Debt Limit is Back, Time for Reforms

- The debt limit comes back into effect on March 16.

- The Treasury Department can delay the deadline for action until sometime in the fall.

- Republicans have a rare opportunity to enact budget reform that will change the trajectory of Washington’s future spending.

The debt limit will come back into effect on March 16. It has been suspended since November 2, 2015, when the Bipartisan Budget Act of 2015 was enacted. Under the terms of that law, the new debt limit will be the level of debt outstanding on March 16, which is currently $19.9 trillion.

A Time For Action

Under President Obama, the national debt increased by $9.3 trillion – more than $1 trillion per year. Republicans tried over and over to get President Obama to come to the table and craft a grand bargain that would bring down the debt’s trajectory. The president wasted eight years with no structural reforms to the largest drivers of our national debt.

Now, with a Republican president and Republican Congress, the time is ripe for reform that strengthens mandatory programs so that they will not suffer huge, arbitrary cuts when their trust funds run dry. Congress has time to formulate solutions, since the true deadline for action will not hit until sometime this fall.

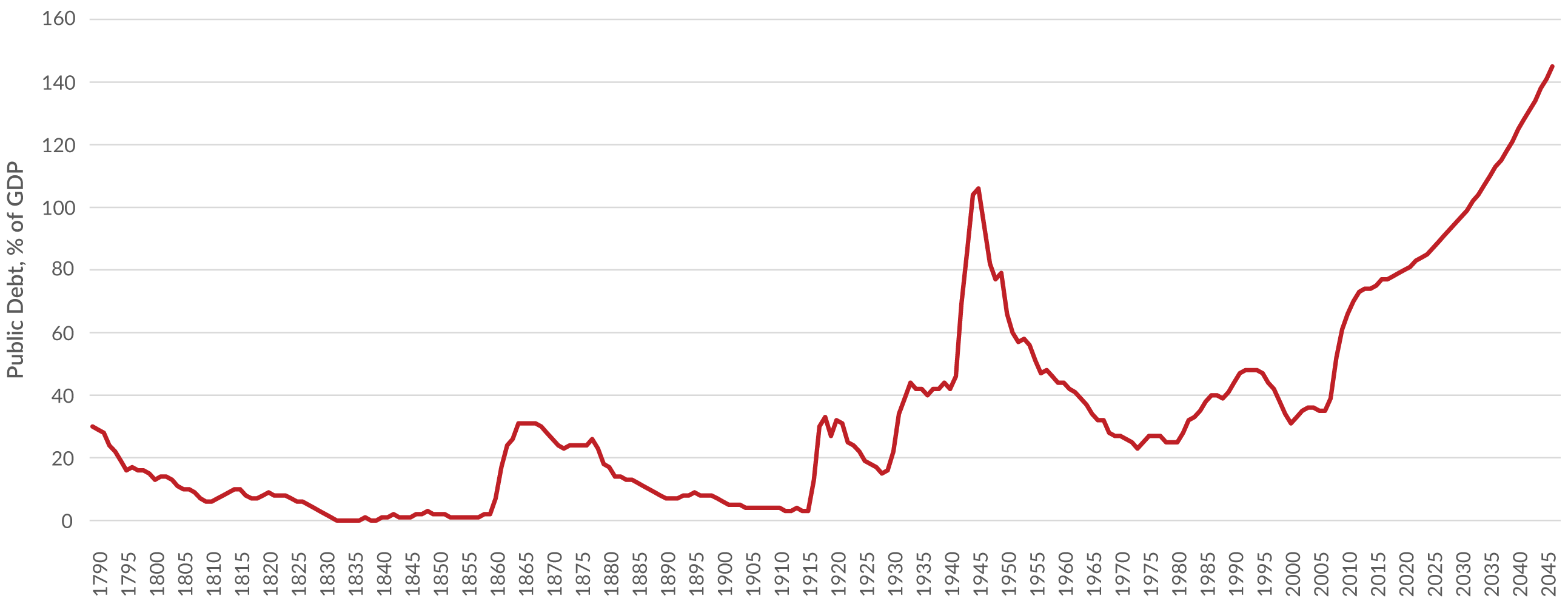

NATIONAL DEBT SOON WILL BREAK ALL RECORDS

Source: CBO Long-Term Budget Outlook and January Budget and Economic Outlook

Source: CBO Long-Term Budget Outlook and January Budget and Economic Outlook

Solutions Get More Expensive The Longer We Wait

Washington’s debt is set to skyrocket in future decades. In our nation’s history, debt spikes generally have been precipitated by some sort of crisis, such as wars of existential proportions. The coming debt problem has no such cause, just a failure to act while deficits pile up and America’s social safety net programs get closer to bankruptcy.

Last summer, CBO projected that if we wanted to keep the amount of debt held by the public in 2046 to the same level it’s at today, we would have to close a budget gap of 1.7 percent of GDP. This would mean raising revenues by 9 percent every year from now until 2046, or cutting spending by 8 percent every year. That would mean savings of $330 billion every year, starting now.

For every year Congress waits to address this problem, the solution gets more expensive. If Congress waits until 2022 instead, the gap we need to close every year will total 2.1 percent of GDP, or $445 billion (in 2016 dollars). If we wait until 2027, the gap will be 2.7 percent of GDP per year, or $630 billion. Delaying these inevitable decisions is like ignoring your car’s check engine light and not taking it to the shop until the transmission falls out. Ignoring the problem just makes it more expensive.

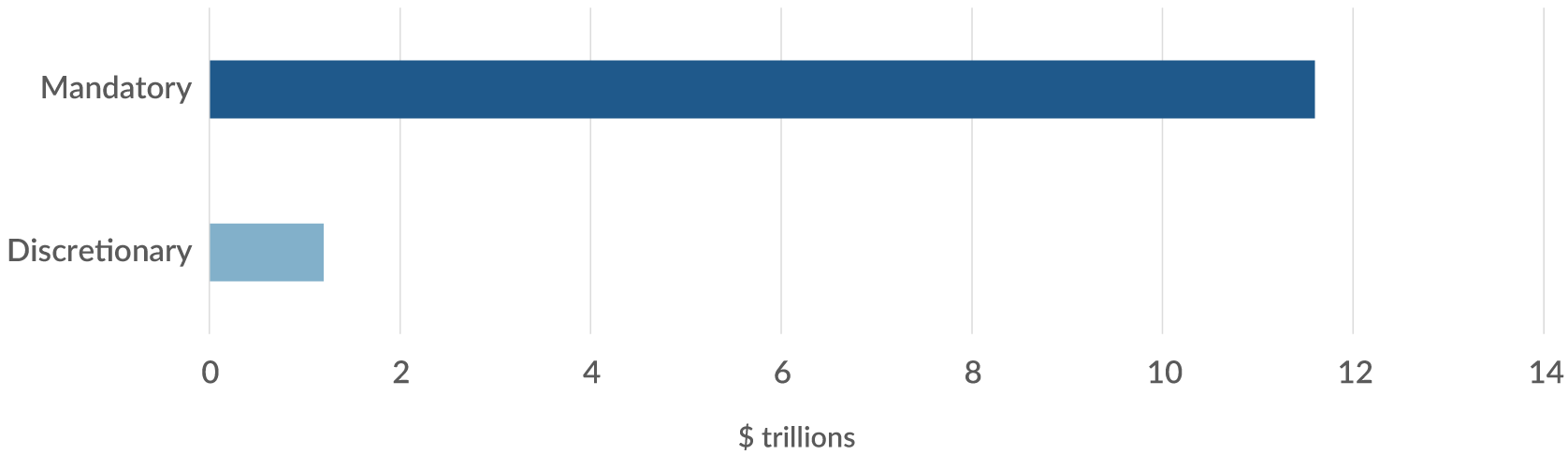

mANDATORY sPENDING dRIVES THE dEBT

According to CBO’s Budget and Economic Outlook issued in January, trillion dollar deficits will return in just six years. This projection actually assumes sustained revenue levels that we haven’t seen since the late 1990s tech boom.

TOTAL SPENDING GROWTH, 2018-2027

Spending is the problem, and mandatory spending is the driver of Washington’s debt. Congress will need to tackle the real source of spending if we are to have any hope of protecting future generations from out-of-control debt.

Next Article Previous Article