Deficit Spending is a Sugar High

- Two ways to pay for government “investment” are by reducing other spending or by borrowing.

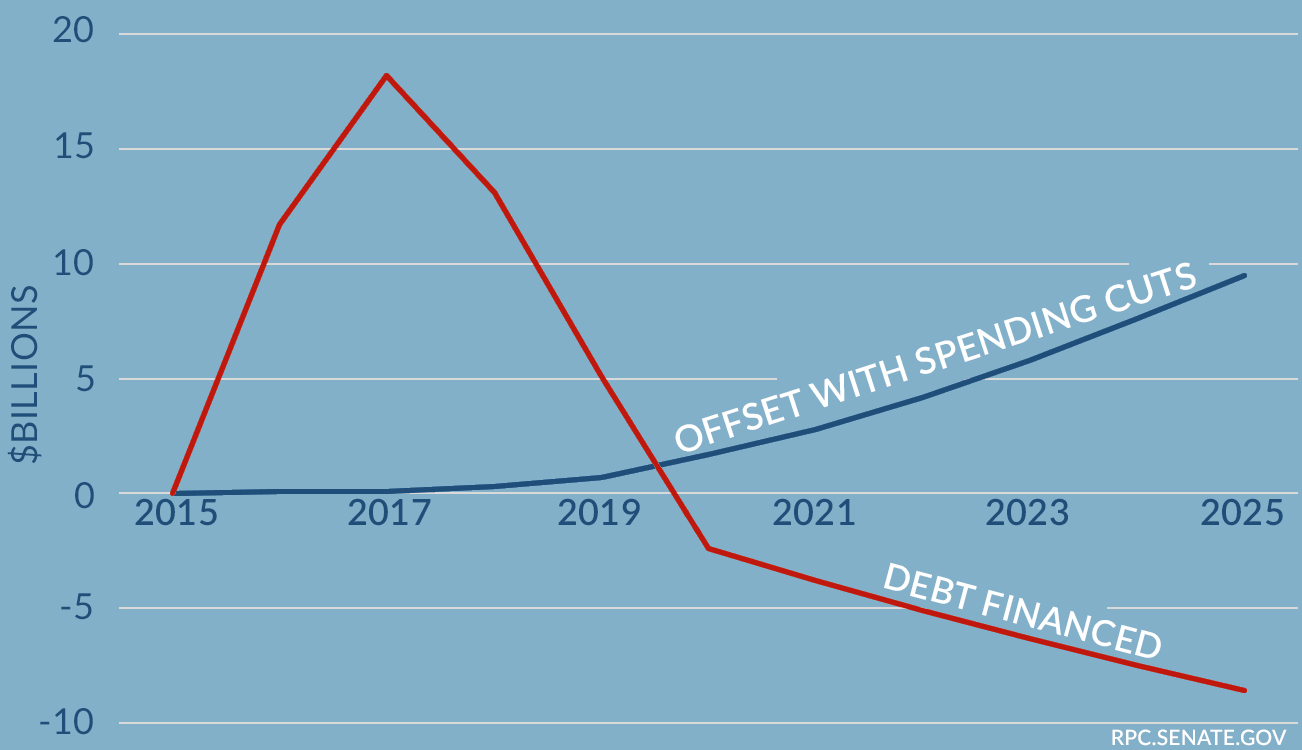

- Deficit-financed federal investment expands the economy at first, but then shrinks the economy in later years.

- The best option for financing federal investment is to cut spending elsewhere.

Last month CBO issued a report analyzing the effects of federal investment spending on the economy. It concluded that deficit-financed investment by Washington expands the economy at first, but then shrinks the economy in later years – like a sugar high for the economy.

The crash comes later: debt-financed spending is only a sugar-high

GDP effect of $50 billion per year increase in federal investment

What is Federal Investment?

CBO defines federal investment as spending that is “expected to increase private-sector productivity.” CBO considers things like infrastructure spending, education, training, research, and development to be “investment.” Things like health care spending or hiring more federal workers are not. Under this thinking, the federal government spent $293 billion on non-defense investment in fiscal year 2015. Because the vast majority of defense spending does not increase private-sector productivity, CBO does not consider the effects of this spending.

Government has HAlf the Impact of the Private Sector

CBO estimates that the rate of return on federal investment is 5 percent – for every $1 of federal investment funding, economic output is increased by five cents. The private sector has double the impact, increasing economic output by 10 cents for every $1 of private investment. Importantly, for every $1 increase in investment by the federal government, state and local governments decrease investment by 33 cents.

Why does federal investment spending have less impact than private spending? Because the private sector uses free markets and the price system to efficiently allocate resources across the economy. Federal spending is not determined by these forces, and so it allocates resources less efficiently. For example, the federal government requires higher wages for certain construction projects under the Davis-Bacon Act.

Debt-Financed Investment is Followed by a Crash

Increasing federal investment may seem like a good idea, but how it’s paid for matters. CBO says that increasing federal investment by cutting other, non-investment federal spending increases productivity. In turn, this increases economic growth and cuts the deficit in future years. This is a slow and steady way to manage federal investment policy. It increases the size of the economy in the long run, as the private sector builds on gains from a new road or new research.

In contrast, it does not make sense for Washington to borrow money to invest. Policy makers like this option because the economy does expand in the short term, but that gain is illusory. Over time, two effects work against each other. The productivity gains from the federal investment increase economic growth. Meanwhile, the lost private-sector investment that did not happen because the money instead was loaned to the Treasury tends to decrease economic growth.

In the initial years, the increase in demand from the federal investment will increase the size of the economy. In the long term, this initial economic jolt is gone, and the economy feels the pain of not having the higher-return private sector investment that would have occurred. CBO calculates that a debt-financed investment increase of $50 billion per year only leads to a $14 billion expansion in the economy over 10 years. The same investment increase paid for by other spending cuts would lead to a $33 billion increase in the economy.

Next Article Previous Article