Fall 2021 Policy Calendar

|

aa | aa |

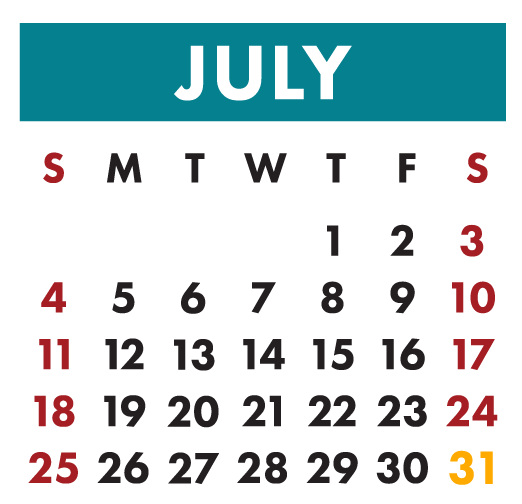

July 31 – The 2019 suspension of the debt limit expired, and the debt limit was reset at the current level of debt outstanding: $28.4 trillion. Treasury began using “extraordinary measures” to temporarily avoid passing the limit. |

|

aa | aa |

September 6 - Temporary, enhanced federal unemployment benefits expired, including the extra $300 weekly payment. September 15 – FY 2022 budget deadline for House and Senate committees to submit their recommendations for Democrats’ reckless tax and spend plan to the Budget Committees. September 27 – Deadline for House consideration of the Senate amendment to H.R. 3684, the Infrastructure Investment and Jobs Act. Expiring authorizations for traditional programs:

Expiring authorizations enacted for temporary pandemic relief:

Additional expiring authorizations:

Expiration of additional Medicaid funding and federal medical assistance percentage rate for territories |

|

aa | aa |

October 1 – First day of fiscal year 2022. Congress should have completed action on all 12 appropriations bills for the new fiscal year. October/November – CBO projects Treasury will exhaust extraordinary measures, requiring an increase or suspension of the federal debt limit. Treasury has projected extraordinary measures will be exhausted during October. |

|

aa | aa |

December 31 – Expiration of certain tax extenders, including the expansions of the Earned Income Tax Credit, Child Tax Credit, and Child and Dependent Care Tax Credit enacted in H.R. 1319, the American Rescue Plan Act.

|

Next Article Previous Article