FHFA Director in Charge of $5 Trillion in Mortgages

Soon the Senate will consider the nomination of Rep. Mel Watt to be director of the Federal Housing Finance Agency (FHFA). The director of the FHFA is not only a regulator, but also conservator of Fannie Mae and Freddie Mac, two extremely large, highly complex businesses.

Vast Authority, Little Oversight

Congress created the FHFA in 2008 and gave it enormous power to oversee Fannie Mae, Freddie Mac, and the Federal Home Loan Banks. In September 2008, the FHFA director used his authority to appoint the agency as conservator of the regulated entities.

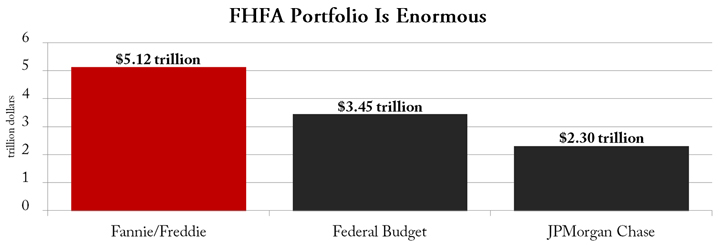

As conservator, the FHFA director operates Fannie and Freddie with all of the powers of the shareholders, the board of directors, and the officers of these companies. Combined, these companies hold more than $5 trillion in mortgages: $3.179 trillion for Fannie Mae and $1.945 trillion for Freddie Mac. In comparison, this year’s federal budget is approximately $3.455 trillion. The largest bank in the United States, JPMorgan Chase, overseen by a board of directors, has $2.3 trillion in assets – less than half of what is controlled by the FHFA director alone.

Once confirmed by the Senate, the director has nearly complete autonomy. Congress has no control over the FHFA’s budget, and neither this President nor the next could remove him during his five-year term, except “for cause.”

In addition to shaping the business operations of Fannie and Freddie, the director of the FHFA has the authority to shape housing finance reform. The acting FHFA director is developing a single securitization platform to support Fannie’s and Freddie’s existing businesses, upgrade their aging infrastructures, and attract private capital to share credit risk. FHFA also is pursuing efforts to improve the contractual and disclosure framework to support a more efficient and effective secondary mortgage market with the development of a single security. The director can take all of these steps under his existing authority.

Statute Explicit on Experience Required for FHFA Director

A political appointee in such a powerful job could allow an Administration to use Fannie’s and Freddie’s assets to mask Washington’s debt or return the businesses to their failed practices. So the statute establishing the conservator role explicitly required that the FHFA director “have a demonstrated understanding of financial management or oversight, and have a demonstrated understanding of capital markets, including mortgage securities markets and housing finance.”

Rep. Watt has pointed to his tenure on the House Financial Services Committee as experience that qualifies him to serve in this position. In that role, he said in 2011: “For all of the last term of Congress, I sat in the Financial Services Committee, and a lot of these arguments that I am hearing today are the same arguments that I heard about derivatives. Well, I didn’t know a damn thing about derivatives. I am still not sure I do.”

One commentator, a former staffer on the Senate Banking Committee during the creation of the FHFA, has suggested that Rep. Watt may not meet the statutory qualifications due to lack of expertise in financial oversight and management. Others have questioned whether his experience is sufficient to run the equivalent of a multi-trillion dollar corporation affecting such a large portion of the American economy.

Preserve and Conserve

The director of the FHFA is bound by two separate statutes to “preserve and conserve the assets and property” of Fannie and Freddie, and to “maximize assistance to homeowners.” Balancing these two mandates is not a simple matter, and Rep. Watt was unclear during his confirmation hearing on how he would do this. As a member of Congress, Rep. Watt was one of 19 House Democrats to sign a letter urging President Obama to require that the FHFA permit principal reductions in any deal resolving the fiscal cliff. He was also an original cosponsor of 2007 cramdown legislation that would force lenders to accept mortgage principal reductions in bankruptcy proceedings. He voted in favor of another cramdown bill that failed in 2009.

In considering the nomination of Mel Watt to be director of the FHFA, the Senate should consider carefully the unique magnitude of this position. While Rep. Watt has a long political career, his resume includes no experience operating a financial institution, let alone a conservatorship.

Next Article Previous Article