Democrats Target Family Farms for Death Taxes

If President Obama and Senate Democrats do not act, the federal government will begin taking more than half the value of family farm estates exceeding $1 million beginning next year. This summer, Majority Leader Harry Reid and Senate Democrats passed legislation (S.3412) on a party-line vote that allows Washington to take up to 55 percent, a huge increase over today’s top rate of 35 percent, and drop the tax’s exemption from $5.1 million to $1 million. The lower exemption -- combined with soaring farm real estate values -- could put more than 420,000 additional farm estates at risk from the death tax.

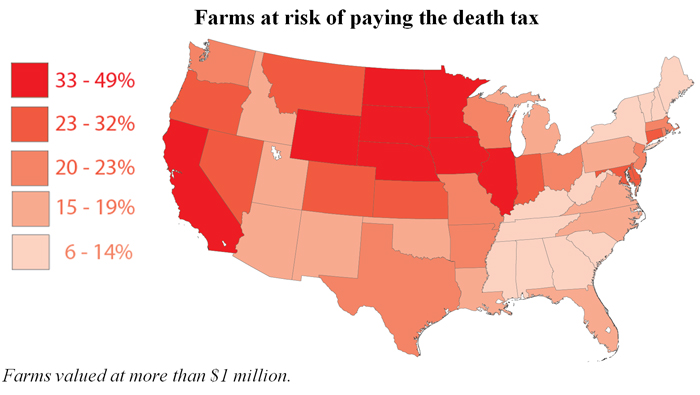

Farm values are largely tied up in non-liquid assets like land, buildings, and livestock. Many farm and ranch families would be forced to sell their assets to satisfy Washington Democrats’ insatiable appetite for tax money. Up to 24 percent of America’s farm and ranch families could be forced to hand over a large chunk of their heritage to the Internal Revenue Service when a family member dies. This would economically devastate rural communities. The President and Senate Democrats should join Republicans in rejecting this irresponsible policy.

Farm operations vulnerable to death tax beginning 2013

Data provided by the Senate Republican Conference, Senate Committee on Finance, and Senate Committee on Agriculture, Nutrition and Forestry. Analysis based on farm values reported in the USDA 2007 Census of Agriculture and adjusted to reflect present values as reported in the USDA 2012 Survey Data.

Next Article Previous Article