Dodd-Frank: Too Big to Succeed

Two years ago -- on July 21, 2010 -- President Obama signed the Dodd-Frank Wall Street Reform Act into law, calling it "common-sense reforms." The 2,300 page bill more accurately has been called the "biggest wave of new federal financial rule-making in three generations." The law and its corresponding regulations are too big to succeed.

Complex Web of Red Tape

The complexity of Dodd-Frank's regulations is staggering. Administration bureaucrats responsible for issuing the rules have been overwhelmed. Dodd-Frank has 398 rulemaking requirements, the deadlines for 221 of those rules have already passed, and only 119 have been finalized – the regulatory onslaught is just 30 percent complete.

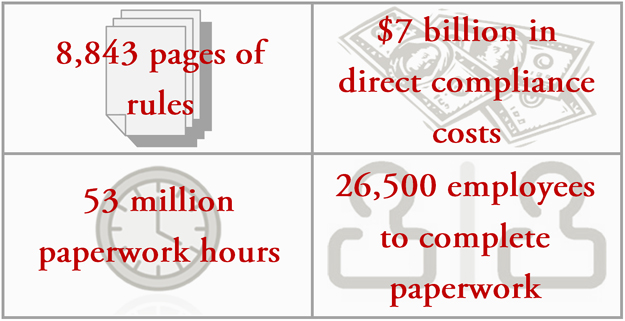

Dodd-Frank final rules the Obama Administration has written so far carry:

Source: American Action Forum

Bad for American Businesses and Jobs

The New York Times admitted that Dodd-Frank is too complex, noting: "Do we have faith that overly complex regulations will prevent the next crisis? Sad but true: they won’t."

- Doesn’t End "Too Big To Fail": The law creates a protected class of large firms that the "Financial Stability Oversight Council" would subject to enhanced regulation. Such a designation demonstrates to the market that these firms are too important to fail.

- Bigger Government: Federal agencies will add thousands more taxpayer-funded regulators to carry out the law.

- Fannie and Freddie Still Not Reformed: The bailouts of Fannie Mae and Freddie Mac, government sponsored enterprises, have cost taxpayers approximately $150 billion to date.

- Doesn’t End Bailouts: The law allows the Federal Deposit Insurance Corporation to make funds available for the liquidation of covered financial institutions.

- Increased Costs: The law places a large cost on American businesses. Just the 119 regulations that are finalized will cost American businesses $7 billion in compliance costs, and there are still another 279 regulations to come. The thicket of regulations will make the U.S. less competitive globally, and the costs of this regulatory burden will be passed on to consumers.

No Real Reform

Counting both final and proposed rules, the Dodd-Frank regulations are still only about half written. Unaccountable bureaucrats are making the rules of the road, heightening uncertainty in the economy. Financial institutions, just like any business faced with high levels of uncertainty, cannot properly fulfill their role in our economy, further stalling the weakest recovery since 1945. No President since then has failed to achieve four percent GDP growth in least one quarter of his presidency, except President Obama.

Next Article Previous Article