Democrats' Plan to Erode Employer-Sponsored Coverage

KEY TAKEAWAYS

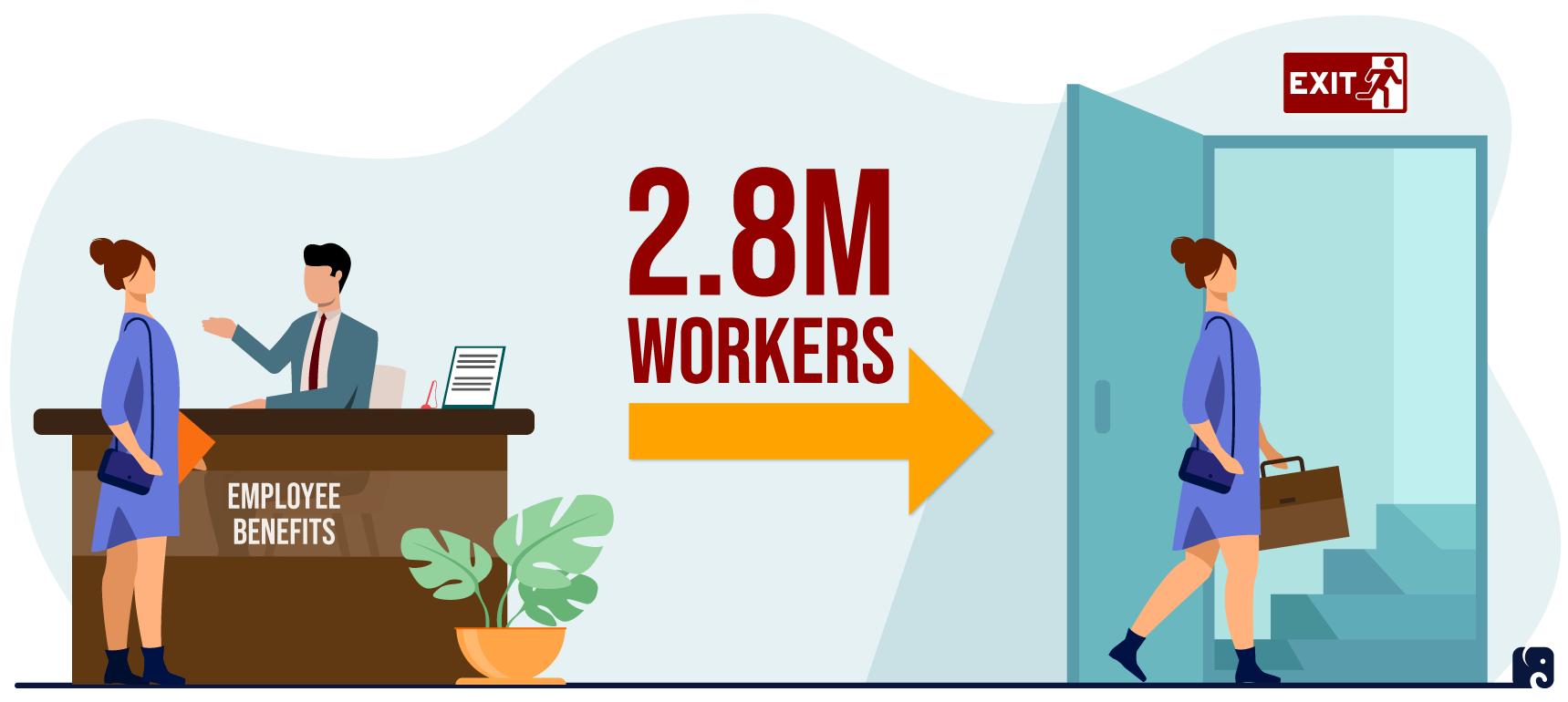

- Democrats’ reckless tax and spending spree would erode employer-sponsored health coverage by expanding Obamacare subsidies and making them permanent.

- The changes would discourage businesses from offering health benefits to their workers.

- Their plan would shift 2.8 million workers out of employer-sponsored coverage, according to the Congressional Budget Office.

Democrats’ reckless tax and spending spree includes provisions that would shift more people away from getting insurance through their jobs and push them into the Obamacare marketplace.

Pushing Workers Out of Employer-Based Coverage

Threat to Employer-Sponsored coverage

Democrats are pushing for several changes that would end up raising costs for employers and making government-subsidized coverage more attractive. The Congressional Budget Office predicts that the changes would shift 2.8 million workers out of employer-sponsored coverage by 2031. They would also increase the deficit by $231 billion over the 10-year budget window, even if they all expired on the artificially short timelines Democrats included in their bill. If the provisions continued, as Democrats obviously expect, the costs would be much higher.

When Obamacare was being written, it included a “firewall” to protect people with job-based insurance from being forced onto Obamacare. The firewall makes workers who have an offer of affordable coverage from their employer ineligible for Obamacare subsidies, protecting their job-based coverage. Currently, workers who would have to pay more than 9.61% of their household income on health insurance through their job could switch to an Obamacare plan and potentially get a government subsidy. Democrats are trying to lower that threshold to 8.5% of income. This would begin in 2022 and run through 2025, creating an artificial and costly cliff. CBO expects that this will push some workers out of their job-based insurance and into Obamacare.

The reckless tax and spending spree would also extend the enhanced premium subsidies for coverage purchased through Obamacare marketplaces through 2025. These subsidies were expanded in the American Rescue Plan Act through 2022. Under this policy, people who already get a subsidy in the exchanges get a bigger one or have their premium fully covered; and people who previously earned too much money to get a subsidy now get one. CBO expects some companies, especially small businesses that are exempt from Obamacare’s employer-coverage mandate, to stop offering insurance as a result, since more of their workers would be eligible for government-subsidized Obamacare coverage. With the expanded subsidies being so large, it would make little financial sense for a small business to continue offering health insurance as the federal government would be paying a share of the premium instead. Originally, CBO did not “anticipate that many employers would change their decision to offer health insurance given the temporary nature of the enhanced subsidy.” Businesses that stopped their insurance plans may have to restart them when the program ended. Making the subsidies permanent would give employers the incentive to stop offering the benefit. In other words, if you like your plan, you may not be able to keep it.

Taken together, businesses worry these and other provisions could drive younger and healthier workers to leave their employer-sponsored plans to get subsidized Obamacare coverage. The remaining older and less healthy workers would have to pay more.

Rather than focus on providing people with more health insurance options, Democrats are working to ensure employers who want to offer coverage have less incentive and ability to do so. Their plans also include adding services to the financially unstable Medicare program and drug-price controls that would threaten medical innovation and future cures.

Next Article Previous Article