CBO Warns Again on Debt, Democrats Silent

This week the Congressional Budget Office (CBO) released its annual report on the nation’s long-term fiscal outlook. Washington Democrats should learn some key lessons from the report.

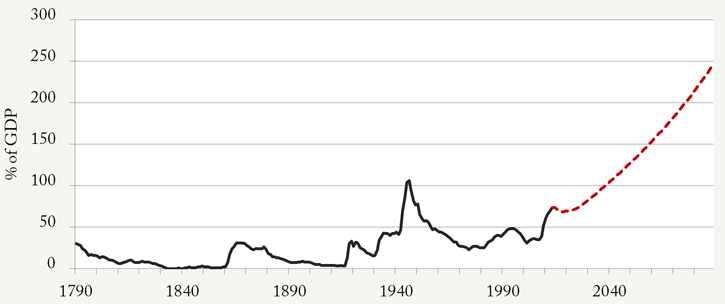

Debt Unsustainable, Despite Democrat’s Tax Increases

CBO assumes that revenue reaches 18.5 percent of GDP in 2023 and continues to rise to 19.7 percent in 2038. This may be overly optimistic, as average revenue over the past 40 years has been 17.4 percent of GDP; and during that time period revenues have only hit 19 percent four times. In last year’s long term outlook, CBO estimated in its more realistic alternative scenario that revenues would stabilize at 18.5 percent from 2022 on.

Despite the higher revenues contained in the 2012 fiscal cliff deal, the nation’s debt picture is still unsustainable.

Federal Debt Held by the Public – CBO Baseline

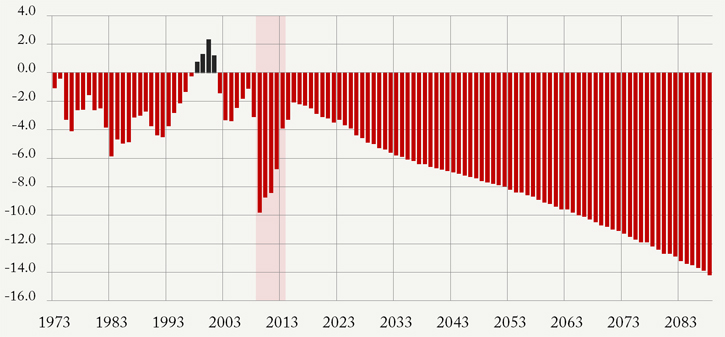

Of course, driving the spike in debt is the fact that we will keep adding to it with record deficits, despite the President’s assertion that “our deficits are now falling at the fastest rate since the end of World War II.”

Deficits as a Percentage of GDP, 1973-2088

The U.S. debt-to-GDP ratio, right now at 73 percent, will soon be at European levels. Current EU debt is 85 percent of GDP, a level the U.S. will hit in just 18 years.

Entitlement Spending Is the Problem

The President recently said that we should not make “even deeper cuts to education, even deeper cuts that would gut America's scientific research and development, even deeper cuts to America’s infrastructure investment.” Although he was trying to criticize Republicans, the CBO report makes clear that to meet his goal he will need to endorse entitlement reform.

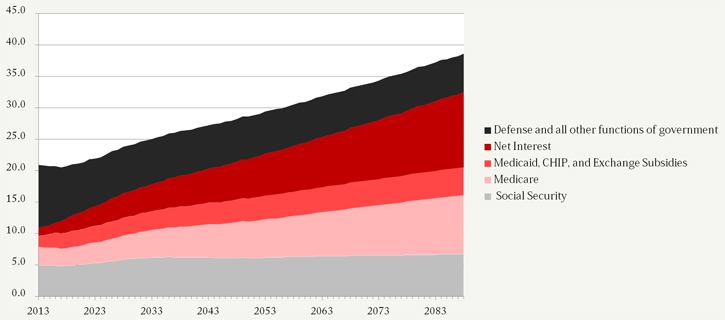

Size of Government will Nearly Double

Spending as percentage of GDP, CBO Baseline Scenario

Without reforms, in the next 25 years, entitlement programs will squeeze out spending on national defense and all of the priorities that Democrats say they care about, like infrastructure and education. It would take discretionary spending to its lowest levels since the Great Depression. Meanwhile, in 2038, spending on entitlements doubles from an historic average of 6.9 percent of GDP to 14.2 percent.

More Debt, More Problems

CBO has been known to say that debt reduction in the short term hurts GDP. But even CBO acknowledges in its report that in the long term, more debt leads to many more problems for the economy:

Less Saving, Less Investment, Less Income. Known as “crowding out,” this is the idea that the money the government borrows must come from somewhere; namely from lenders that would have lent the money to the private sector instead. Because the private sector uses the price system in order “to coordinate the separate actions of different people” it is more efficient at allocating resources than the government is. In fact, the CBO report shows in Figure 6-1 that factoring debt levels into economic calculations leads to less GNP per person.

Autopilot Is Not Forever. At some point, decisions need to be made on whether to cut spending or raise taxes. This decision will be forced by the huge increase in interest payments that will gradually take up a larger and larger portion of the budget. If we delay long enough, investors may decide to stop lending us money altogether and a Greek-style crisis could ensue -- except our debt is so large that there will be no one to bail us out.

More Debt Means Less Flexibility. Just like a family that experiences a personal emergency while holding a lot of debt, the national debt can constrain our ability to react to problems. CBO points out that the low debt levels before the financial crisis gave the U.S. the flexibility to respond. If another expensive financial or world crisis occurs, our debt may prevent us from reacting as we want.

Increased Risk of Another Financial Crisis. By continuing to borrow money, the U.S. gets closer to the point where investors decide they need much higher interest rates in order to continue lending to the federal government. CBO points out that this would not only cost the government money, but it would cause large losses for holders of existing Treasury bonds, which CBO says may “cause some financial institutions to fail.”

The Longer We Wait, the Harder the Decisions Become

CBO’s report shows that the longer we put off tough decisions, the tougher those decisions become. If Congress waits until 2015 to address skyrocketing debt, then it will need to cut spending or hike taxes by 0.9 percent of GDP every year until 2038. If it waits until 2020, then the total is 1.3 percent. If it waits until 2025 to do anything, then the total is 1.9 percent. Even more frightening is that these spending cuts or tax hikes are required simply to keep the debt-to-GDP ratio at 2013 levels. Those spending cuts or tax hikes would do nothing to decrease the debt.

Next Article Previous Article