Economic Costs of the Health Care Law

For the first two years of this administration, President Obama and Democrats lost focus on the economy. Instead they forced through a health care law they claimed would be good for jobs. The law never achieved the popularity Democrats promised, and Americans suffered through a bad economy and a recovery that has been the weakest ever.

In selling the law, former Speaker of the House Nancy Pelosi declared: “So this bill is not only about the health security of America, it’s about jobs. In its life it will create four million jobs – 400,000 jobs almost immediately. Jobs, again, in the health care industry but in the entrepreneurial world as well.” The former Speaker’s claim runs counter to independent analysis that says otherwise. In fact, the President’s health care law will cost 800,000 American private sector jobs.

The President’s health care law wraps businesses in bureaucratic red tape and uncertainty – the number one problem facing small businesses. Already almost 13,000 pages of regulations have come from the 2,700-page law. With unemployment remaining above eight percent for 40 straight months, the President and Washington Democrats should be doing everything possible to spur job creation. Instead, they stubbornly continue to implement and spend more money -- $2.7 billion just since the Supreme Court arguments -- on a health care law that threatens a real economic recovery, increases costs, and limits job growth.

Health Care Law Costs 800,000 Jobs

The independent Congressional Budget Office (CBO) reported that the President’s health care law will reduce the labor supply by approximately half a percent – equal to 800,000 jobs. CBO also explained that the unprecedented Medicaid expansion “will encourage some people to work fewer hours or to withdraw from the labor market.”

CBO noted the phase-out of federal subsidies to buy expensive, government approved health insurance “will effectively increase marginal tax rates, which will also discourage work.”

The health care law’s perverse economic incentives encourage Americans to work less in order to receive a generous federal subsidy to buy health insurance.

Recent jobs data support this analysis. There are more than eight million people in the U.S. who are employed part-time but want full time work. Nearly half of the jobs being created right now are part-time jobs.

Health Care Red Tape

Since the beginning of the Obama presidency, businesses large and small have been seeking certainty. The private sector cannot hire new, full time workers with so much uncertainty surrounding future healthcare costs as dictated by the President’s health care law. Many U.S. businesses have been in a holding pattern while they wait for the Supreme Court to provide direction.

Meanwhile, the economy stagnates and unemployment stays unacceptably high. Ultimately, this uncertainty falls at the President’s feet. The Supreme Court can change that. Businesses should be conducting business, not constructing costly plans to comply with burdensome federal mandates.

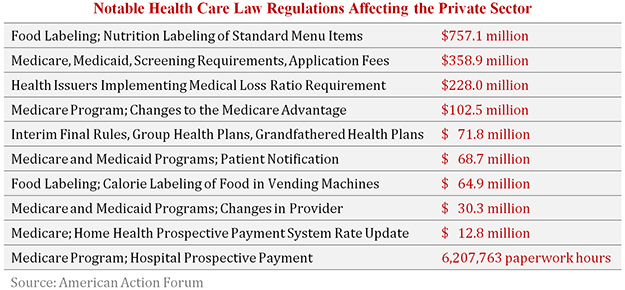

Since passage, the President’s health care law has imposed an estimated $14.9 billion in private-sector burdens, approximately $7 billion in costs to the states, and 58.9 million annual paperwork hours.

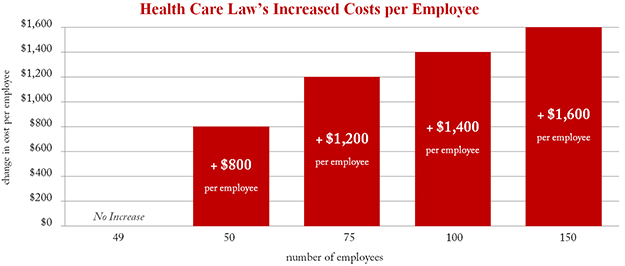

Employer Penalty Reduces Wages

The President’s health care law imposes new penalties on businesses that do not offer health insurance to their workers. Beginning in 2014, however, businesses that employ 50 or more full-time workers will be fined $2,000 per employee (after the first 30 workers) if they fail to provide government-approved health insurance to their workers. Even those companies that offer insurance will pay a $3,000 penalty for every full-time worker whose coverage is deemed unaffordable and who receives a federal subsidy to buy insurance in the exchange. Proponents insist these penalties are not a mandate because businesses are not required to offer health insurance coverage to their workers.

This labor market distortion creates a permanent disincentive against business growth.

Source: Manhattan Institute

Example:

- A small business could become subject to the employer mandate just by hiring one new employee. If a 49-employee firm that does not provide healthcare hires one more worker to raise employment to 50, it will trigger a penalty of $2,000 per worker multiplied by the entire workforce. After subtracting the first 30 workers, who are exempt, the fine would be $40,000.

This creates an incentive not to hire more full-time employees and instead use part-time workers or independent contractors.

CBO noted that the law’s new penalties on employers “will, over time, generally be passed on to workers through reductions in wages … However, firms generally cannot reduce workers’ wages below the minimum wage which will probably cause some employers to respond by hiring fewer low-wage workers.”

Independent economic analysis confirms the CBO findings.

- According to a Harvard study: “When the cost of benefits rises, wages fall (or rise more slowly than they would have otherwise), leaving workers to bear the cost of their benefits in the form of lower wages … When it is not possible to reduce wages, employers may respond in other ways: employment can be reduced for workers whose wages cannot be lowered, outsourcing and reliance on temp agencies may increase, and workers can be moved into part-time jobs where mandates do not apply.”

- Another study found that 33 percent of uninsured workers earn within $3 of the minimum wage. These low-wage workers are put at high risk of unemployment if their employers are required to offer health insurance. Workers at highest risk are more likely to be high school dropouts, minorities, and female.

The employer mandate forces businesses to choose between two bad options: limit jobs and reduce wages, or stop offering health coverage. The restaurant chain White Castle calculated the health care law’s mandates and regulations will cause health insurance costs to consume more than half of the company’s net income after 2014. As a direct result of the health care law, businesses like White Castle will struggle to keep their doors open.

Medical Device Tax Stifles Innovation and Manufacturing Jobs

With 20 different taxes, the President’s health care law threatens jobs across the spectrum. Especially hard hit is the entrepreneurial field of medical device research and development, in which the United States has long been the world leader. The U.S. medical device industry employs 422,778 workers -- 80 percent of them at businesses employing fewer than 50 workers -- who develop products such as pacemakers, artificial joints, surgical tools, and ultrasound equipment. An estimated 43,000 of those jobs could be wiped out by the health care law’s crushing $20 billion tax on medical device manufacturers.

The tax would cover all revenues, not just profits, and will roughly double the industry’s total tax bill. Medical device makers will face one of the highest effective tax rates of any industry in the world. Because the tax does not affect devices manufactured and sold abroad, businesses have a huge incentive to shift operations overseas. Innovative companies already are moving to lower-tax nations to develop and sell life-saving medical devices. Additionally, medical device businesses with facilities in the U.S. will engage in “workforce trimming” in order to sustain profit margins.

Bracing for the tax to hit next year, device companies have already started shrinking their payrolls. In November 2011, Stryker Corp. announced plans to lay off 1,000 workers because of the new tax. Covidien announced it would lay off 200 American workers – transferring those jobs to Mexico and Costa Rica.

The President and Democrats in Congress made promises they did not keep. They squandered an opportunity to focus on jobs and instead produced a health care law that is bad for patients, bad for taxpayers, and bad for the economy.

Next Article Previous Article