International Tax Reform Spurs Investment in America

Key Takeaways

- Announcements by Apple, Comcast, Fiat Chrysler, and others about plans to increase investment in America provide strong early evidence tax reform is spurring growth and creating jobs in America.

- By lowering the corporate tax rate to 21 percent – below the average for developed countries – American companies can better compete around the world.

- Moving to a territorial tax system also attracts capital to the U.S. rather than locking it out so it stays overseas.

Apple announced plans on January 17, 2018, to significantly increase investment in its U.S. operations by contributing $350 billion to the U.S. economy over the next five years. The news came on the heels of announcements by other companies with international operations – including AT&T, Comcast, Fiat Chrysler, and Boeing – about new investments in the U.S. because of the tax law. AT&T will increase capital spending by $1 billion in 2018; Comcast will invest more than $50 billion over the next five years; and Fiat Chrysler will invest $1 billion in a truck plant in Michigan.

Reforming our international tax system is boosting investment in America and creating jobs here at home. This is what many economists predicted during the debate over tax relief.

The New Territorial Tax System Is Working

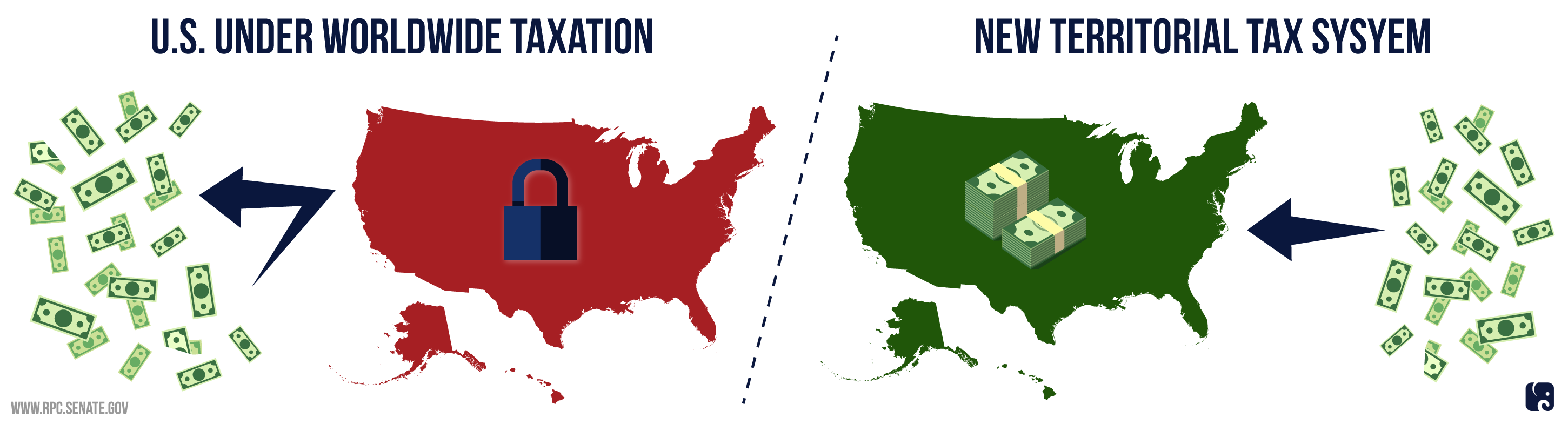

The old U.S. international tax system put American companies at a disadvantage compared to their foreign competitors, hampering investment. When global businesses based in the U.S. earned profits overseas, Washington penalized them for bringing money back to the U.S. The IRS taxed foreign profits at a 35 percent rate, even when the businesses had already paid taxes where the money was earned.

This “worldwide” taxation system was a significant deterrent for investing in U.S. jobs. If a business kept its foreign income overseas, it could reinvest the money there without paying the U.S. tax. Other companies – based in countries with a “territorial” tax system – didn’t have to pay a second layer of tax when they brought income back home after earning it in the United States. This encouraged foreign investment over U.S. investment.

Under the new U.S. territorial tax system, which was included in the tax relief law, business income earned in the U.S. is subject to U.S. tax. Income earned overseas is not. This enables U.S. businesses to bring foreign profits back to the U.S. to invest in jobs here. It also allows them to compete with foreign businesses on a level playing field.

The U.S. Must Be Vigilant

The Tax Reform Act of 1986 cut the U.S. corporate rate to 34 percent, which was a lower rate than most other developed nations had at the time. Other countries responded by lowering their rates and moving to a territorial system. The U.S. actually went the opposite direction and raised our corporate rate to 35 percent in 1993. Eventually, the U.S. had the highest corporate tax rate in the developed world.

With the Tax Cuts and Jobs Act of 2017, the U.S. now has a corporate rate below the worldwide average. It puts American businesses in a competitive position, though their position is tenuous. Countries like China, the United Kingdom, Japan, and Australia already are considering their own tax changes to counter the lower U.S. rates. Australia’s treasurer said that his country could see 1 percent lower economic growth due to a more competitive US tax code. If the Tax Cuts and Jobs Act spurs other countries to cut their rates, like the 1986 reform did, we will need to take additional steps to ensure that the U.S. remains competitive.

Next Article Previous Article