Big Tech Gets Bigger, Calls for Antitrust Changes Get Louder

KEY TAKEAWAYS

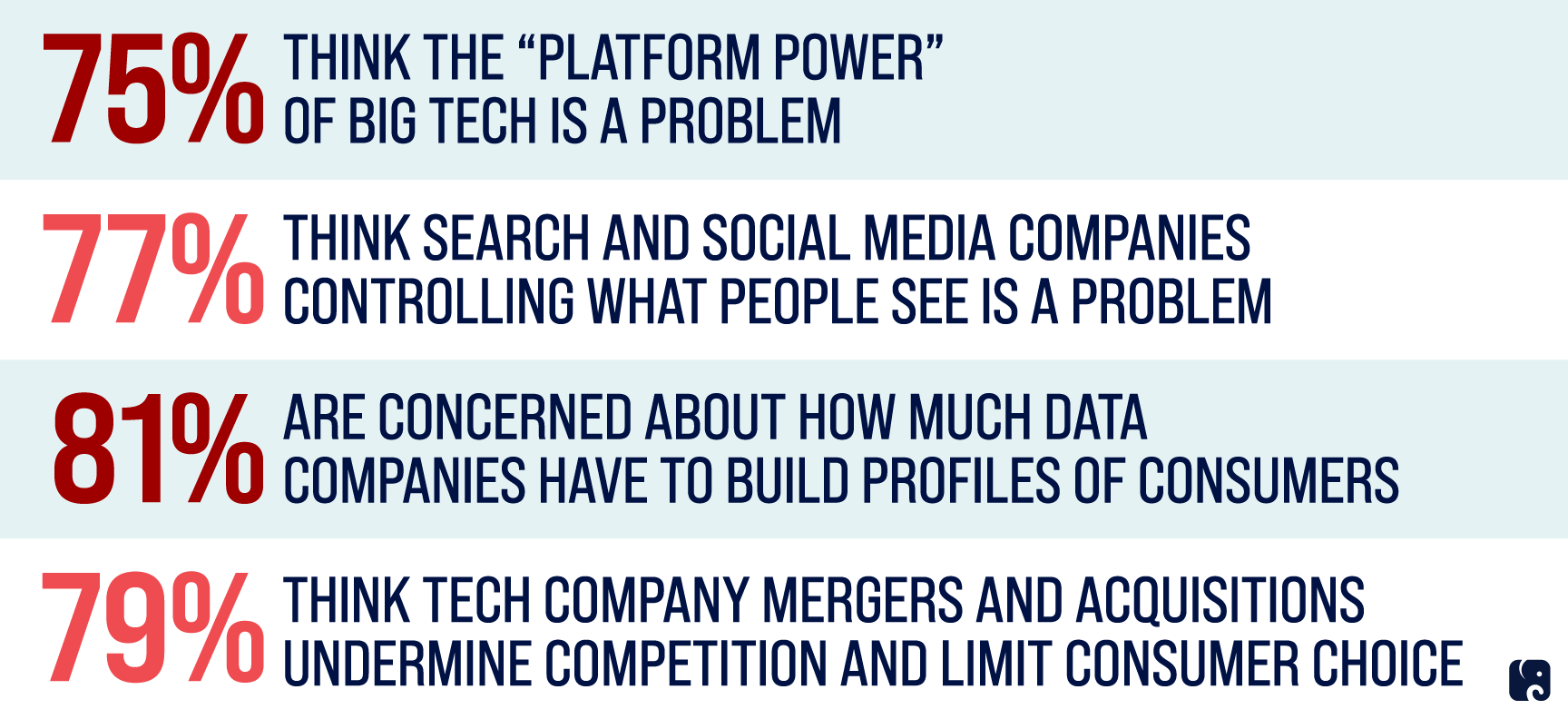

- Americans are concerned about the power that big tech platforms wield, as well as the amount of personal data they hold.

- The House Judiciary Committee reported a package of bipartisan antitrust bills this summer intended to restore competition in the digital marketplace, strengthen antitrust laws, and invigorate antitrust enforcement. Many of the bills have been introduced in the Senate.

- Supporters contend the bills will rein in big tech and put consumers at the forefront of antitrust law; opponents warn the bills could chill competition, reduce investment, and stifle innovation.

Big tech firms, including Amazon, Apple, Facebook, and Google, are a daily presence in billions of people’s lives. They have revolutionized nearly every aspect of our economy and culture. While they have brought amazing technological advances and convenience, their business practices and sheer size are increasingly a concern for citizens and lawmakers. A 2020 Consumer Reports survey of Americans’ views on big tech concluded: “roughly three quarters (75%) of Americans think that platform power, in a variety of forms, presents a major or moderate problem.”

Americans’ Perceptions of Big Tech

House legislative package

In October 2020, the House Committee on the Judiciary’s Subcommittee on Antitrust, Commercial, and Administrative Law concluded a 16-month investigation of big tech and some of its business practices. Its 450-page staff report recommended a number of measures to “restore competition in the digital marketplace, strengthen antitrust laws, and reinvigorate antitrust enforcement.”

A number of its recommendations have been introduced in bipartisan legislation. In June, the House Judiciary Committee reported out a package of bills focused on big tech. If enacted, it would represent the biggest change in antitrust law in a generation. Judiciary Committee ranking member Jim Jordan stated at the markup for the bills, “Big Tech censors conservatives, these bills don’t fix that problem, they make it worse.” He also said the bills give too much power to the Federal Trade Commission and other regulators.

Twelve former national security leaders, including Dan Coats, former director of national intelligence, and Leon Panetta, former CIA director and secretary of defense, wrote to House leaders to oppose the bills on national security grounds. They said in their letter: “recent congressional antitrust proposals that target specific American technology firms would degrade critical R&D priorities, allow foreign competitors to displace leaders in the U.S. tech sector both at home and abroad, and potentially put sensitive U.S. data and IP in the hands of Beijing.”

The American Innovation and Choice Online Act

H.R.3816 prohibits certain digital platforms from giving an advantage to their own products or services. A similar version of the bill was introduced in the Senate by Senators Klobuchar and Grassley.

The Senate Judiciary Subcommittee on Competition Policy, Antitrust, and Consumer Rights has held a number of hearings examining big tech and its practices, including a September hearing on big data, a June hearing on home technologies like Amazon’s Alexa smart speaker, an April hearing on competition in app stores, and a March hearing examining the case for antitrust reform.

H.R.3816 applies to a narrow list of companies that have at least 50 million U.S.-based monthly active users or 100,000 U.S.-based monthly active business users; are owned or controlled by firms with net annual sales or market capitalizations greater than $600 billion; and are critical trading partners for the sale or provision of any product or service offered on or directly related to the platforms. Amazon, Apple, Facebook, and Google are currently the only companies that meet these criteria.

Supporters cite examples like Google boosting its own shopping and map services in its search results, Amazon ranking its private-label products higher in search results, and Apple requiring in-app purchases use Apple’s payment system. They say big tech companies should stick to their core line of business and not use their market power to boost other lines of business.

Opponents of the legislation contend it employs arbitrary thresholds, could chill innovation, and that many of the examples do not harm consumers and may actually benefit them.

The Ending Platform Monopolies Act

H.R.3825, bans platforms from offering a service whenever a similar service already exists on the platform. For example, Amazon could not offer a marketplace and also sell its own products on that marketplace. There is currently not a Senate companion bill.

Supporters argue this “structural separation” approach is simpler than having regulators and courts determine neutrality, as H.R.3816 would likely require.

Opponents argue that when these big tech firms enter into markets it usually helps competition, resulting in lower costs and better options for consumers. For example, Google expanded from search to develop Google Maps, and Amazon expanded to online streaming with Prime Video. Under a rule like H.R.3825 proposes, these consumer-friendly products and services might never have been developed.

The Platform Competition and Opportunity Act

H.R.3826 would significantly change the legal standard for evaluating mergers and acquisitions, and it could effectively prohibit mergers among the big tech companies. Senators Klobuchar and Cotton introduced a Senate version of the bill earlier this month.

Under current law, plaintiffs bear the burden of proving that a proposed transaction would have anticompetitive effects. Under H.R.3826, the burden of proof would be shifted to the “dominant platforms” to show that proposed acquisitions are in the public interest.

Supporters of the legislation contend that many of the largest tech companies have grown in size and power primarily through mergers and acquisitions. Facebook’s acquisitions of Instagram and WhatsApp, and Google’s acquisitions of YouTube and Waze are commonly cited examples.

Opponents of the legislation argue that being acquired by a bigger company is often the goal for entrepreneurs and investors in startups. Removing this incentive could harm entrepreneurship and kill innovation and investment in new and innovative products and services.

The Augmenting Compatibility and Competition by Enabling Service Switching Act

H.R.3849 requires dominant digital platforms to ensure their products are “interoperable” with those offered by competitors and to enable users to transfer their data to competitors, referred to as “data portability.” Senators Warner and Hawley introduced a Senate companion last Congress.

Supporters of the legislation argue that interoperability and data portability help combat the “network effects” that big platforms like Facebook benefit from. A network effect is the phenomena of a product or service, such as a social network, increasing in value as the number of users increases. As more people join Facebook, more people want to join it because it is the place where their friends and associates are; and advertisers and sellers gravitate to it for the same reason.

Opponents cite privacy and security concerns associated with interoperability and data portability, as well as the technical difficulties and costs associated with mandating them.

The State Antitrust Enforcement Venue Act

H.R.3460 would enable state attorneys general to remain in the court of their choice for state antitrust suits, rather than being required to move to the court of the defendant’s choice. Senators Lee and Klobuchar have introduced the bill in the Senate.

Supporters argue that forcing state attorneys general to litigate in courts far from their homes leads to delays, increases costs to taxpayers, and can result in big technology companies receiving unfair “home court” advantages in the court of their choosing.

Opponents counter the bill could lead to frivolous litigation, and could force large settlements over meritless claims.

The Merger Filing Fee Modernization Act

H.R.3843 would increase the pre-merger filing fee for large mergers. The fees would go toward beefing up the resources for federal antitrust regulators like the Federal Trade Commission. Senators Klobuchar and Grassley have introduced companion legislation in the Senate.

Supporters argue that pre-merger filing fees have not increased in decades, leaving agencies without enough resources to properly vet big tech mergers.

Next Article Previous Article