Ending Democrats’ Drive for More Debt

As the budget conference committee seeks to produce a bipartisan budget resolution, the nonpartisan CBO has reported on options to reduce the deficit. Several of their findings would be good starting points, if Democrats can get over their insistence in raising tax rates.

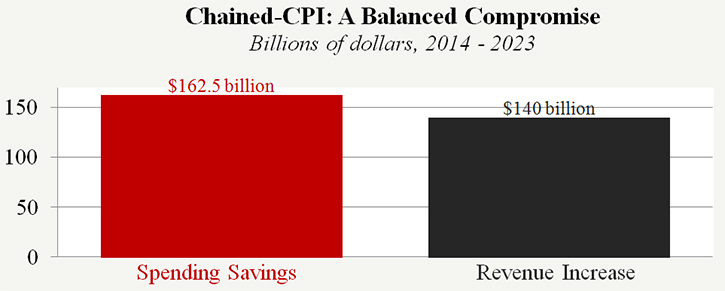

Chained-CPI

This more accurate inflation measure was included in President Obama’s fiscal year 2014 budget proposal. It accounts for the fact that people change the products they buy in response to changes in prices. This could be applied to federal benefits as well as the indexing of tax brackets.

CBO estimates that this proposal would lower deficits during the 2014-23 window by $302.5 billion. Of that, $162.5 billion in savings would be from lower spending and $140 billion would be from higher tax revenue. CBO evaluated a more traditional chained-CPI proposal; the President’s proposal was more narrow and only saved approximately $230 billion over 10 years.

Reduce the federal workforce through attrition

The Simpson-Bowles plan recommended reducing the federal workforce by 10 percent through attrition. Specifically, it recommended hiring two new federal workers for every three who leave federal service. The CBO option would hire one federal worker for every three who leave federal service, but approximately two-thirds of all federal employees would be exempt if the President chose to exempt them. Exempt agencies would likely include the departments of Defense, Homeland Security, and others.

CBO estimates savings of nearly $43 billion from 2014-23. In comparison, the Simpson-Bowles commission estimated that its recommended reductions would save $13 billion in 2015 alone.

Reform federal employee retirement

Many federal pension benefits are more generous than those available in the private sector. CBO evaluated only one change to federal employee retirement: lengthening the earnings period on which retirement benefits are based. This would lengthen the basis for benefits calculation from the three highest consecutive earning years to the five highest consecutive earning years. It estimated this would save $5.5 billion between 2015 and 2023. Again, savings would likely be higher in years beyond the window examined by CBO.

The Simpson-Bowles commission report recommended a task force to reform federal employee retirement programs, which would consider not only the above reform, but also COLA adjustments and requiring federal employees to contribute more to their retirement. Its plan was originally estimated to save $73 billion over 10 years, and updated projections later put that estimate over $90 billion.

Republicans have offered numerous responsible ways to rein in Washington’s out-of-control debt. Democrats can accept any of these during negotiations over the budget resolution, or turn to them separately at any time. But Democrats must do something about their reckless spending, and soon. Their current drive to simply pile up more debt and higher taxes is not an option.

Next Article Previous Article