Democrats Increased Student Loan Rates To Pay for Healthcare Law

Over the past three years, student loan borrowers benefited from a temporary interest rate reduction on their subsidized student loans. Unless taxpayers pay for a rate extension, the reduced rates will expire in July.

As Congress works on a solution, it’s important to remember that the White House and Democrats in Congress took over the student loan industry in order to fund part of the President’s expensive health care law. Once again, it’s clear that the President’s law was drafted quickly and without any consideration of economic consequences.

Republicans are committed to extending the interest rate reduction for another year and also making it cheaper and easier for the private sector to create jobs for young Americans.

Under President Obama’s leadership:

- College costs are increasing faster than the cost of living

- 65 percent of students who got a bachelor’s degree in 2010 graduated in debt

- More than half of recent graduates are either unemployed or underemployed.

Despite a recent college tour and more empty promises, the Obama economy offers little hope to young Americans soon entering the workforce.

Federal Student Loans Program

The Direct Loan (DL) program is the primary federal student loan program and is administered by the U.S. Department of Education. Until July 2010, there was also the Federal Family Education Loan (FFEL) program, which allowed private lenders to use their own capital to offer student loans. The federal government provided a guarantee against financial loss on those loans and a special allowance payment (SAP) that ensured the lenders received a fair return on their loans. Democrats eliminated the FFEL program as part of the Health Care and Education Reconciliation Act of 2010, using $8.7 billion of “savings” generated by the government takeover of student loans to help pay for the president’s health care law.

Both loan programs offered subsidized and unsubsidized Stafford Loans for college students. The subsidized Stafford Loans are based on financial need. As of 2011, subsidized loans are only available to undergraduate students. Unsubsidized Stafford Loans, on the other hand, are not based on need and are available to both undergraduate and graduate students.

The Higher Education Act (HEA) of 1965 established the maximum interest rate that can be charged for student loans. Subsidized and unsubsidized Stafford Loans that were disbursed between October 1, 1992, and June 30, 2006, all have an annually adjusted variable interest rate that is capped at either nine percent or 8.25 percent, depending on the year of the loan. A 2001 law established that beginning in 2006, the subsidized and unsubsidized Stafford Loan interest rate would switch from being a variable rate to being fixed at 6.8 percent. FFEL program lenders would often use the SAP to originate student loans at a lower interest rate than the one established by law. However, now that all loans are originated through the federally financed and administered DL program, all students pay the interest rate set by statute.

Democrats were not satisfied with a fixed 6.8 percent interest rate, so in their 2006 campaign platform, they promised to cut interest rates in half -- to 3.4 percent for students and 4.25 percent for parents. In trying to implement the campaign promise, Democrats realized a permanent interest rate reduction would be too costly. They engineered a temporary reduction for only the subsidized Stafford Loans, implemented over a four-year period before reverting to the 6.8 percent. Only undergraduate students with a loan disbursement during the 2011-2012 school year received a 3.4 percent interest rate. Loans disbursed in 2008-2009 were at six percent interest, 2009-2010 loans were 5.6 percent, and 2010-2011 loans were 4.5 percent.

The Congressional Budget Office (CBO) estimates that extending the 3.4 percent interest rate on new subsidized Stafford Loans for a second year (2012-2013) will cost about $6 billion. The interest rate reduction will not apply to unsubsidized loans or to loans that have already been made.

Calculating the Interest Rate

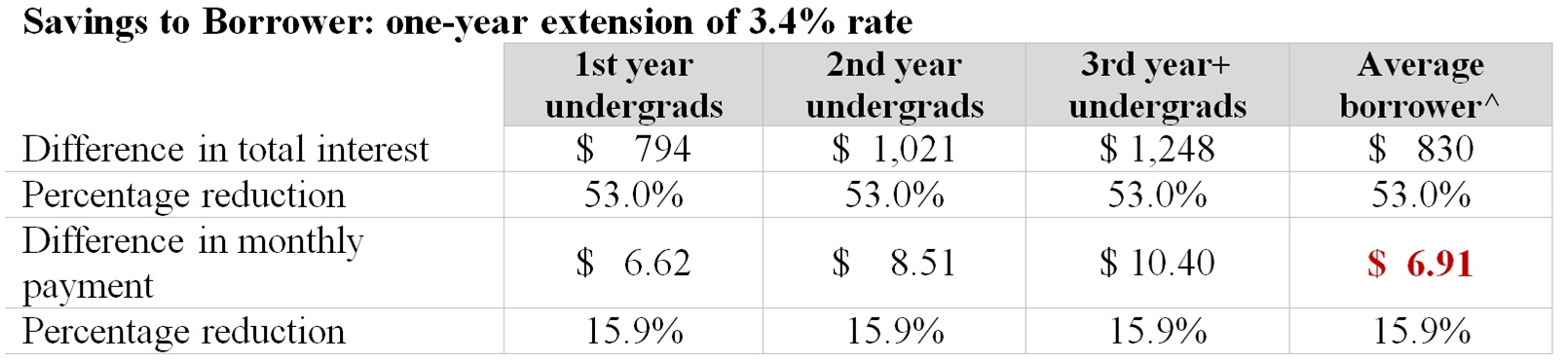

The average student borrows $3,658 per year to pay for college tuition. If the 3.4 percent interest rate on new subsidized Stafford Loans is extended for one year, the average borrower will save $6.91 a month when loan repayment begins -- approximately $83 per year or $830 for the standard 10-year loan repayment plan.

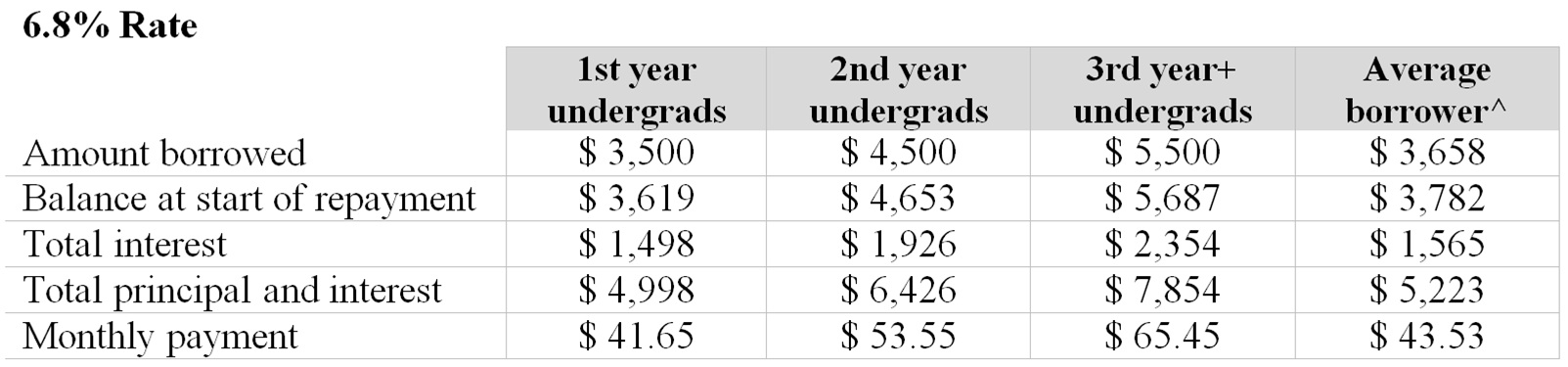

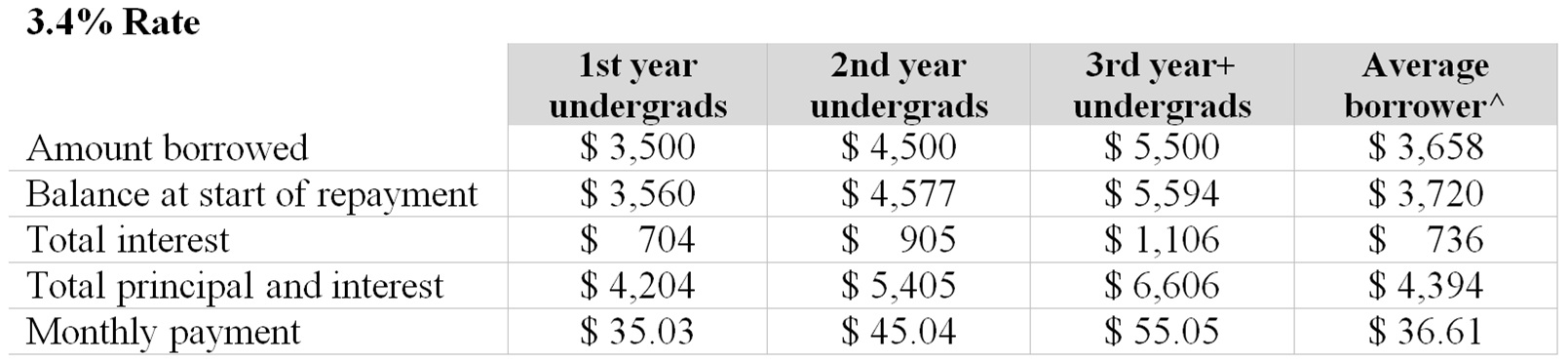

The Congressional Research Service compared a 6.8 percent interest rate and a 3.4 percent interest rate for students who borrow the maximum amount allowed for each academic year, as well as for the average undergraduate borrower.

Estimates of the impact of an interest rate increase on borrowers’ monthly payments do not take into consideration any tax deductions. The vast majority of recent graduates make less than $49,000 a year – 75 percent of them in 2008. Their wages fall well below the limit to qualify for a tax deduction for as much as $2,500 of their interest payments; and there is evidence that working graduates are taking this deduction. However, the borrowers have to make the loan payments initially, as well as remember to claim the deduction come tax time.

Subsidized Stafford Loan Interest Rate Analysis (academic year 2012-2013)

^Figures for average Subsidized Stafford Loan to undergraduate borrowers for AY2010-2011 from the College Board, 2011 Trends in Student Aid, Table 6A.

Democrats’ Plan: Tax Hike on Small Businesses

Senator Reid introduced the Stop the Student Loan Interest Rate Hike of 2012 (S. 2343) to extend the current 3.4 percent student loan interest rate. To pay for the interest rate reduction, Democrats proposed increasing taxes on S-Corporations. S-Corporations are businesses that pay their taxes through the owner’s individual tax returns.

The bill raises taxes on S-Corporations by requiring the IRS to implement a new policy that would change how S-Corporations’ income is classified. Currently, business income from an S-Corporation is passed onto its shareholders, and the shareholders pay tax on this income. The Democratic bill would reclassify much of this business income as a salary for the owners, and would require them to pay payroll taxes on this newly-reclassified income.

The Democrats’ bill then raids these increased Medicare taxes in order to pay for the student loan provision. This week the Medicare trustee report, approved by multiple members of the Obama Administration, verified that Medicare is financially unsustainable. This underscores the fact that now is not the time to use tax revenue for Medicare to offset more spending. Additionally, this would raise taxes on job creators at the worst possible time. The economy grew by 1.7 percent last year, and new taxes will further stifle job creation and economic growth. S-Corporations account for nearly four out of 10 small businesses with employees. S-Corporations also operate in critical areas of the economy, including manufacturing, retail, mining, transportation, and construction.

The U.S. economy is struggling. A one-year interest rate reduction could help next year’s college graduates. But, a permanent tax increase on four out of 10 small businesses -- who could otherwise be hiring these graduates -- is not the answer.

Republican Plan: Do Away With Another Washington “Slush” Fund

Instead of taxing job creators, Senator Alexander and 13 other Republicans introduced S. 2366, which would eliminate the controversial Prevention and Public Health Fund (PPHF) to pay for extending the interest rate reduction for one year.

The president’s health care law set aside $15 billion over its first 10 years to fund the PPHF “slush” fund. PPHF provides the Secretary of Health and Human Services unlimited authority to expend funds well above congressionally appropriated spending levels. The statute’s intent, however, is clear. The PPHF was designed to fund innovative prevention and wellness strategies, not to be used as a slush fund when the Administration wants extra dollars to finance existing government programs.

President Obama and Washington Democrats are already on record supporting cuts to the PPHF. In September 2011, President Obama recommended stripping $3.5 billion from the fund to reduce the federal deficit. Then in February 2012, the President submitted his fiscal year 2013 budget request to Congress, proposing to cut the PPHF by $4 billion. On February 17, 2012, Congress enacted the Middle Class Tax Relief and Job Creation Act. The President signed this legislation, which reduced the PPHF by $5 billion.

For the first time in more than a decade, 1.5 million or 53.6 percent of recent graduates spent the last year jobless or underemployed. Keeping interest rates low for another year while not saddling future generations with a growing national debt and higher taxes is a common sense approach.

Next Article Previous Article