Buffett Tax and Distract

As tax day approaches, President Obama and Senate Democrats want Americans to send even more money to Washington to pay for their spending binge. Instead of passing a budget or cutting spending, they are proposing the Buffett Tax. This new tax proposal won’t create a single job, ease the pain at the pump or reduce the debt.

Buffett Tax is a Stunt

The Buffett Tax is a purely political stunt. Since the Senate Democrats’ bill creating the new tax would affect revenue, it is also unconstitutional. Revenue bills must originate in the House of Representatives.

Democrats have put forward a plan that does not even attempt to reform taxes, it is just political theater. Originally, President Obama said that the tax “could raise enough money” to “stabilize our debt and deficits for the next decade. Now, even his top economic advisor admits that the Buffett tax will not “bring the deficit down and the debt under control.”

Meanwhile, Democrats are ignoring the real issues facing Americans – jobs and high gas prices.

Buffett Tax Will Fuel Obama Spending Spree – Not Pay Off Serious Debt

The most the Buffett Tax will raise is $5 billion next year and $47 billion over 10 years. This barely puts a dent in President Obama’s out of control spending. Another tax will encourage more wasteful Washington spending – instead of solving America’s debt and deficit problems.

- More Taxes, More Spending, More Government. The Buffett Tax is being proposed so the President can spend more money on Washington programs.

- Less Than 4 Days of 10 Years of Obama Budget. The President’s budget spends an average of $12.4 billion every day for the next 10 years. If the White House actually put this money toward the debt – which it won’t – the Buffett Tax would only pay for what Washington will spend in less than four of those days.

- 1½ Days of Obama Borrowing This Year. Under the President’s budget, in fiscal year 2012, the United States will borrow $5 billion in one and a half days.

- Less Than 1 Percent of New Debt for the Next Decade. Buffett Tax revenue of $47 billion over 10 years is just 0.7 percent of the total new debt President Obama is proposing for the next decade.

Small Businesses Hit With Buffett Tax

For a small business paying taxes through the individual code, the Buffett Tax could impose higher taxes on every dollar of income over $1 million.

- Small Business is Critical to Jobs. Four out of five people hit by higher taxes on incomes over $1 million are business owners – the same people we need to create new jobs. Over one-third of all business income reported on individual returns would be taxed more under a “millionaire” tax increase.

- Thousands More in Taxes. A business paying a 25 percent effective tax rate that increases its adjusted gross income from $1.9 million to $2 million would pay $14,500 more in taxes than it would without the Buffett Tax.

- Disincentive to Growth. If that business were to increase its income from $1.9 million to $2.1 million, it would pay $19,500 more in taxes than it would without the Buffett Tax.

- With narrow profit margins, these additional tax payments make it harder and more expensive for small businesses to hire and invest.

“Fair Share” is a Fake Slogan

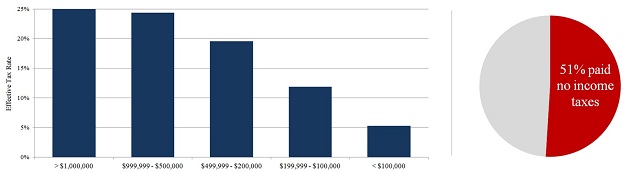

Only half of Americans send money to Washington each year, and pay their taxes in a progressive tax system. For tax year 2009:

According to the Joint Committee on Taxation, “for tax year 2009, approximately 22 percent of all tax units, including filers and non filers, will have zero income tax liability, approximately 30 percent will receive a refundable credit...” This means over half of Americans paid no income taxes.

The Buffett Tax would also deny certain taxpayers many credits and deductions such as the R&D tax credit, mortgage interest deduction, state and local tax deduction, the child-care tax credit, and a host of other tax credits.

Higher Taxes Won’t Fix the Spending Problem

The federal government does not have a revenue problem, it has a spending problem. Before President Obama took office, spending was 20.6 percent of gross domestic product and the 40-year historical average spending was 20.8 percent of GDP.

- President Obama’s Out of Control Spending. In fiscal year 2009, spending was 25 percent of GDP. In both fiscal years 2010 and 2011, spending was 24 percent of GDP.

- Spending in President Obama’s budget request would lock in this high spending – his budget never lowers spending below 22 percent of GDP, and spending steadily increases at the end of the 10-year budget window.

- Based on his record, it’s clear that President Obama would spend any additional revenue from the Buffett Tax instead of putting it toward the debt.

Next Article Previous Article