First Steps on USMCA

KEY TAKEAWAYS

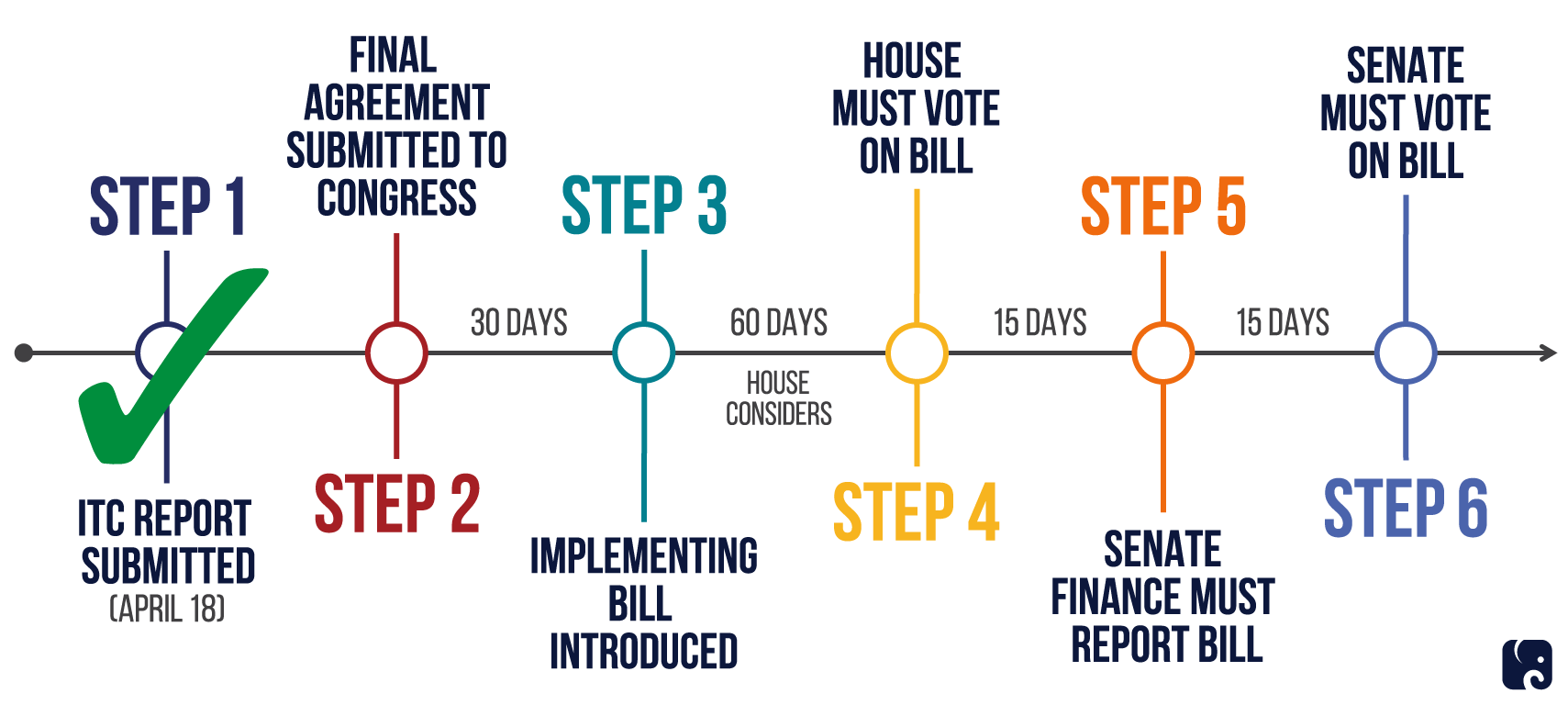

- In order to be considered under the expedited trade promotion authority process, the U.S.-Mexico-Canada Agreement must be passed by both chambers of Congress within 90 session days of the implementing bill’s introduction.

- The implementing bill has not yet been introduced, and it will not be introduced until at least 30 days after the draft statement of administrative action and final legal text of the agreement have been submitted to Congress.

- The U.S. International Trade Commission has issued its report on the likely economic impact of the trade agreement, predicting gains in U.S. exports, GDP, jobs, and wages.

Last fall, President Trump signed a new trade deal with Mexico and Canada to replace the Clinton-era North American Free Trade Agreement. Once the administration formally submits the new United States-Mexico-Canada Agreement to Congress, it can follow a process for fast-track consideration under trade promotion authority.

General Timeline of Session Days under the TPA Process

The Trade Promotion Authority Process

The likeliest process by which the USMCA would become law is through TPA, as provided by the Bipartisan Congressional Trade Priorities and Accountability Act of 2015. No amendments are possible at any point under this process. Without TPA, the USMCA would have to be passed like any other bill, subject to amendment and filibuster.

Mexico, Canada, and the United States signed the USMCA on November 30, 2018. On January 29, 2019, the administration submitted to Congress a description of changes to U.S. law that the president says would be necessary to bring the U.S. into compliance with USMCA.

There is no deadline for the administration to send Congress a draft statement of administrative action – an official description of significant steps the executive branch must take to implement the agreement – and a copy of the final legal text of the USMCA. However, that submission triggers a strict timetable that would see the bill through to a vote on final passage.

Under TPA, the administration must make that submission at least 30 days before it sends Congress an implementing bill to be introduced. It is during this period of at least 30 days that the House Ways and Means Committee and the Senate Finance Committee typically hold hearings and conduct mock mark ups to share congressional views on USMCA.

The House must pass the bill first because the implementing legislation is considered a revenue bill. The House Committee on Ways and Means must report the bill within 45 session days after it is introduced, or the bill is automatically discharged to the floor. It must be voted on within 15 session days of reaching the House floor. So, the House could take as many as 60 session days between introduction and a vote on passage. If the House does not pass the bill in that time, the bill loses access to the expedited TPA process and its protections against amendment and filibuster.

The Senate Finance Committee must report the bill no later than 15 session days after the House passes the bill. If the Finance Committee fails to report the bill, it is automatically placed on the Senate calendar for a vote. The full Senate vote must take place within 15 session days after report or discharge to the floor.

ITC Report

On April 18, the U.S. International Trade Commission released a report assessing the likely impact of USMCA on the U.S. economy and on specific industry sectors. It concluded that within six years of going into effect, USMCA will lead to the creation of 176,000 new U.S. jobs, an increase in real GDP of $68.2 billion, average wage hikes of 0.27 percent, $33.3 billion in additional exports, and $31.5 billion in additional imports.

Next Article Previous Article