CBO Shows We Need to Act on the Debt

- The country is set to break the record for largest public debt in U.S. history.

- Revenue is not the problem – mandatory spending is the problem.

- Not acting has huge risks, including the risk of another financial crisis.

CBO released its latest report on the long-term budget outlook last week. As it did during the Obama administration, the office predicts that the debt, while high now, will quickly get out of control unless we act. President Obama seemed more interested in lofty rhetoric than he was in heeding these warnings. With control of the political branches of government, Republicans have a rare opportunity to do something to help reduce the looming economic danger of Washington’s debt.

A Crisis is Staring Us in the Face

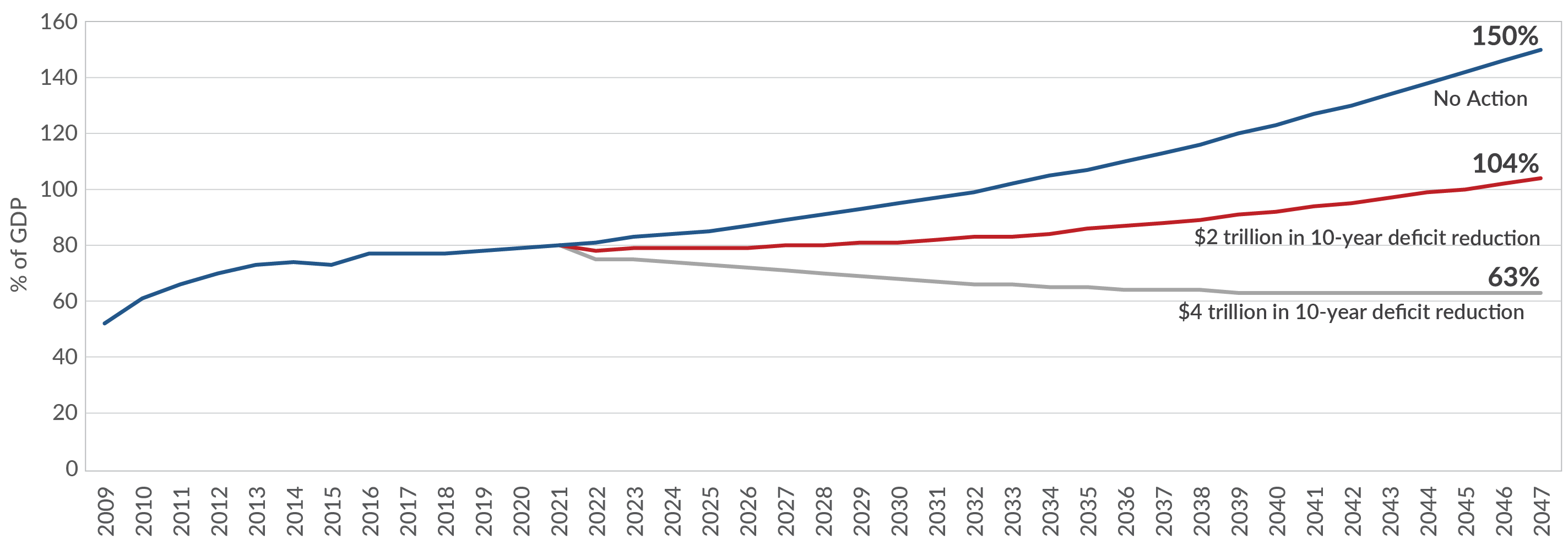

Our nation’s highest public debt level is 106 percent of GDP, reached in 1946 due to World War II. If we don’t act, we will exceed this debt level without any war or economic crisis. CBO projects that public debt will reach 150 percent of GDP in 2047. Interest on the debt will more than quadruple, going from 1.4 percent of GDP in 2017 to a projected 6.2 percent in 2047.

CBO includes illustrative examples of how $2 trillion and $4 trillion in deficit reduction would affect the debt. If Congress enacts policies that lower deficits by $2 trillion over 10 years (2018-2027), these savings continue in future decades and in 2047 public debt would be 104 percent of GDP. If Congress achieves $4 trillion in deficit reduction, then in 2047 public debt would be 63 percent of GDP, even lower than the level of debt today.

Public Debt With and Without Action

CBO estimates that we won’t be able to grow our way out of the problem. Over the next 30 years, inflation-adjusted economic growth will be approximately 1.9 percent – one point lower than the 2.9 percent average growth of the past 50 years. This decrease is due in part to much less growth in the labor force, because of the aging of the population.

Spending is the Problem

CBO projects that government revenue will reach 19.6 percent of GDP in 2047 and will be 19 percent or higher from 2036-2047. This is highly optimistic. Since 1930, we have only had seven years when revenue was 19 percent or higher. The longest continuous stretch was three years from 1998-2000. Despite projected revenue that would break records, our debt would still increase. This is because spending growth is projected to outpace revenue growth. Spending will eventually total 29.4 percent of the economy in 2047, far above the average of 20 percent over the last 50 years.

Taking a closer look at spending, CBO states that the growth in spending comes primarily from Social Security, mandatory health programs, and interest on the debt. Discretionary spending and smaller mandatory spending programs – federal pensions, income security programs – will actually decrease as a percentage of the economy.

In order to keep the debt at its current level, we would need to decrease deficits by a total of 1.9 percent of GDP every year from now until 2047. This would mean cuts of $380 billion in 2018, which is $1,100 per person in the United States. If we wait until 2023 to make changes, we would have to close a gap of 2.3 percent of GDP every year from 2023-2047, or $490 billion in today’s dollars. If we wait until 2028, the gap to close would be 2.9 percent of GDP from 2028-2047, or $690 billion.

The Consequences of Not Acting

Past spikes in the debt have occurred because of wars and huge economic crises: the Civil War; World War I; the Great Depression; World War II; and the Great Recession. The future spike that CBO is predicting comes about through America’s own inaction, even though we have known for years that this spike was coming.

Without action, CBO points out that the rising debt will have many negative consequences. First, investment will be lower, which means lower productivity and lower national income. Second, the part of the budget that lawmakers have annual control over will shrink, since interest costs and the largest mandatory spending programs grow as a share of both the economy and the budget. Third, the government will have less budgetary ability to respond to a domestic or international crisis.

Another consequence is the risk of another financial crisis. Our high debt levels could eventually cause investors to demand higher interest rates. At what point this will happen is uncertain, but if the demanded interest rate is substantially higher, then the value of existing government bonds will fall by a similar magnitude – interest rate increases cause existing bonds to fall in value. These existing bonds are held by many institutions, including pension funds, insurance companies, and banks. If one or more of these institutions go bankrupt because of the fall in value of existing Treasury bonds, it could trigger another financial crisis.

We know the negative consequences of our higher debt, we have a clear view of what is causing higher debt, and Republicans control the political branches of the federal government. The time is right to act on Washington’s debt.

Next Article Previous Article