Democrats' Student Debt Forgiveness Favors High Earners

KEY TAKEAWAYS

- Democrats are pushing to cancel $50,000 in student debt for borrowers. This would be unfair to Americans who did not go to college, paid off their student loans, or worked during school to avoid borrowing.

- Targeted programs already exist that make student loan payments manageable for borrowers with low incomes, even forgiving debt entirely after a certain amount of time of payments.

- People with higher incomes, including doctors and lawyers who borrowed for their education, would get most of the benefits of Democrats’ plan.

Congressional Democrats are pushing for the federal government to forgive up to $50,000 in debt for every person who has borrowed money in the form of federal student loans. Under their across-the-board debt cancellation, which they want President Joe Biden to do by executive action, people with higher incomes would get far more of the benefit than people with lower incomes. Democrats’ plan would be unfair to millions of Americans who did not go to college, who paid off their loans without taxpayer help, who worked during school so they did not have to take out loans, and who take out loans after the forgiveness program.

Who holds student debt and how much?

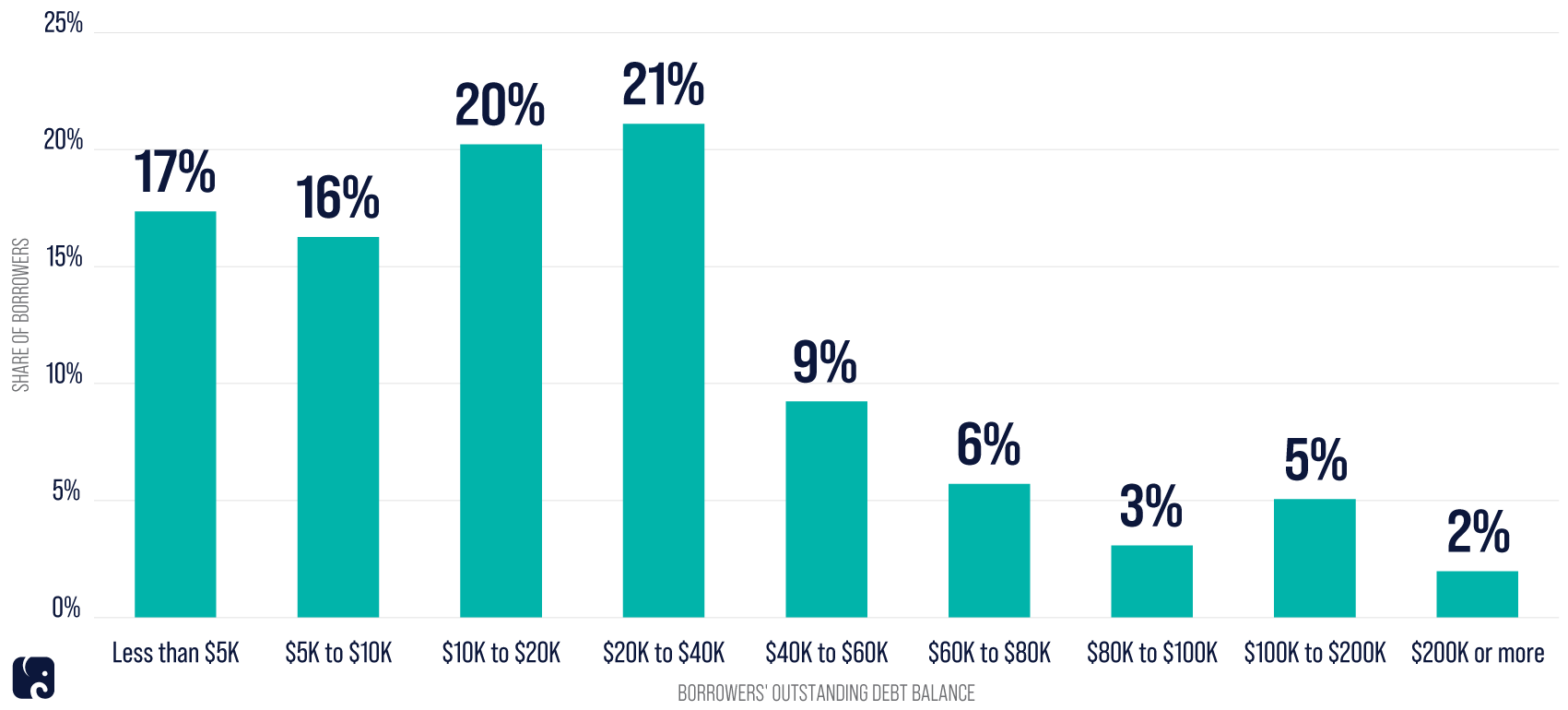

Some calls for broad student debt cancellation focus on the total amount of outstanding student debt, implying most borrowers have crushing levels of debt. Most borrowers owe more modest amounts. Within the federal student loan portfolio, which accounts for most outstanding student debt, more than 45 million student and parent borrowers have roughly $1.6 trillion in loans. Three-fourths of these borrowers, however, owe less than $40,000 and together they account for less than one-third of the debt. Only 10% of borrowers owe $80,000 or more, but they hold 45% of the total federal student loan debt.

Higher-income households have disproportionate amounts of student debt. According to an analysis by the Brookings Institution, the top 40% of households by income hold 58% of outstanding student debt, while the bottom 40% of households owe a little less than 20% of the debt. It also found that households that have graduate degrees hold 56% of the student debt, even though only 14% of people over the age of 25 have graduate degrees. Undergraduate borrowers are subject to limits on their borrowing, but grad students can borrow up to a school’s total “cost of attendance,” including tuition, housing, food, and transportation. This, and the possibility that they borrowed for their undergraduate education, helps explain why they tend to borrow larger amounts.

Just 36% of adults over the age of 25 have a bachelor’s or advance degree. This education generally brings better economic opportunities, even if it was financed with student loans. College grads are less likely to be unemployed and they tend to have higher pay and lifetime earnings, which gives them the means to pay back their loans.

Three-Fourths of Federal Student Loan Borrowers Owe Less than $40,000

existing options for struggling borrowers

Nevertheless, some people struggle to pay back their student loans. People who do not finish their degree may not get the earnings boost needed to pay down their student debt, and they may be more likely to default on their loans. This could be one reason why people who have smaller loan balances may be more likely to default on their loans than other borrowers with larger balances. For some other people, they may have borrowed heavily for an expensive degree program that did not lead to a job with higher pay.

Instead of granting blanket forgiveness for borrowers, over the years Congress and the president have created several income-driven repayment plans to help low-income borrowers manage their student loan payments. In general, these IDR plans limit payments to 10% or 15% of a person’s income above 150% of the federal poverty level. A single person earning $35,000 a year who has $30,000 in debt and a 4% interest rate could pay $131 per month under IDR, instead of $304 under a fixed-payment, 10-year plan. After a borrower make payments for 20 or 25 years, depending on the plan, the federal government forgives any remaining loan balance. Public service workers repaying in an IDR plan can get forgiveness after 10 years of payments. The share of borrowers participating in the repayment plans has jumped in recent years, especially among grad students, who tend to have higher loan balances. The Congressional Budget Office estimated last February that grad student borrowers will have a larger share of their loans forgiven under IDR than undergraduate borrowers.

In March 2020, due to the pandemic, Congress and President Donald Trump suspended loan payments, interest accrual, and collections on defaulted loans that the Education Department owns. This policy is set to last through September. It applies regardless of whether the borrower actually experienced any financial difficulties because of the pandemic-related economic shutdowns, though borrowers may continue making payments. Last month, the department extended the policy to include people who have defaulted on privately held Federal Family Education Loan program loans. One analysis found that just 7% of federal student loan dollars were in repayment in the third quarter of 2020, down from 59% in the first quarter. The Democrats’ partisan $2 trillion “coronavirus relief” law included a provision that makes forgiven student loan debt tax-free through 2025. Senator Elizabeth Warren said this “clears the way” for the president to forgive student debt.

In recent years, lawmakers and policy experts have offered proposals to improve the federal loan repayment system, strengthen accountability in higher education, and other ideas to help borrowers. In December 2019, Congress passed legislation that included provisions to simplify the application and income verification process for borrowers in IDR plans. Instead of pushing a costly, unfair debt cancellation policy, Democrats could work with Republicans on bipartisan solutions.

Broad Student Debt Forgiveness Benefits High Earners

blanket loan forgiveness benefits higher earners

Researchers at the University of Chicago found that broad student loan forgiveness would give substantial benefits to higher-income people, more than the benefits to lower-income people. They determined the present value gains from loan forgiveness by estimating repayment and forgiveness under current law, including the assumption that taxation of forgiven amounts is ended. They found that if the federal government forgave $50,000 per borrower, the bottom 20% of earners would get 8.5% of the benefit. The top 20% of earners would get 22% of the total debt wiped out. Democrats would give the benefits to these higher-income people, including those now working as doctors and lawyers, regardless of whether they needed help or not. Analyses of other loan forgiveness proposals from Democrats in recent years reached similar conclusions.

Some experts also have observed that broad student loan cancellation would be a weak economic stimulus. Another criticism is that such a large taxpayer-funded bailout would far outstrip federal spending on programs that have been carefully directed at helping Americans with lower incomes, such as Pell Grants and Temporary Assistance for Needy Families.

Legal Uncertainty

On January 12, the Department of Education Office of the General Counsel issued a memo concluding that the secretary of education lacks legal authority under the Higher Education Act to forgive student loans on a mass or blanket basis or to “materially” change loan repayment amounts or terms. Senator Warren and other Democrats have argued the opposite, citing a memo issued last year by the Legal Services Center of Harvard Law School. Recently, President Biden ordered the department to review its conclusion from January.

If the Biden administration did cancel student loan debt on its own, it is not clear who would have standing to challenge the action legally. Standing generally requires an actual, specific injury, and the harms of mass cancellation would be broad. A policy that is generally bad or wasteful does not confer standing on individual taxpayers.

In this scenario, a possible plaintiff with standing might be a loan servicer that lost profits because of the cancellation. Also, under existing precedent, one chamber of Congress might be able to authorize a lawsuit that would have standing, but individual lawmakers probably could not.

Next Article Previous Article