Federal Audits Find More Obamacare Problems

-

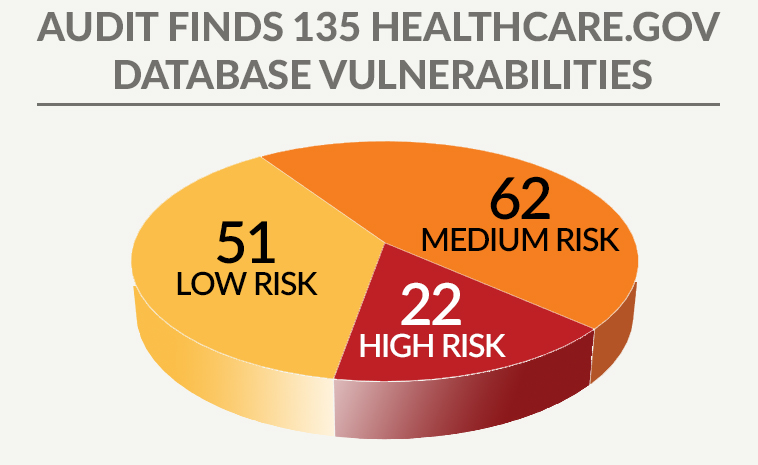

An HHS audit found millions of Obamacare users’ data on HealthCare.gov is at risk, meaning people’s personal information could be stolen.

-

A second HHS audit found HealthCare.gov contracts were poorly managed, costing taxpayers tens of millions of dollars.

-

A Treasury audit said that the IRS was unable to verify premium data for health insurers so it couldn’t adequately assess taxes.

There is more bad Obamacare news – this time from the administration’s own Department of Health and Human Services and the Department of the Treasury.

HealthCare.gov exposes millions of Americans’ data to risk

A new HHS audit found that the personal data of millions of people who used Obamacare’s HealthCare.gov website was stored on a network with high-risk cybersecurity flaws. The audit found 135 database vulnerabilities, 22 of which were classified as “high risk” and 62 of which were classified as “medium risk.” According to the report, CMS failed to perform basic vulnerability scans that might have uncovered website server weaknesses.

“‘It sounds like a gold mine for ID thieves,’ said Jeremy Gillula, staff technologist for the Electronic Frontier Foundation, a civil liberties group focused on technology.” – Associated Press, September 24, 2015

Healthcare.gov contracts were mismanaged

Another HHS audit out this month found that there was significant mismanagement of HealthCare.gov contracts by the Centers for Medicare and Medicaid Services. The audit focused on 20 contracts totaling more than $605 million that were most “critical to the development, implementation, and operation” of HealthCare.gov. The report noted that “consumers experienced significant problems accessing [HealthCare.gov], including slow response times, errors that dropped consumers out of the enrollment process, and unplanned outages that made enrollment difficult or impossible.” According to the report, CMS employees failed to comply with federal rules regarding contract oversight, did not keep required records, and allowed unauthorized staff to work on contracts that led to cost overruns of $28 million.

IRS unable to verify premium data more than half of the time

The Treasury Inspector General for Tax Administration released a report finding that the IRS was unable to verify premium data submitted last year by more than half of health plans. The purpose for verifying these premiums is to calculate Obamacare’s insurance provider tax. Section 9010 of the health care law became effective in January 2014 and imposes an annual tax on health insurance providers. The IRS was unable to obtain independent data to substantiate the premium information for 54 percent of insurers.

The report also found that 143 of 477 insurers were late in reporting their insurance provider information to the IRS. Under Obamacare, these insurers may be required to pay $10,000 for late filing, plus additional fees based on the number of days their information is late. According to the report, as of February, the IRS had not assessed late penalties yet, even though the forms were due the previous April.

Next Article Previous Article