Act Now to Capture America’s LNG Opportunity

-

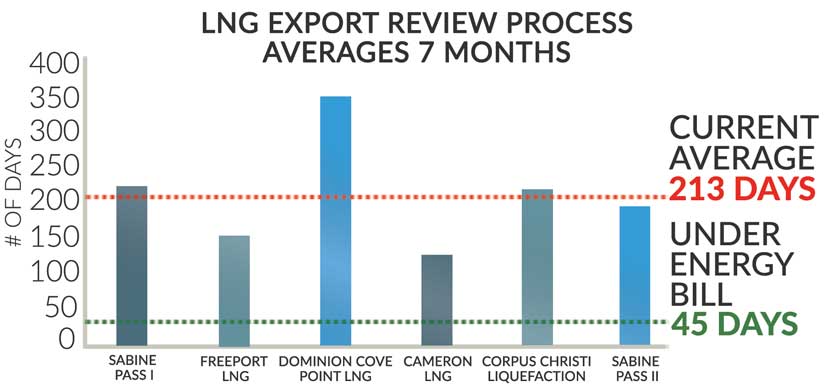

The Obama administration spends an average of seven months after an LNG export project’s final environmental review to consider whether it’s in the “public interest.”

-

Slow-walking LNG export projects jeopardizes their widespread economic and geopolitical benefits.

-

S. 2012 would ensure timely decisions on LNG export applications.

The first cargo of liquefied natural gas exports from the continental U.S. is scheduled to sail by early March. This will mark a stunning reversal from a decade ago, when experts projected that the U.S. would import 25 percent of its daily gas use by 2015. Innovations in hydraulic fracturing and horizontal drilling have given the U.S. new access to abundant gas supplies and positioned us to be a net gas exporter by 2017. This opportunity is jeopardized by the Obama administration’s sluggish process for permitting U.S. LNG exports.

Slow-walking LNG export permits

The Energy Department announced new procedures for processing applications to export LNG to non-free trade agreement countries in August 2014. The department suggested it would have “sufficient information” to take final action on an application within 30 days after issuance of a project’s final environmental review. A few months later, officials testified before the Energy and Natural Resources Committee that they “could comply” with a proposed 45-day deadline. Yet on average the department has spent seven months from the issuance of a project’s final environmental review deciding whether or not that project was consistent with the “public interest.”

In total, the Energy Department has granted final approval for six projects that required environmental review under the National Environmental Policy Act. Five of those approvals came after the department’s August 2014 announcement of new procedures for processing LNG export applications. One of the approvals came two years before that announcement. These projects are expected to export a combined 9.95 billion cubic feet of gas per day.

The final environmental reviews for another three LNG export projects totaling 3.88 billion cubic feet of gas per day were issued 173, 126, and 82 days ago. These projects still have not received final decisions from the Energy Department.

Final environmental reviews for an additional 27 LNG export projects – totaling almost 30 billion cubic feet of gas per day – have not yet been completed. These projects can also expect to be subjected to the department’s foot dragging.

Denying global widespread benefits

The president’s Council of Economic Advisers reported last year that increasing U.S. gas exports will have “a number of mostly beneficial effects on natural gas producers, employment, U.S. geopolitical security, and the environment.” By slow-walking reviews of LNG export projects, the Energy Department blocks these benefits.

A December 2012 study commissioned by the department projected that the U.S. would “gain net economic benefits from allowing LNG exports” and “net economic benefits increased as the level of LNG exports increased.” The study’s findings were confirmed by an update in March 2014. Another estimate concluded that in 2035, U.S. LNG exports would generate up to 452,300 jobs if the U.S. exports 16 billion cubic feet per day. That study found that in 2035, U.S. gross domestic product could increase by as much as $73.6 billion per year.

A former energy adviser to President Obama wrote in a November 17, 2015, Wall Street Journal blog post that U.S. LNG exports would provide eastern and central European countries with “alternative options to Russian supply, thereby reducing Russian leverage.” The prospect of U.S. LNG exports gave Lithuania leverage to negotiate a 25 percent discount on its gas bill from Gazprom. “U.S. LNG exports would save Europe around $20 billion a year on its gas import bill, and cost Russia roughly the same,” the blog post noted.

About half of Russia’s revenue comes from oil and gas. Increasing American LNG exports will boost the volume and share of gas that is competitively priced. It could help reduce Russia’s market share in Western Europe, which one analysis projected would decline from 27 percent in 2009 to 13 percent by 2040. Removing restrictions on U.S. LNG exports “could drive Russia’s revenues from natural gas exports down by as much as 30 percent, and in the longer term could cut those revenues by as much as 60 percent,” an economist told the Energy Committee on March 25, 2014.

A narrowing window of opportunity

The volume of global LNG trade increased by more than 50 percent from 2006 to 2014, and it is projected to nearly double by 2040. The number of countries competing in the global LNG trade increased from six exporters in 2000 to 26 in 2014. The number of importers increased from eight in 2000 to 28 in 2014. More than 60 LNG export projects are currently planned or under construction around the world. As these come online, the competition for global LNG market share will intensify, and America’s chance could slip away.

The Obama administration opened the door to even more competition when it lifted sanctions on Iranian natural gas exports last month. Iran’s proved natural gas reserves are among the largest in the world. According to an article in the Wall Street Journal on January 27, Tehran is exploring options to “join the international LNG club.” The article reported that Iran’s onshore LNG export plant is already 40 percent complete. Construction had stalled in 2012 due to sanctions, but can now begin again. Iran could also develop a floating LNG export facility. In addition, Oman plans to complete a pipeline beneath the Persian Gulf to transport Iranian gas to its LNG export facilities, and then to global markets. The European Union has indicated it could import up to 35 billion cubic meters of gas per year from Iran by 2030 to “help reduce the bloc’s dependence on shipments from Russia.” America and our allies do not benefit by trading dependence on Russian gas for dependence on Iranian gas.

This week, the Senate will continue consideration of a comprehensive energy bill that includes provisions to streamline Energy Department reviews of U.S. LNG export projects. The legislation requires the department to issue a final decision approving or disapproving an application no later than 45 days after conclusion of the project’s environmental review. It codifies a deadline that the Energy Department has said it can meet. The legislation does not tell the department what decision to make – it just requires that a decision be made in a timely manner.

The Obama administration should support this bipartisan legislation. It would ensure that U.S. LNG export capacity is built in time for Americans to realize the full economic and geopolitical benefits of global LNG markets, before the window of opportunity slams shut.

Next Article Previous Article