Expanding Affordable Alternatives to Obamacare

- The Trump administration has taken several steps to increase access to more affordable health insurance options.

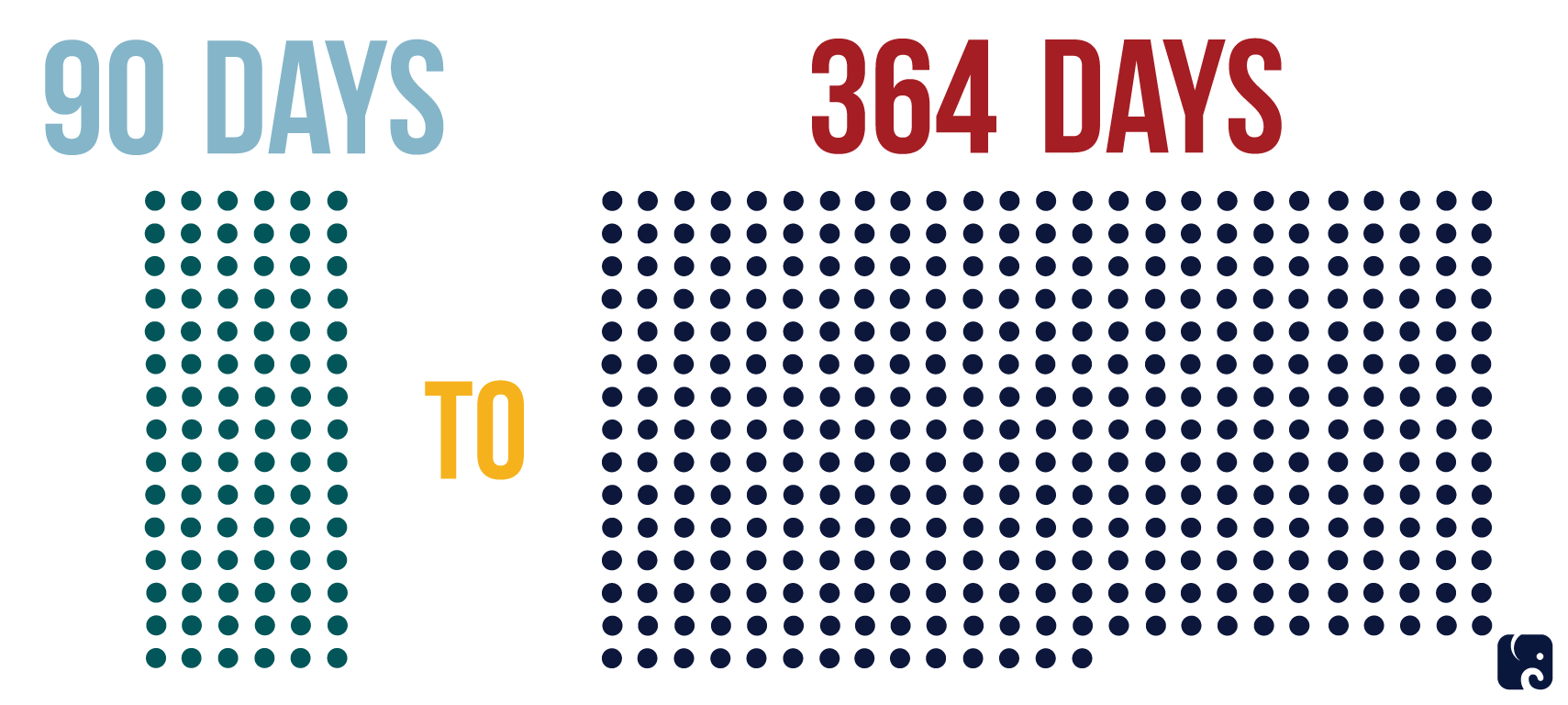

- A new proposed rule extends the maximum length of coverage for short-term limited-duration health plans, which do not have to comply with many of Obamacare’s costly rules, from 90 days to 364 days.

- Another proposed rule makes changes to association health plans to allow more small businesses and the self-employed to join together to buy insurance.

Since President Trump’s administration began, he has acted to increase options and reduce costs for health insurance. The administration has proposed two new rules that give people access to additional health insurance choices that may work better for them and their families. One proposed rule would restore access to short-term health plans that were restricted in the last months of the Obama administration. The other would make it easier for up to 11 million Americans who are self-employed or working for small business to get access to employer provided health insurance through “association health plans.”

Short-term, Limited-Duration Plans Extended

Obamacare Reduced Health care choice

Obamacare put the federal government in charge of insurance regulation in the individual and small group markets, defined what type of products insurers could sell, and mandated everyone purchase a government-approved health care plan.

Obamacare’s overregulation caused a steep decline in insurer competition and choice in the individual market. The 2018 exchange market as a whole is 54 percent less competitive than the individual market was in 2013, before Obamacare’s implementation, according to a January 25, 2018, report by the Heritage Foundation. People living in more than half of U.S. counties have an insurer monopoly on their insurance exchange. Another 30 percent of counties have only two insurers.

This lack of competition – combined with Obamacare’s burdensome regulations – caused premiums to soar. The average premium for the benchmark plan for a 27 year-old in HealthCare.gov has increased 88 percent since 2014.

The tax relief law Republicans passed in December 2017 effectively repealed Obamacare’s onerous individual mandate penalty, starting in 2019. The repeal makes Obamacare’s insurance plans a choice, not a requirement. Families still need more affordable options if they want to have health insurance.

The Trump administration has been working to improve America’s broken health care system. On October 12, 2017, President Trump signed an executive order to promote consumer choice and insurer competition. It instructed executive agencies to review regulations governing four areas: association health plans; short-term limited-duration health plans; health reimbursement arrangements; and selling insurance across state lines. The two rules that have been released so far can significantly increase consumer choice and create more affordable alternatives to Obamacare.

Short-term, limited-duration health plans

On February 20, 2018, the administration proposed a rule to expand the availability of short-term limited-duration health plans. As the name suggests, this type of health plan is generally meant to be temporary. These plans often serve as a bridge to provide people with coverage for catastrophic health issues that might arise between jobs.

Short-term limited-duration plans are not subject to the insurance regulations that apply to the Obamacare individual market. Insurers can deny coverage to applicants because of pre-existing conditions and can vary premiums based on health and other factors. The plans generally place a cap on out-of-pocket costs and include annual limits on coverage.

For nearly 20 years, regulations allowed these plans to last as long as 364 days, and they could be renewed. The Obama administration limited the duration of the plans to no more than three months and prohibited insurance companies from renewing plans beyond that.

The new Trump administration rule would change the definition of short-term plans back to coverage lasting less than 12 months. It also seeks comments on the issue of renewability.

The primary advantage is that they cost much less than Obamacare coverage. According to the Trump administration, “the average monthly premium in the fourth quarter of 2016 for a short-term, limited-duration policy was approximately $124 compared to $393 for an unsubsidized [Obamacare]-compliant plan.” Plans can also be purchased year-round, unlike individual market plans that typically can only be purchased during the annual open enrollment period.

The administration estimates 100,000 to 200,000 people will shift from an Obamacare plan to a short-term plan the first year the new rule is in effect. They do not estimate how many currently uninsured people would sign up for a short-term plan. The left-leaning Urban Institute estimates that 4.2 million would enroll in short-term plans in 2019 under these proposed rules.

The net effect on total premium tax credit costs is uncertain, but the administration estimates an extra cost of $96 million to $168 million per year. They assume the risk pools for Obamacare plans will deteriorate as healthier people move into short-term plans, leading to higher premiums for ACA plans.

State insurance commissioners and legislatures can oversee this tool to help increase lower cost options available in their states, reaffirming the traditional regulatory authority of the states for health insurance products.

These steps by the administration coincide with a move made recently by Idaho’s governor to allow plans to be sold in the Idaho market that do not comply with Obamacare’s rules, similar to the rules that short-term plans are able to avoid. Blue Cross of Idaho has already indicated it would offer these plans, and the price difference is significant. “A family of four would pay a monthly premium of $933 for the insurer's ACA-compliant Bronze 5500 plan with a deductible of $11,000. Under Blue Cross’ similar state-based plan, the average family would pay $572 per month and have a deductible of $8,000.”

Expanding access to health plans that are not burdened by all of Obamacare’s rules will give families an affordable option that could save them thousands of dollars a year.

GREATER ACCESS TO ASSOCIATION HEALTH PLANS

On January 4, 2018, the Department of Labor released a new rule that proposes changing existing regulations to allow more employers to form “association health plans.” This gives small businesses the opportunity to join together to spread the risk and administrative costs of providing health insurance across a greater number of people.

AHPs are a great vehicle to expand access to employer coverage. DOL estimates that up to 11 million Americans and their families lack employer-sponsored insurance because they work for themselves or for a small business. These Americans could gain access to the kind of insurance benefits normally seen only at larger businesses.

Broadening Association Health Plans

The rule increases access to these plans by:

- Allowing employers to band together for the purpose of providing health insurance.

- Broadening who can form and join an AHP by allowing them to be based on common geography or line of business. An AHP could cover different kinds of businesses in a state or metropolitan area, or all businesses in a particular industry could join up nationwide.

- Allowing self-employed people to join an AHP.

The rule also applies nondiscrimination rules to AHPs, including a prohibition on charging premiums or denying coverage based on health issues. This is intended to mitigate any risk selection between AHPs and the individual and small group markets.

The rule allows more AHPs to be regulated by the large group market. If the AHP has enough employees to qualify as a large group plan, it can avoid several expensive regulations that apply to the individual and small group markets. These include the essential health benefits package, participation in the risk adjustment program, the single-risk pool requirement, and premium rating rules.

Next Article Previous Article