CBO Confirms Obama Budget Shirks Responsibility

Last Friday, CBO released its estimate of the President’s budget, which showed $1.1 trillion in reduced borrowing. That is significantly less deficit reduction than the President’s claim of $1.8 trillion when he released his budget just last month. CBO also shows almost all of the deficit reduction is through higher taxes. The President’s budget would raise nearly $1 trillion in taxes to pay for canceling the nearly $1 trillion sequester. This is nothing new from President Obama. His budgets have always supported higher taxes -- not to reduce the debt, but to finance his vision of a liberal government that has a simple answer for every problem: more spending.

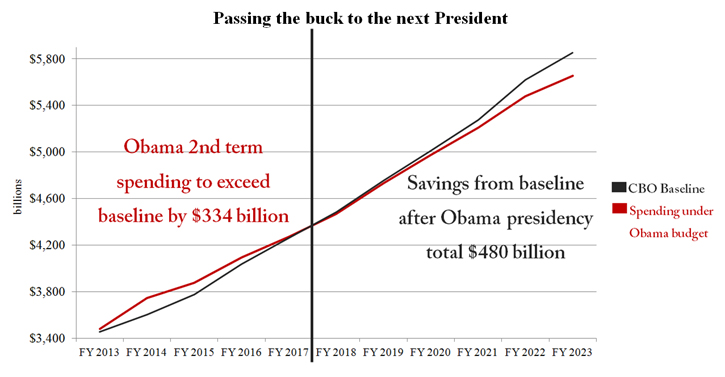

Spending increases during Obama’s second term

Compared to the CBO current law baseline, the President’s budget would spend more money now. Spending cuts – if they occur at all – are left for after he leaves office.

Over 10 years, the President’s budget increases mandatory spending by $222 billion. This is the category of spending driving our budget crisis. In comparison, the President “cuts” discretionary spending by $301 billion -- but this relies on gimmicks such as using war funding that will not be needed (for $601 billion in false savings) and assuming zero disaster spending in future years (for $290 billion in improbable savings).

Tax hikes

Over 10 years, the Obama budget would increase taxes on hardworking taxpayers by nearly $1 trillion over the CBO baseline:

- $493 billion – limit the value of certain tax deductions to 28 percent;

- $99 billion – adjust the tax code inflation adjustment to chained CPI;

- $83 billion – increase federal tobacco taxes;

- $77 billion – raise death taxes;

- $70 billion – create America Fast Forward Bonds (this proposal also increases outlays by $86 billion, making it a net deficit increase of $16 billion);

- $69 billion – Buffett Rule tax;

- $49 billion – create a financial transaction tax (the “Financial Crisis Responsibility Fee”);

- $33 billion – Miscellaneous tax increases.

Chained CPI

CBO’s estimates of the Administration’s chained CPI proposal are similar to the Administration’s own estimates. CBO estimates that the proposal will decrease deficits by $232.7 billion, including $99.5 billion in higher taxes and $133.2 billion in lower spending. The spending number includes savings of $89.2 billion in Social Security, $20 billion in other cost-of-living-adjustment programs, $7.8 billion in Medicare, $1 billion in other federal spending, and $15.3 billion in refundable tax credit savings (which score as lowered outlays).

Future generations need real leadership

By refusing to make real fiscal reforms that avoid gimmicks, President Obama is pushing America toward European-style austerity measures down the road to avoid a complete economic collapse. We do not know when the moment of crisis may finally come, but the President’s budget does not do future generations any favors by passing up yet another opportunity to offer real reform.

Next Article Previous Article