Fiscal Path Forward

Over the next several months, Congress will need to fund the government for the rest of fiscal year 2014 and will be asked to raise the debt limit. This must be done in a way that lowers future deficits, bends the curve on our national debt, and fosters economic growth.

Revenue Should Not Be Used to Offset Sequester

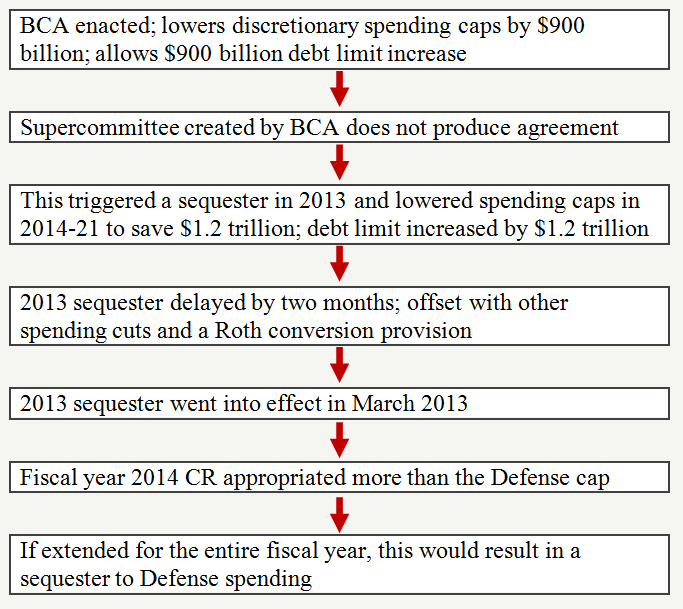

Democrats are renewing their typical calls for tax hikes, but Republicans should not agree to revenue increases that would only serve to offset hard fought spending cuts. It is important to remember that the 2013 sequester, as well as any 2014 enforcement sequester, is the result of the Budget Control Act -- it is current law. These sequesters were the way Republicans ensured that the debt limit would only be raised with corresponding dollar-for-dollar spending cuts. Replacing some sequester cuts with revenue increases would reverse this achievement -- an achievement even President Obama boasted about during the 2012 presidential campaign.

It is true that a portion of the 2013 sequester’s two-month delay was offset with a revenue provision, but this provision expanded eligibility for converting traditional retirement accounts to Roth accounts. It was not a rate increase, and the conversion (and subsequent tax liability) was entirely voluntary.

Defense spending in the CR is $20 billion higher than the revised 2014 caps, so a defense-only sequester will be triggered if the eventual legislation that funds the government for the rest of fiscal year 2014 still exceeds the defense cap. Congress can and should replace these blind sequester cuts with smarter cuts, but raising taxes to spend more enlarges government on both the spending side and the tax side of our national ledger.

The BCA Agreement

Next Article Previous Article