CFPB Rule: A Gift to Trial Lawyers

- The Consumer Financial Protection Bureau rule banning arbitration between consumers and businesses goes into effect this week over the objections of the White House.

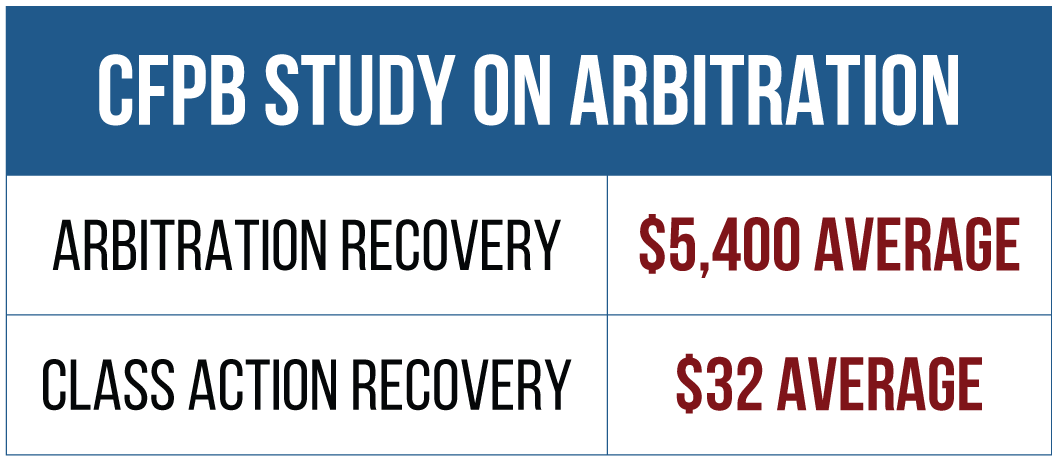

- Under arbitration, disputes take an average of five months and consumers get an average of nearly $5,400. Class action lawsuits take an average of about 23 months and consumers collect an average of just $32.

- The House has already passed Congressional Review Act legislation overturning the rule.

In July, the Consumer Financial Protection Bureau finalized a controversial rule that would ban certain financial contracts from including arbitration agreements that prevent consumers from filing or participating in class action lawsuits. For decades, millions of contracts have relied on arbitration provisions, including agreements for credit cards, checking accounts, cell phones, and cable television. On July 25, the House passed H.J. Res. 111, which uses the Congressional Review Act to overturn this controversial rule. Senate action is expected.

The Trump administration issued a Statement of Administration Policy noting that it “strongly supports House passage of H.J. Res. 111.” The White House added: “if allowed to take effect, the CFPB’s harmful rule would benefit trial lawyers by increasing frivolous class-action lawsuits; harm consumers by denying them the full benefits and efficiencies of arbitration; and hurt financial institutions by increasing litigation expenses and compliance costs (particularly for community and mid-sized institutions). In many cases, these increased costs would be borne, not by the financial institutions, but by their consumers.”

Section 1028 of the Dodd-Frank Act required the CFPB to conduct a study of the use of arbitration agreements in the consumer financial markets. Based on the results of the study, the bureau may prohibit or impose conditions or limits on the use of arbitration agreements. The CFPB issued its final arbitration study on March 10, 2015.

In addition to banning arbitration agreements, the CFPB rule requires covered businesses that use pre-dispute arbitration agreements to submit to the CFPB certain records from court and arbitration proceedings. The bureau will publish these on its website in some form and use them to “determine whether there are developments that raise consumer protection concerns that may warrant further Bureau action.” These include initial claims and counterclaims, answers to the claims and counterclaims, and arbitration awards. The rule took effect on September 18, with a compliance date of March 19, 2018.

Widespread Concerns

Opposition to the rule has been widespread, with many noting that CFPB’s prohibition is likely to harm the very consumers it purports to help, and it will benefit mostly trial lawyers.

Another criticism has been that the accumulated data and the findings of the CFPB study provide no foundation for imposing new restrictions on arbitration agreements. The Dodd-Frank Act requires that any rule restricting arbitration must be in the “public interest and for the protection of consumers.” It also must be consistent with the study’s findings.

In testimony before the House Financial Services Committee, Don Hong of the Consumer Bankers Association noted that “while the Bureau’s study is the most extensive one ever conducted on arbitration, it remains incomplete and fails to prove that restricting arbitration is ‘in the public interest and for the protection of consumers.’” Hong noted that the vast majority of consumer disputes are resolved through internal company processes, such as a simple conversation with a bank’s customer service representative.

A review of the CFPB study by the Mercatus Center found that it failed “to support any conclusion that arbitration clauses in consumer credit contracts reduce consumer welfare or that encouraging more class action litigation would be beneficial to consumers and the economy.”

The Wall Street Journal noted in a July 12 editorial that the CFPB study “is more political than scientific. Like the agency’s enforcement actions, the study engages in misdirection and obfuscation. The bureau avoids apples-to-apples comparisons and has stonewalled requests by the House Financial Services Committee for its raw data. But the evidence still suggests that consumers derive greater benefits from arbitration than they do from class-action lawsuits. Of the 562 class actions the CFPB studied, none went to trial. Most were dismissed by a judge, withdrawn by the plaintiffs or settled.”

The CFPB rule benefits trial lawyers instead of consumers. According to the bureau’s study, consumers recover an average of $5,389 when using arbitration, compared to $32 when a consumer participates in a class action suit. Opponents of the rule argue that one reason for this disparity is the fee class action attorneys take from their clients. The study noted attorneys take an average of 21 percent of the cash award, and some take as much as 63 percent. Class action attorneys earned $424,945,451 during the period studied. More than 60 percent of class actions resulted in no relief for class members, as the cases were either settled individually or withdrawn by the plaintiff. Only 12 percent of class actions even obtained a final class settlement.

The study also showed that arbitration is faster than class action suits. Disputes in arbitration that were resolved on the merits were, on average, resolved in approximately five months, while class action lawsuits averaged about 23 months for completion – and some more than two years. Arbitration can also be cheaper, with consumer costs capped at a $200 filing fee. Businesses are responsible for the remainder of the costs in arbitration. For many consumers, pursuing litigation is complicated, time-consuming, and requires a lawyer to navigate the process. Many claims may be too small to attract an attorney.

According to a recent letter by the acting comptroller of the currency: “arbitration can be an effective alternative dispute resolution mechanism that can provide better outcomes for consumers and financial service providers without the high costs associated with litigation. As some have noted, the CFPB’s proposal may effectively end the use of arbitration in cases related to consumer financial products and services. Eliminating the use of this tool could result in less effective consumer protection and remedies, while simply enriching class-action lawyers. At the same time, the proposal may potentially decrease the products and services offered to consumers, while increasing their costs.”

Next Article Previous Article