Four Deficit Reduction Options

Deficit reduction must be part of the debate over raising the debt ceiling. As part of that, the White House and Democrats in Congress must abandon their calls for more tax hikes and embrace ways to manage America’s spending. Four options for how that can be done are:

- Retirement Age

- Means Testing

- Tax Reform

- Chained CPI

These are not necessarily policies that all -- or even a majority of -- Republicans would support, but they are among the most frequently discussed.

Retirement Age

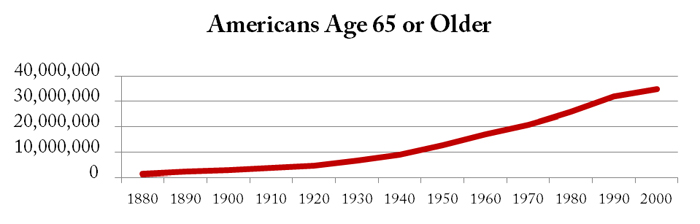

The only time the retirement age for Social Security was increased was 1983. When faced with the collapse of the program, the White House and Congress worked together to secure the program for future generations. Medicare’s eligibility age has never been increased despite improved longevity rates.

Social Security’s 75-year present value operating deficit is $8.6 trillion; while Medicare’s total realistic 75-year deficit is $37 trillion. This means that in order to pay all benefits over the next 75 years that won’t be financed by tax revenue, the U.S. would need $45.6 trillion saved and invested today. Meanwhile, the U.S. is more than $16 trillion in debt. Our net is more than $62 trillion.

Last year, CBO estimated that adjusting the retirement age would have the following budgetary effects from fiscal years 2012 to 2021:

- Medicare savings of $113 billion;

- Social Security early retirement age savings of $144 billion; and

- Social Security full retirement age savings of $120 billion.

Means Testing

In order to keep Social Security solvent, benefits could gradually be reduced for seniors with incomes above a threshold that Congress would set. This would help strengthen Social Security while also keeping it true to its original intent, as Franklin Roosevelt put it, to provide a “measure of protection … against poverty-ridden old age.”

Social Security could also be linked to price inflation. Currently, initial benefits are calculated by adjusting a worker’s wages for every year of their career by the average wage increase. In contrast, progressive indexing would lower initial benefits for higher-income retirees by linking their lifetime earnings to price inflation rather than wage inflation. The Social Security Advisory Board reports that this reform would completely eliminate the program’s 75-year actuarial deficit.

Medicare is already a means-tested program. Beneficiaries with incomes at or above $85,000 per year pay higher Part B and Part D premiums. Some policymakers want higher-income beneficiaries to pay higher Medicare Part B and Part D premiums.

Changes to Medicare’s current income related premiums have been proposed both by House Republicans as part of the 2011 payroll tax extension debate and by President Obama as part of his September 2011 deficit reduction recommendations to Congress. The two proposals are virtually identical. Specifically, the policies would:

- Extend the current income bracket freeze included in the health care law until 25 percent of beneficiaries pay higher premiums; and

- Increase the premiums that high-income beneficiaries pay by 15 percent.

CBO estimates that this policy could reduce federal spending by $30 billion over 10 years.

Tax Reform

U.S. corporations have approximately $1.7 trillion in cash sitting overseas. They earned this money overseas, and the U.S. tax system encourages them to keep it overseas. In this way, the U.S. is out of step with most other industrialized nations in that it taxes income even if it is earned in another country. The U.S. should move to a territorial system that would only tax income earned here. It has been estimated that simply moving to a territorial system would raise $76 billion in revenue over 10 years. In addition, the law reforming international taxes could apply a tax rate to non-repatriated cash earned under the old worldwide tax regime. A similar approach was used in 2004 and 2005 when companies were allowed to repatriate earnings and pay a 5.25 percent tax. This resulted in approximately $400 billion being returned to the U.S.

On the personal income tax side, eliminating various tax expenditures and lowering rates could bring in more revenue in one of two ways. First, a simplified tax system would promote economic growth and lead to higher than expected tax revenue under a dynamic scoring method. Second, even under a static scoring method, tax reform could increase revenue by some portion of the amount of eliminated tax expenditures.

Chained-CPI

A more accurate inflation measure, Chained-CPI will account for behavior change. People purchase different products in response to price changes. Chained-CPI could be applied to federal benefit payments as well as the indexing of tax brackets. This would save an estimated $200 billion over 10 years.

Next Article Previous Article