the poor economic recovery caused tax revenue to decline as a percentage of GDP over the past year. This shows that we cannot tax our way to a balanced budget.

CBO specifically noted that the rising deficits are due to “significant growth in mandatory spending and interest payments.” Discretionary spending – including defending the nation – will decline as a percentage of the economy.

Income

U.S. median income in 2015 rose to $56,516. According to the Census Bureau, “This is the first annual increase in median household income since 2007.” The new income level is still 1.6 percent less than the pre-recession level of $57,423 in 2007. It is also 2.4 percent less than the all-time high of $57,909 in 1999. Part of the rise last year may be because many Americans have dropped out of the labor force, and the remaining Americans who work can therefore seek higher wages.

“Last year’s encouraging progress doesn’t obscure the reality that neither the economy nor workers are reaching their full potential. The next President can build on this late uptick by changing policy direction.” – Wall Street Journal, “America Gets a Raise, Finally,” 09-14-2016

Also in 2015 the poverty rate declined to 13.5 percent, which is still well above its 2007 level of 12.5 percent.

Spending

Washington spending is estimated to be $178 billion higher this year than it was last year. As a percentage of the economy, spending has increased to 21.1 percent in 2016. This is far above the 50-year average of 18 percent.

Interest rates are a key factor driving future spending growth, with CBO estimating that the days of incredibly low rates will end soon. Rates on three-month Treasury bills are expected to rise from almost zero to 2.8 percent by 2019. CBO expects rates on 10-year Treasury notes to rise from near 2 percent today to 3.6 percent in 2021. This will cause the federal government’s net interest costs to rise from $248 billion in fiscal year 2016 to $712 billion in 2026.

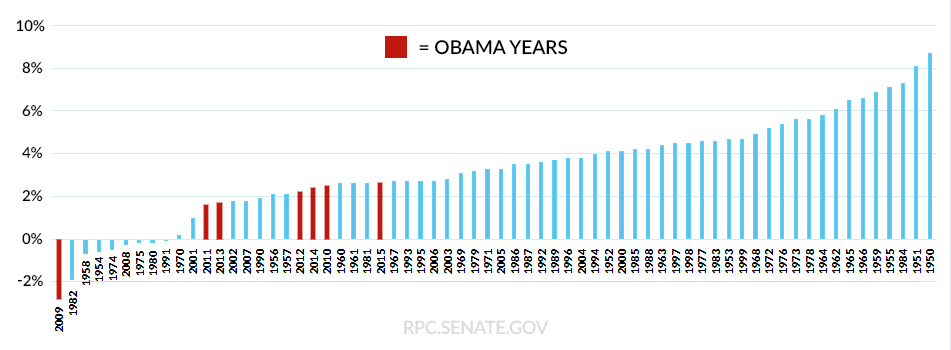

Economic Growth

Although incomes are finally rising, economic growth continues to stagnate. The most recent estimates show that GDP grew at 1.1 percent in the second quarter of 2016 – a number that was recently revised down from an estimated 1.2 percent. Economic growth in the first quarter of 2016 was only 0.8 percent, and fourth quarter 2015 growth was 0.9 percent. It has been two years since the U.S. GDP achieved quarterly growth of more than 2.6 percent.

Annual GDP growth rate, 1950-2015, sorted from worst to best

Jobs

While the U.S. labor market continues to show signs of improvement, our recovery is not complete. In August, the Bureau of Labor Statistics reported average hourly earnings have risen over the year by 2.4 percent. Prior to the recession, wage growth routinely exceeded 3 percent. In 2016 so far, employment growth has averaged 181,500 jobs per month. While many economists consider this adequate to absorb new people entering the job market, it is lower than monthly averages in 2014 and 2015.

Unemployment remained at 4.9 percent in August. Concerns remain for the 15.6 million Americans who are unemployed and under-employed. In August, the labor force participation rate remained at 62.8 percent, near its lowest level since the 1970s, showing that millions of Americans are staying on the sidelines.

In December 2015, the Federal Reserve raised its main interest by rate 0.25 percent, its first rate increase in nearly 10 years. Since then, mixed economic reports and global concerns have been noted as reasons to refrain from further adjustments. Fed Chair Janet Yellen recently stated that the Fed continues to anticipate that gradual increases in the federal funds rate will be appropriate over time. She has said that she believes the case for an increase has strengthened in recent months. The next meeting of the Federal Reserve is September 20-21.

Next Article Previous Article